Downward Pricing Trajectory for PP; Upward for PE, PS, PVC, PET

Commodity resin prices climbed in the first week of February, with the exception of PP, which spiked in January and is now correcting along with propylene monomer.

Meanwhile higher prices are in the offing for PE, PS, PVC and PET for the February/March time frame—and, beyond in some cases. Factors behind the upward movement include higher crude oil prices and exports demand, planned and unplanned polymer and feedstock outages, and expected strong demand going into second quarter. This, according to purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas; Houston-based PetroChemWire (PCW), and Michael Greenberg, CEO of The Plastics Exchange in Chicago. Here’s a brief summary on each resin according to these industry sources:

● PE: After a reduction 3¢/lb, and in some cases more, in the December/January time frame, suppliers were out with a 4¢/lb price increase, effective February 1. Moreover, at least three suppliers had issued price hikes of 3¢/lb, effective March 1.

Mike Burns, RTi’s v.p. of client services for PE noted that export markets are very strong and oil prices are very high—two factors that work against lowering domestic PE prices. Unless these factors change drastically, he anticipated firm PE prices heading into second quarter.

Greenberg reported a slowed PE spot market as spot prices rose by as much as 9¢/lb during January—essentially swinging from a discount to premium to contract level. PCW senior editor David Barry characterized spot PE prices as flat to higher in early February amid balanced-to-tight supply, reporting that strong consumer sentiment was being cited as boosting domestic resin consumption, while a combination of planned and unplanned outages kept output in check, despite the ongoing ramp-up of new capacity.

● PP: After spiking up by 9¢/lb in January, in step with propylene monomer contracts, and following a 2 cents/lb increase in November/December time frame, a reversal appeared to be taking place before January’s end, with spot monomer prices dropping by as much as 13¢/lb, according to Scott Newell, RTi’s v.p. of PP markets.

Both Newell and PCW’s senior editor David Barry described the market as very volatile—one that pushed prices of both monomer and PP way above the rest of the world and within the double-digit range. Both reported that there was significant demand destruction, domestically and in the export market, due to high prices. PCW referred to reports of downstream customers pulling orders for a variety of finished PP goods, preferring to wait until prices moderate. The roughly 20¢/lb gap between HDPE and PP prices was also cited as a headwind for PP demand.

Newell foresaw a turnaround taking place—venturing PP prices to be flat to down for February based on settlement of lower monomer contracts as supply improved. While the price volatility is difficult to gauge, he anticipated a correction taking place for both monomer and PP by this month and did not expect PP suppliers to attempt margin expansions. In early Feburary, The Plastics Exchange’s Greenberg reported spot PP prices to have dropped sharply—4¢/lb on average—following a sharp drop in spot propylene monomer prices down to 52¢/lb, after peaking at 68¢/lb, with the spring months valued even lower.

● PS: PS prices were flat in January, as benzene contract prices dropped by 11¢/gal, which represents a 1¢/lb decrease in PS production costs. There was, however, a substantial increase in spot styrene monomer prices due to a number of both planned and unplanned global monomer outages, according to Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC.

So, PS suppliers are out with price hikes of 2-7¢/lb, effective February 1. Both RTi’s Kallman and PCW’s Barry expected prices to move up this month but on the lower end of the price hikes issued. Said Kallman, “There’s a lot of negotiation taking place due to downward pressure from benzene, but upward pressure from styrene.”

● PVC: After flat pricing last month, suppliers issued a 3¢/lb price increase, effective February 1, followed by a 4¢/lb increase, effective March 1, according to RTi’s Kallman and PCW’s Barry. The latter, in fact, reported that some suppliers were warning of an April price hike, as well.

Contributing factors cited by suppliers, according to Barry, is that too much margin was lost as a result of the December 1¢/lb decrease, 2-3¢/lb resets in fourth quarter 2017 contract negotiations, along with financial losses during Hurricane Harvey. Kallman noted that overseas demand was very good as global prices rose so that domestic export prices have been increasing, putting pressure on domestic prices. “So, there are a couple of opposing forces at work—a substantial decrease in February ethylene prices is expected which will yield a discount off the 3¢/lb increase.” Still, he ventured suppliers are likely to implement 4-5¢/lb by April—the start of the construction season, which is anticipated to be strong this year.

● PET: PCW’s senior editor Xavier Cronin reported that domestic bottle-grade PET resin ended January at 71¢/lb bulk-truck shipments delivered Midwest, up 2¢/lb from December. Supply was limited due to the idling of M&G Chemicals’ PET plants in Apple Grove, W. Va., and Altamira, Mexico. These facilities ceased operations in October when M&G subsidiaries filed for bankruptcy protection. One of Altamira’s two production units was restarted in mid-January. Meanwhile, imported PET with an IV of 78 or higher was at 65¢/lb, delivered duty-paid (DDP) to the West Coast and 67-70¢/lb DDP East Coast and the Chicago area, plus 2-5¢/lb for inland freight, up 1-2¢/lb from early January.

Cronin ventures that PET prices will likely rise in March as anti-dumping duties go into effect (March 5) on U.S. PET imports from five countries: South Korea, Brazil, Indonesia, Taiwan, and Pakistan. These countries account for about 40% of all U.S. imports. Cronin ventures that truckload and bulk-truck spot business PET prices will likely rise from the current level of 70-71¢/lb to around 75¢/lb for domestically produced PET resin, and 2-4¢/lb lower for bulk truck and railcar business tied to published PET feedstock indexes. Imports of PET from the five countries started to drop in December 2017. Cronin also expects import prices to rise 2-4¢/lb above the levels noted above.

Related Content

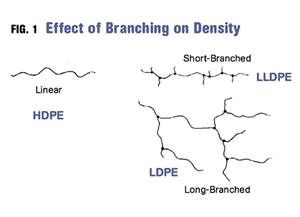

Density & Molecular Weight in Polyethylene

This so-called 'commodity' material is actually quite complex, making selecting the right type a challenge.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreRecycling Partners Collaborate to Eliminate Production Scrap Waste at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair will seek to recover and recycle 100% of the parts produced at the show.

Read More