U.S. Plastics Industry Maintains its Trade Surplus

PLASTICS’ chief economist says this speaks to the U.S. plastics industry’s continued impact on the international market.

The creation of Global Trends 2017 recently released by the Plastics Industry Association was overseen by the association’s chief economist, Perc Pineda and contains the following new features:

● “Recent Developments in U.S. Plastics Trade” offers an analysis of plastics trade data from the first six months of 2017 and a forecast of what these figures mean for the remainder of the year, and for 2018.

● A section focusing on “contained trade” returns to this year’s report after a hiatus. It discusses trade in goods that contain resins and plastic products and offers readers greater insights into the business opportunities that exist among the plastics industry’s myriad end-use market applications.

● “Outlook for U.S. Plastics Industry Exports” gives a country-specific forecast for the markets that are most important to the U.S. plastics industry’s international footprint.

The new report shows that the U.S. plastics industry retained its trade surplus in 2016, while U.S. demand for plastic goods grew by 1.8%. And, despite its decline from $7.1 billion in 2015 to $4 billion in 2016, the U.S. plastics industry’s trade surplus has stood now for more than two decades and, as noted in the report’s summary: “That the U.S. plastics industry maintains its trade surplus at all makes it something of an anomaly among similarly situated manufacturing sectors.”

The decline in the trade surplus was once again driven by a strengthening U.S. economy that depends heavily on imports to meet demand for plastic products, according to the report, which also noted that in 2016, apparent consumption of plastics industry goods—a measure of overall demand—increased in the U.S. by 1.8%, from $284 billion to $289 billion in 2016.

Said Pineda, “The U.S. plastics industry maintains its trade surplus due to its strong cost position as a plastic materials supplier, as well as its strong trade relationships with other countries—particularly neighbors to the north and south….On a country-by-country basis, Mexico and Canada continue to be the largest ($15.4 billion) and second ($11.7 billion) largest export markets for the U.S. plastics industry, respectively.” The industry’s largest trade surplus is with Mexico at $10.7 billion, and its fifth-largest surplus is with Canada at $719 million.

This has been the case for the U.S. plastics industry in previous years, but it warrants special mention in this year’s edition of the report as the agreement that has enabled these figures to benefit the U.S. plastics industry’s trade balance with its neighbors—the North American Free Trade Agreement (NAFTA)—is in the midst of renegotiation and, according to some observers, facing elimination if the new agreement does not meet the needs of American companies to some unspecified degree.

“The U.S. has a powerful competitive advantage in resin products due to its scale, infrastructure and low-cost raw materials. It would take a great deal of nationalism and protectionism to erase that advantage,” according to the report. This sentiment was expressed by Pineda in his presentation just last month at the fifth Global Plastics Summit (GPS 2017) in Chicago, hosted by IHS Markit and PLASTICS.

The 8-page report summary of Global Trends 2017 can be downloaded for free on the PLASTICS website. A full copy of the report is available for free to PLASTICS members.

Related Content

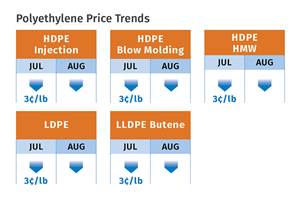

Prices of All Five Commodity Resins Drop

Factors include slowed demand, more than ample supplier inventories, and lower feedstock costs.

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MoreThe Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More