Wood On Plastics: Economic Pressures Shift Consumption Patterns

While the economy has been expanding for most of the past two years, it is far from clear that it has entered a “self-sustaining” phase.

Though the official data will not be available for a few more weeks, it’s safe to say that the current period of economic expansion in the U.S. will have lasted two years by the end of this second calendar quarter. According to data reported by the Dept. of Commerce’s Bureau of Economic Analysis, the last quarter in which U.S. economic activity declined was the second quarter of 2009. The GDP has registered gains ever since, with the annual growth for 2010 coming in at an inflation-adjusted rate of 2.8%. This expansion should continue through 2011 and 2012, and our latest forecast calls for a gain of 4% in GDP this year.

Good news. The bad news is that while the economy has been expanding for most of the past two years, it is far from clear that it has entered a “self-sustaining” phase. A self-sustaining recovery is a virtuous circle where rising demand leads to increases in production, which ultimately leads to more hiring. This in turn leads to more demand, and whole process continually repeats itself.

The problem at the present time is the “more hiring” part of the circle. Consumers are spending more in recent months, and U.S. industrial production and demand for exports have increased. But these trends have yet to produce a significant increase in hiring. The consensus view remains optimistic that hiring activity will accelerate soon, but it has not happened yet. There will likely be some pent-up demand that will be released once firms start adding to payrolls and consumers become more confident about their future financial situation.

Another factor that is clouding the outlook for consumer products is the ongoing sluggishness in residential construction. From a historical perspective, demand for many types of consumer products correlates strongly with spending on new homes or upgrades to existing houses. The number of new houses started in the U.S. will increase in 2011 for the first time since 2005, but the increase will be small, and we are at the bottom of a deep hole.

Another consideration for makers of consumer products will be the long-term impact of the concepts of “sustainable” or “green.” Though nobody wants to admit it now, many of the popular consumer products of the past were designed, manufactured, and marketed with an eye towards “planned obsolescence.” But the rapidly rising costs of raw materials combined with increasing awareness about disposal costs and the benefits of recycling are affecting consumption patterns. The products that save energy, enhance safety, or raise productivity are garnering more attention from an increasingly savvy marketplace.

There’s some good news for domestic manufacturers: Chinese consumers are demanding more goods, while the cost of shipping is escalating at an accelerating rate. The U.S. will continue to trade with China, but the trend in both of these markets is towards products that are produced closer to the consumer.

The consumer marketplace is changing rapidly. Many types of materials and products will either rise in price, or consumers will simply stop using them. Many sectors of the plastics industry will be hurt by this. But for those who position themselves correctly, the coming months and years will be full of opportunity.

WHAT IT MEANS TO YOU

•Think “enhancement” rather than “consumption” as you plan for the marketplace of the future. Consumers will need to get more out of their disposable dollars, so they need products that will last longer or will add some clear benefit to their lives.

•Design products that will be easy to recycle.

•Many products that migrated overseas will come back to be manufactured domestically, while some others will simply fade away. Find real needs and then fill them.

Related Content

Foam-Core Multilayer Blow Molding: How It’s Done

Learn here how to take advantage of new lightweighting and recycle utilization opportunities in consumer packaging, thanks to a collaboration of leaders in microcellular foaming and multilayer head design.

Read MoreAutomotive Awards Highlight ‘Firsts,’ Emerging Technologies

Annual SPE event recognizes sustainability as a major theme.

Read MoreWisconsin Firms Unite in Battle Against Covid

Teel Plastics opened new plant in record time, partnering with AEC & Aqua Poly Equipment Co. to expand production of swab sticks to fight pandemic.

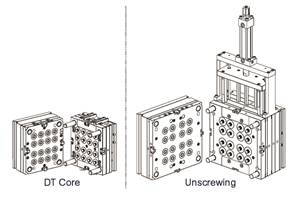

Read MoreBest Methods of Molding Undercuts

Producing plastics parts with undercuts presents distinct challenges for molders.

Read MoreRead Next

Processor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreHow Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read More