Reports from PLASTICS, VDMA and Haitian Show Mixed Machinery Results

Second quarter North America sales grow, while over the first half of 2020, domestic sales were flat for Haitian in China, as German machinery makers saw sales fall 20% over same time.

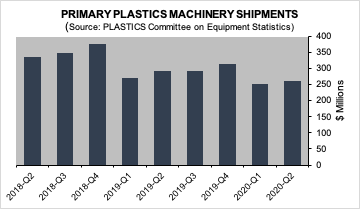

A trio of reports from trade associations and the largest maker of injection molding machines by volume globally shed some light on the state of plastics equipment demand in North America, Europe and Asia during the COVID-19 pandemic. The Plastics Industry Assn.’s (PLASTICS; Washington, D.C.) Committee on Equipment Statistics reported that second quarter shipments of primary plastics machinery—injection molding and extrusion—rose 4% in the second quarter compared to the first, hitting $263.4 million. In the first quarter of 2020, shipments fell by 19.8% compared to the previous three-month period.

By process and technology in the second quarter: single- and twin-screw extruder shipment value was down 35.8% and 30.1%, respectively. In injection molding equipment, shipments rose 11.4% over first quarter but were down 8.5% from the year-ago quarter.

According to a survey PLASTICS undertakes looking at overall business sentiment, 40% of respondents expected conditions to either improve or hold steady in the third quarter—higher than the 18.5% who felt similarly in the first quarter. For the next 12 months, 24% of respondents expected market conditions to be steady or better, slightly above the 22.6% who felt similarly in the previous quarterly survey.

Second quarter plastics machinery exports fell 21% from the first quarter, totaling $289 million. Imports, however, rose by 15% to $649.5 million, resulting in a trade deficit of $360.5 million, 9% lower than in the second quarter last year. Combined exports to Mexico and Canada totaled $134.5 million, representing 46.5% of total U.S. plastics machinery exports in the second quarter.

China Sales Hold Steady

China’s Haitian Group sold nearly 19,000 machines worldwide in the first half of 2020, with revenue technically up, rising 0.1%. Domestic sales in the first half of the year were unchanged compared to the same period last year. That said, Haitian reported that sales have declined in most regional markets due to the pandemic. Exceptions included Turkey, Vietnam and the Philippines which showed a significant increase according to the company. Overall export sales increased by 0.1%.

Spurred by demand for medical, packaging and consumer goods fueled by the pandemic, Haitian said its bestselling Mars Series achieved record sale volume, with more than 16,000 units sold in the first half of 2020. That was an increase of 17.6% compared to the same period 2019. Total Mars Series sales now exceed 250,000 units.

The View from Germany

Germany’s plastics and rubber machinery association (VDMA) reported on 2019 and first half 2020 sales for its members. In 2019, sales fell by 6%, the first annual decrease in 11 years. Through the first six months of 2020, VDMA reported that sales were down 20%.

In the first five months of 2020, VDMA reported that German exports of plastics and rubber machinery were down 19%, with deliveries to China and the U.S. off 3% each, due to the coronavirus crisis. VDMA said there are some positive signals from the Chinese market, but that the “present decline in the U.S. is only the beginning.” In Europe, exports dropped precipitously, with deliveries down markedly in Italy (-31%), France (-42%) and Spain (-48%). Sales to India were off 73%, but shipments were actually up in Russia (28%) and Turkey (102%).

The majority of manufacturers of plastics and rubber machinery stated that they expected a turnover decline of up to 30% in 2020. Looking forward, 80% expect a return to the turnover volumes of 2019 in 2022 at the latest.

Related Content

In Sustainable Packaging, the Word is ‘Monomaterial’

In both flexible and rigid packaging, the trend is to replace multimaterial laminates, coextrusions and “composites” with single-material structures, usually based on PE or PP. Nonpackaging applications are following suit.

Read MoreHow to Extrusion Blow Mold PHA/PLA Blends

You need to pay attention to the inherent characteristics of biopolymers PHA/PLA materials when setting process parameters to realize better and more consistent outcomes.

Read MoreABC Technologies to Acquire Windsor Mold Group Technologies

The Tier One automotive supplier with compounding and blowmolding machine capabilities adds the 50-yr-old molder and moldmaker.

Read More‘Monomaterial’ Trend in Packaging and Beyond Will Only Thrive

In terms of sustainability measures, monomaterial structures are already making good headway and will evolve even further.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE 2024.

Read More