PE, PP Prices Firming, Others Soften

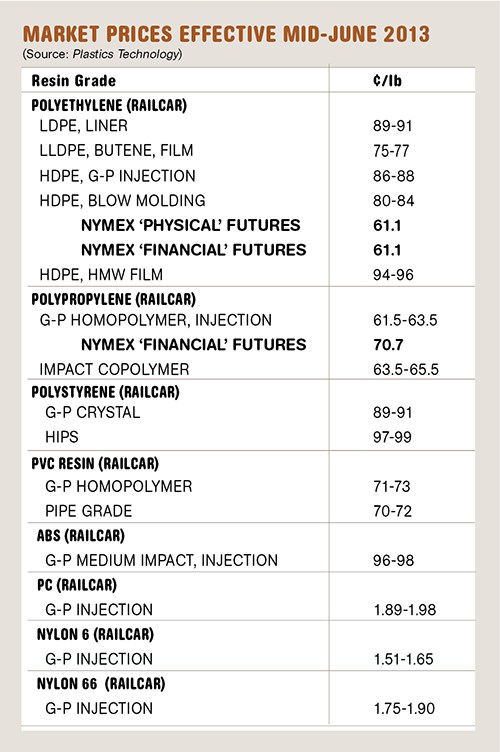

Polyolefin prices appear to have bottomed out, with flat-to-upward pricing expected, while PS and PVC prices are likely to flatten. Prices of ABS, PC, and nylons are soft and going nowhere in the near future.

Polyolefin prices appear to have bottomed out, with flat-to-upward pricing expected, while PS and PVC prices are likely to flatten. Prices of ABS, PC, and nylons are soft and going nowhere in the near future. These projections, based on key contributing factors such as supply/demand, feedstock prices, and competitive domestic and export activity, reflect the views of purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas; CEO Michael Greenberg of Chicago-based The Plastics Exchange; and Craig Blizzard of Blizzard Consulting LLC, Chevy Chase, Md.

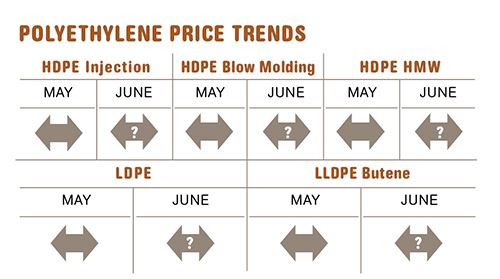

PE PRICE HIKES AHEAD?

Polyethelene contract prices remained unchanged through May, with two HDPE producers that had unplanned plant outages—Formosa Plastics and ChevronPhillips—trying unsuccessfully to raise prices by 2¢/lb. By last month, ethylene monomer spot prices dropped to 54¢/lb, averaging at least 10¢ below January levels. Still, PE suppliers were expected to make a third attempt to implement their April 4¢/lb price increase, even as processors will aim

for some relief from the 9¢ increases in January/February, based on the sizable decline in feedstock costs, according to Greenberg.

Mike Burns, RTi’s v.p. for PE, ventured that PE pricing in June and July was likely to remain flat but would follow an upward trend from there on. He says supplier inventories will continue to be a key driver for any price changes, noting that there were 30 days of inventory in January vs. 35 days in May. However, he also noted that there was a significant increase in exports to Mexico in early June and that inventories have not recovered. Also, he expects

PE prices in Latin America and Asia to remain higher than in the U.S. This would decrease the chances of a domestic price reduction. And going into the fall, there is a new round of planned

ethylene cracker outages, as well as the coming hurricane season.

PP COULD GO HIGHER AND LOWER

Polypropylene prices dropped 1¢/lb in May, following decreases of 6¢ and 10¢ in March and April, respectively, in step with propylene monomer tabs. That left a net 4¢ increase out of the

whopping 21¢ hike early in the year. However, PP suppliers were still aiming for a 3¢/lb increase on June 1, as spot monomer prices rallied in late May. Greenberg noted that June monomer contract price proposals included a 3¢ increase.

There is a significant probability that PP prices will move up a full 3¢/lb if June monomer prices move up as proposed, says Blizzard. But he expects that there will be a downward drift of PP

prices in the third quarter due to market weakness. The American Chemistry Council has reported that PP domestic demand was down 8% in the first quarter while exports were off 48%. Part of the domestic drop in PP sales in a major market like rigid packaging—ranging from cups, containers, and closures to crates and totes—is related to the trend in lightweighting, Blizzard notes. Also, domestic buyers worked on depleting their inventories

through the first quarter, when PP prices were moving up sharply.

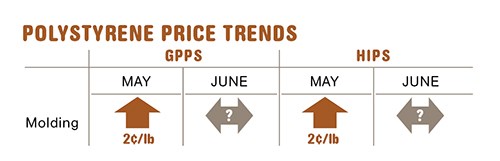

PS PRICES FLATTEN

Polystyrene prices moved up 2¢/lb in May, but the other 2¢ sought by suppliers in June appeared unlikely to take hold. Moreover, flat pricing was expected this month, according to Mark Kallman, RTi’s director of client service for engineering resins, PS, and PVC. Although PS seasonal demand is better in the second and third quarters, benzene feedstock prices dropped 5¢/gal in June, and ethylene monomer dropped as much as 7¢/lb in May, as most ethylene crackers were fully up and running after planned maintenance outages.

PVC PRICES DOWN TO FLAT

PVC prices dropped 2c/lb in May, and flat prices was expected last month. Still suppliers issued 2c/lb price hikes, which RTi’s Kallman expected they would push for this month to prevent any further downward pressure from lower feedstock prices. Suppliers’ justification includes higher export demand and PVC planned outages through this month that will tighten supply during still strong domestic seasonal demand.

ABS PRICES PULLED DOWN BY IMPORTS

ABS prices were generally lower in the second quarter, which started with suppliers aiming to implement a 5¢/lb price hike amidst rising competition from low-cost Asian ABS imports. ABS prices then fell by 1¢ to 4¢/lb in April and another 1-2¢ in May.

Third quarter pricing is expected be flat, as Asian ABS import prices remain low and domestic suppliers have to stay competitive while throttling back on operating rates, according to RTi’s Kallman. Domestic demand continues to be good in the automotive sector but less so in appliances and electronics.

PC PRICES STABLE

Polycarbonate prices were largely flat or a bit lower in the second quarter, primarily due to domestic competitive activity. Suppliers were unsuccessful in implementing any of their January hikes, totaling 11-12¢/lb hikes. Third-quarter PC pricing will most likely fare similarly, says RTi’s Kallman.

Globally, PC demand continues to be lackluster and the market is oversupplied. Domestically, PC demand continues to be good in the automotive sector and somewhat improved in the construction market.

NYLON PRICES FLAT

Nylon 6 and 66 prices remained flat in the second quarter. A 5¢/lb price hike sought by suppliers for low-viscosity nylon 6 resins in March fell by the wayside. A new 5¢/lb increase for June 1 was expected to meet a similar fate.

RTi’s Kallman ventures that third-quarter, nylon 6 and 66 prices will be flat with a possibility of some erosion taking place. “For all key feedstocks—caprolactam, propylene, and butadiene—prices are significantly lower, as is their demand.” Domestic demand for compounded nylon 6 is good in automotive and food packaging, but its biggest market, fibers, is way down. Demand for nylon 66 in automotive continues to be pretty good.

Related Content

Prices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

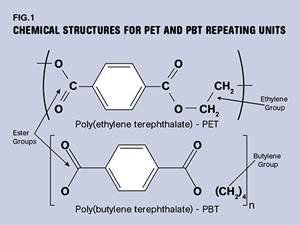

Read MorePBT and PET Polyester: The Difference Crystallinity Makes

To properly understand the differences in performance between PET and PBT we need to compare apples to apples—the semi-crystalline forms of each polymer.

Read MorePrices of Volume Resins Drop

Price relief is expected to continue through the fourth quarter for nine major commodity and engineering resins, driven by widespread supply/demand imbalances.

Read MoreThe Fantasy and Reality of Raw Material Shelf Life: Part 1

Is a two-year-old hygroscopic resin kept in its original packaging still useful? Let’s try to answer that question and clear up some misconceptions.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More