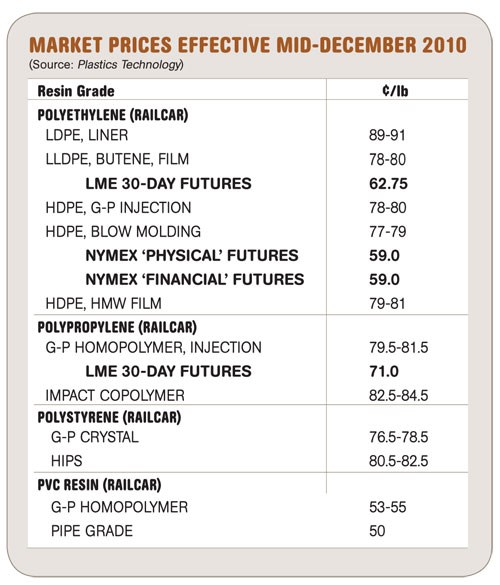

Prices Up for PE, PP, Down for PS, PVC

Higher prices are likely for PE and PP through this first quarter, driven by higher exports, tightly managed supplier inventories, and, in the case of PP, higher priced monomer due to supply shortages.

Higher prices are likely for PE and PP through this first quarter, driven by higher exports, tightly managed supplier inventories, and, in the case of PP, higher priced monomer due to supply shortages. In contrast, flat to

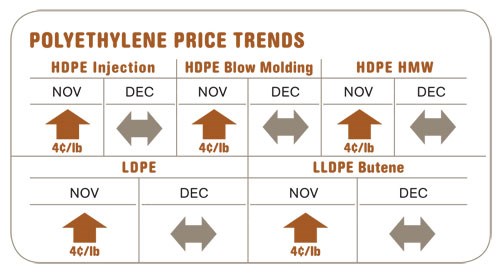

PE PRICES FLAT TO HIGHER

Polyethylene prices remained flat last month, following full implementation of the November 4¢/lb hike. A delay of last month’s 5¢ increase was being negotiated in mid-December.

Spot ethylene monomer prices in mid-December dropped by 5.25¢ to 46¢/lb, spurred by slowed demand and improved supply. By that time, the cash cost to produce ethylene was 5¢/lb lower than the peak in the first half, while PE prices were 13¢/lb higher (not counting the pending December 5¢ hike).

Outlook & Suggested Action Strategies

30-60 Day: The primary focus is to further delay the 5¢ price increase. While it may seem difficult or unrealistic to look for a price concession, if you don’t push back, suppliers will continue to maintain their upward pricing momentum. Market tradition is to go lean by year’s end, creating a “buy position” in January. But that could support the pending price increase. Other possible market drivers to watch are exports and planned or unplanned cracker shutdowns that could affect ethylene supplies.

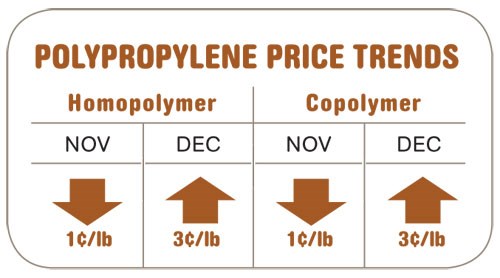

PP PRICES UP

December propylene monomer contract prices settled 3¢ higher at 60.5¢/lb. Spot prices were trading higher at 66.5¢/lb, and January contracts were expected to move up 5¢ to 8¢. The market continued to be plagued by several supply outages of steam crackers and refineries. When the new Petrologistics PDH unit begins to produce propylene at capacity, it will be able to balance out the shortages.

Outlook & Suggested Action Strategies

30-60 Day: Further price increases are possible with the continuation of monomer shortages and/or an increase in demand. Buy as needed.

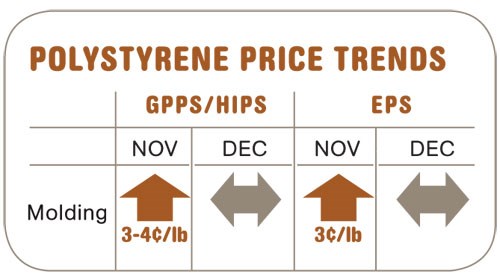

PS HIKE HALTED?

December benzene contract prices dropped by 14¢ to $3.28/gal, but spot prices increased to around $3.57/gal last month, due to high oil prices and refinery production problems. Ethylene spot prices continued to drop. October contracts for styrene monomer moved up 2¢ to 3¢ as had been expected, and November contract prices were expected to settle up another 4¢ to 5¢ to a range of 62-63.5¢/lb, driven primarily by stronger exports.

Outlook & Suggested Action Strategies

30-60 Day: The December price increase did not appear to have much momentum, as it was not supported by feedstock costs. Buy only as needed. Anticipate HIPS prices to remain at a higher than normal premium over GPPS well into the new year. Styrenic product pricing in general is expected to be flat to lower through at least the first quarter.

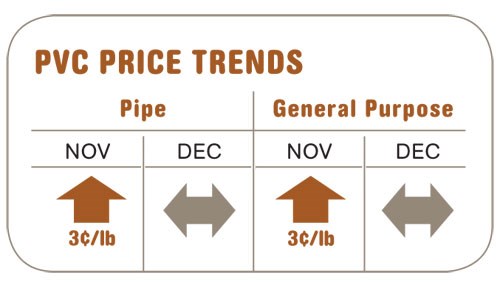

PVC PRICES FLAT FOR NOW

Overall demand for PVC was up 1% for the year. Domestic demand dropped more than 2% (and is expected to decrease further in this first quarter), but exports rose 6%. However, exports to China have been falling off lately with the seasonal drop-off in construction demand and are expected to drop further. While Latin America continues to be a steady export outlet, the overall pace is expected to be lower.

Outlook & Suggested Action Strategies

30-60 Day: Expect growing prospects for lower-cost material through the first quarter. Suppliers will aim to limit oversupply, but inventories are expected to grow as domestic and export demand decline this quarter. Start-up of the Formosa plant expansion over the next couple of months will add 240 million lb of capacity in North America. Look for price-reduction opportunities, barring any significant feedstock or resin production outages.

Read Next

How Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MoreWhy (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read More

.png;maxWidth=970;quality=90)