Flat or Slipping

Prices of most commodity resins were flat or slipping downhill in February and March.

Prices of most commodity resins were flat or slipping downhill in February and March. Polypropylene posted what may be only a temporary gain. Only PET prices appear firm and trending upward.

PE prices down

Polyethylene resin tabs dropped 2¢/lb in early March, which brought the total slump in prices since December to 14¢/lb. There was also talk of another 2¢ drop in March, which would cut in half the price inflation in the second half of 2005. Still, suppliers have not rescinded their December 5¢ increases, but only delayed them again, to April 1.

Meanwhile, international prices at the London Metal Exchange were falling last month. LME’s April short-term futures contract for blown film butene LLDPE was at 51¢/lb, down from 58.5¢ for March and 55.6¢/lb for February.

Contributing factors: With falling energy and feedstock prices, PE resin tabs could soon drop another 4¢ to 6¢/lb, lopping a total of 20¢ to 22¢ off last year’s hikes. Says Bill Bowie, COO of purchasing consultant Resin Technology, Inc. (RTi) in Fort Worth, Texas, “We have seen lower resin orders from PE film processors. One reason is the large volume of imported film and bags. Processors are buying only what they need in the expectation that prices will go down.”

Adds a major PE supplier, “Our margins are still good because of lower feedstock costs. Ethylene contract prices have dropped to 50¢/lb from the 56.5¢ in November-December. Demand is fairly good, and we hope for 5% to 6% growth over last year. With no new capacity coming on stream, there is no likelihood of an oversupplied market.”

PP prices up—for now

Polypropylene resin tabs rose 4¢ to 6¢/lb from February to March, reflecting partial implementation of 12¢ to 16¢/lb hikes slated for those two months. LME’s April short-term futures contract for g-p injection grade dropped to 45.6¢/lb from 54.9¢ for March and 52.2¢ for February.

Contributing factors: Some industry sources think recent increases could be short-lived. Says RTi’s Bowie, “Spot prices at some accounts have fallen about 4¢/lb. Within the next 30 days, resin producers are likely to lose the average 4.5¢/lb they gained last quarter. Demand has slowed and deals are being made on the spot market to move material quickly.”

Propylene monomer contract prices rose 4.5¢/lb in February, but are expected to hold even now because crude oil prices have dropped.

PET prices increase

Bottle-grade PET prices moved up 3¢/lb in February, in partial implementation of 5¢ hikes early in the first quarter. Most suppliers also came out with a 4¢/lb increase for March 1, and some sources expect prices to move up 2¢ more.

Contributing factors: “Prices of raw materials like paraxylene and ethylene glycol rose over 5¢/lb in January and February. While those prices slipped back some in March, margins remained unfavorable for resin suppliers,” says one industry analyst.

Suppliers say resin demand is pretty good. According to one, “Domestic demand is likely to be up 6% to 7% over last year, although we lost about 3% of that to Asian imports.”

Of more concern to suppliers is looming resin oversupply with over 1.1 billion lb of new capacity coming on stream by early 2007. It will start with 200 million lb from Wellman in June. Prices are apt to start dropping by the end of June and suppliers foresee eight to 12 months of excess supply.

PVC remains soft

PVC resin prices dropped 1.5¢/lb in February and were expected to lose another 1.5¢ to 2¢ in March. Suppliers delayed their 2¢/lb hike from January to April 1, but they are hoping the mere threat of an increase will halt the price slide.

Contributing factors: The usual spring pick-up in demand hasn’t kicked in yet. Pipe producers’ inventories are up. Window orders are mixed, and siding orders are soft for this time of year. Ethylene feedstock costs are falling.

PS hike deferred

Polystyrene contract prices held even in March. Tabs for plentiful offspec resin dropped 3¢/lb or more. Producers’ 6¢ hike for Feb. 1 was trimmed to 5¢ and delayed to April 1. It is probably dead, some suppliers concede.

Contributing factors: January’s PS demand was 14% ahead of December’s, but demand in February and March was only so-so. High prices have hurt—some cup makers switched to paper, and lids moved to PET.

Contract prices for benzene feedstock dropped from $2.86/gal in February to $2.73 in March, and futures were as low as $2.60 for May.

| Market Prices Effective Mid-Mar A |

|

|

KEY: Colored areas indicate pricing activity. An arrow () indicates direction of price change. aTruckload, unless otherwise specified. bUnfilled, natural color, unless otherwise specified. cBased on typical or average density. dNot applicable. eNovolac and anhydride grades for coils, bushings, transformers. fNovolac and anhydride grades for resisitors, capacitors, diodes. gIn quantities of 20,000 lb. h19,800-lb load. jLME 30-day futures contract for lots of 54,564 lb.. |

Related Content

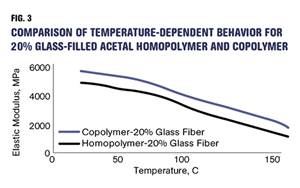

How Do You Like Your Acetal: Homopolymer or Copolymer?

Acetal materials have been a commercial option for more than 50 years.

Read MoreThe Fantasy and Reality of Raw Material Shelf Life: Part 1

Is a two-year-old hygroscopic resin kept in its original packaging still useful? Let’s try to answer that question and clear up some misconceptions.

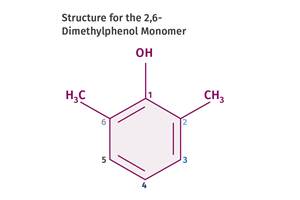

Read MoreTracing the History of Polymeric Materials: Polyphenylene Oxide

Behind the scenes of the discovery of PPO.

Read MoreTracing the History of Polymeric Materials: Aliphatic Polyketone

Aliphatic polyketone is a material that gets little attention but is similar in chemistry to nylons, polyesters and acetals.

Read MoreRead Next

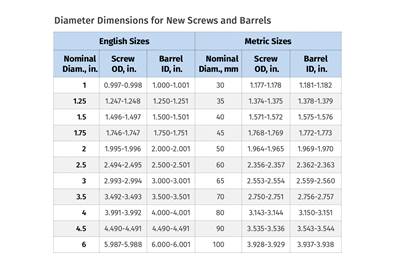

Troubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read More

.png;maxWidth=300;quality=90)