Pricing Update - April 2009

Price Hikes Take a Breather

A short, sharp rebound in the first quarter called an abrupt halt to the long slide in commodity resin prices.

A short, sharp rebound in the first quarter called an abrupt halt to the long slide in commodity resin prices. However, there were signs last month that some hikes would be cut back or delayed indefinitely. With resin demand still weak, it all seemed to hinge on where monomer/feedstock prices were going.

PE HIKE ON HOLD?

Polyethylene prices held steady through early March, following implementation of a 7¢/lb increase. A 5¢ hike originally scheduled for February was delayed to March 1 and then to April for certain markets, according to industry observers. Meanwhile, the London Metal Exchange (LME) North American short-term futures contract in blown-film butene LLDPE for April rose to 35¢/lb from 34¢ in March.

Contributing factors: At press time, it was unclear if any or all of the 5¢ increase would be implemented. Resin capacity utilization is said to be below 70%, but that’s not the whole story. “Resin supply is reasonably tight, particularly for film grades, due to capacity cutbacks,” says Mark Quiner, editor at PetroChem Wire, Houston.

Ethylene monomer contract prices for February settled up 0.5¢/lb at 32¢/lb. But Quiner says monomer spot prices are a better indicator of the direction of PE price movement. He notes that spot ethylene prices rose 6¢ through February, peaking at 33.25¢/lb, as a result of planned and unplanned cracker shutdowns and logistical constraints. However, spot ethylene prices fell back sharply to 26.25¢ on March 10 as crackers restarted.

The very next day, spot ethylene dropped to 25¢/lb with futures trading at 21.5¢, according to Mike Burns, global business director for PE at resin purchasing consultant Resin Technology, Inc. (RTI) in Fort Worth, Texas. “We tell our clients that ethylene prices below 27¢/lb will not result in PE prices moving upwards.” Burns says North American PE prices are now competitive globally and he expects the 7¢/lb increase will stay in place, because resin suppliers need it to retain profitability. He sees the 5¢ increase as purely feedstock driven and unlikely to be implemented if ethylene prices continue to fall.

PP PRICES UP

Polypropylene prices generally moved up 6¢/lb in February, following a 2¢ increase in the previous month. A new price hike of 5¢ to 6¢ for March 1 also emerged. LME’s North American short-term futures contract in g-p injection-grade homopolymer in April dropped to 31¢/lb after rising to 33¢ in March.

Contributing factors: PP resin tabs followed the movement of propylene monomer. Propylene contracts moved up 6¢ to 28¢/lb in February, after January’s 2¢ rise, which was spurred by short supplies, owing to temporary cracker shutdowns and lower supplies from refineries. Quiner at PetroChem Wire says preliminary settlements for March monomer contracts indicated a 1¢ increase to 29¢/lb.

Scott Newell, RTI’s director of client services for PP, does not see any chance of another PP price hike. “Secondary resin markets have loosened up and prices are coming down. While the second quarter might see some increase in demand over February’s all-time low, it is still likely to show declines in PP consumption, except perhaps in food and beverage packaging.”

PET PRICES UP, TOO

PET prices moved up 4¢/lb in February, after a precipitous drop in the fourth quarter and January. A 5¢/lb price hike for March 1 was still on the table.

Contributing factors: PET tabs had followed declining prices of paraxylene and ethylene glycol feedstocks, but suppliers say there was an “overcorrection” of about 4¢/lb. Says a source at one major PET maker, “Starting from last July, feedstock prices dropped a total of 32¢/lb while PET prices fell 36¢/lb.”

Implementation of the March price hike was uncertain at press time. A seasonal upswing for PET typically starts in March, in anticipation of strong second-quarter beverage demand. But PET sales in February and March rose only marginally—about 2% to 3%. “We did not see the normal upswing this March, but there is an uptick in single-serve beverage sales at convenient stores as gas prices have dropped,” says one resin supplier.

PET plant utilization reportedly is in the low 70% range. The only scheduled new capacity—from Indorama’s Alpha-Pet subsidiary in Decatur, Ala.—will equal the permanent shutdowns of PET capacity by Invista and Wellman that have already taken place. However, there are industry reports that a new 800- to 900-million-lb production line at StarPet in North Carolina will start up as soon as June, rather than by the year’s end as originally planned.

PVC HIKES SPLIT

PVC resin producers ended up splitting the February 5¢/lb increase after Georgia Gulf announced that it was delaying 2¢ of that hike to March 1. As of mid-March, Georgia Gulf and OxyChem had announced a further 3¢ increase for April 1.

Contributing factors: Attempting a price increase in the face of very weak demand, at a time when ethylene monomer prices are expected to soften, sounds like a long shot. Some monomer capacity that had been shut down was scheduled to come back up in March, so ethylene pricing is expected to be weak. Contract ethylene settled at 32¢/lb in February, while spot prices in mid-March were at 31¢. According to the American Plastics Council, resin producer operating rates in January were only 64%.

PS HIKE COULD SHRINK

Polystyrene resin producers moved their 5¢/lb price increase from Feb. 15 to March 1. But on March 1, Total cut its hike to 3¢ with a TVA for the rest, so others will probably have to follow suit.

Contributing factors: Benzene feedstock prices are soft. Contract benzene jumped from $1.01/gal in January to $1.35 in February (the ostensible reason for the 5¢ hike in PS), but benzene fell back 6¢ to $1.29 in March. Spot benzene was trading even lower in mid-March at $1.18 to $1.19/gal, adding pressure to shrink the PS increase. Resin demand was steady in the first quarter, with foodservice markets so-so and appliances and electronics very weak.

| Market Prices Effective Mid-Mar A | |||

| RESIN GRADEb | ¢/LB | ¢/CU INc | |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

KEY: Colored areas indicate pricing activity. An arrow () indicates direction of price change. aTruckload, unless otherwise specified. bUnfilled, natural color, unless otherwise specified. cBased on typical or average density. dNot applicable. eNovolac and anhydride grades for coils, bushings, transformers. fNovolac and anhydride grades for resisitors, capacitors, diodes. gIn quantities of 20,000 lb. h19,800-lb load. jLME 30-day futures contract for lots of 54,564 lb.. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Related Content

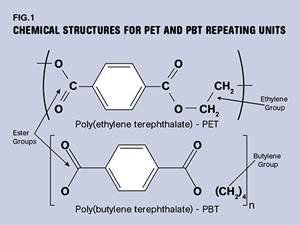

PBT and PET Polyester: The Difference Crystallinity Makes

To properly understand the differences in performance between PET and PBT we need to compare apples to apples—the semi-crystalline forms of each polymer.

Read MoreTracing the History of Polymeric Materials: Aliphatic Polyketone

Aliphatic polyketone is a material that gets little attention but is similar in chemistry to nylons, polyesters and acetals.

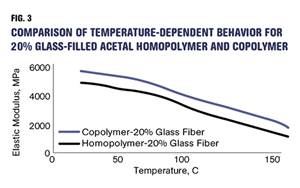

Read MoreHow Do You Like Your Acetal: Homopolymer or Copolymer?

Acetal materials have been a commercial option for more than 50 years.

Read MoreVolume Resin Prices Move in Different Directions

PE, PP, PVC, and ABS prices slump, while PS, PET, PC, and nylons 6 and 66 prices rise.

Read MoreRead Next

Advanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read More

.png;maxWidth=300;quality=90)