Retail Sales Data Point to Continued Economic Expansion

Consumers are the engine that powers the U.S. economy.

Consumers are the engine that powers the U.S. economy. Total consumer spending accounts for two-thirds of the measured economy (GDP), and this proportion would be much higher if the unmeasured economy (private transactions between individuals, legal or otherwise) could be included in the calculation. It should be no secret that the vast majority of plastics products eventually end up in the hands of consumers. Therefore, processors would be well advised to monitor aggregate consumer behavior as an indicator of future demand for their products.

One of the best sources for market information pertaining directly to consumer spending patterns is the monthly retail sales data compiled and reported by the U.S. Commerce Department. According to the latest report, total sales at retail stores and food-service establishments (restaurants) are up more than 9% compared with the same period last year. And if motor-vehicle dealers are excluded from the data, then the year-to-date total is up 10% from 2003.

After adjusting for inflation, these figures indicate that Americans have spent 6% to 7% more in retail stores so far in 2004 than they did during the same period in 2003. Our forecast calls for this momentum to be sustained through the second half, as retail sales (excluding autos) will rise 7% in 2004 after a gain more than 5% last year. This is significantly better than the average rate of growth during the past 10 years, which is just over 5% per year.

The Commerce Department's report provides further value because it breaks down the total figure into several categories. The strongest sales growth so far in 2004 has been for building materials and garden supplies. The flurry of activity in residential real estate and construction in recent months has pushed retail sales of building materials up a whopping 18% through the spring of 2004. This is the fastest growth ever recorded for this sector, and it is a major contributor for the current growth in demand for vinyl windows and siding as well as composite decking and fencing materials.

Another category that is enjoying strong growth is electronics and appliance stores, as sales of these products are up a vigorous 13% this year. And though many electronic products are imported, the growth in the sales figures corroborates the recent uptrend in the data on domestic production of computers and appliances compiled by the Federal Reserve Board. The message here for processors is that consumers are buying more of all types of these products, whether they are manufactured domestically or imported.

Sales at food-service and drinking establishments are also up 13% for the year to date. Many of these establishments are large users of plastics packaging and other types of disposable products. Robust gains in this data suggest that consumers are spending more money eating out and that they are consuming greater quantities of items such as single-serve bottles, tubs, caps, and lids.

And one other area where Americans have demonstrated an increased propensity to consume is in furniture and home-furnishing stores. Sales of these goods are running 11% ahead of last year. Here again, this is related to the activity in residential real estate and construction. There has also been a significant increase in recent years in both the quantity and quality of plastic furniture and home furnishings that are available for consumers.

The major end-market categories that are experiencing relatively slower growth include motor-vehicle and parts dealers, sporting goods, general merchandise, and health and personal-care stores. But though these categories are growing more slowly than the other aforementioned sectors, they are all still enjoying solid growth so far this year that exceeds their long-term averages. Or to put it more simply, Americans are buying more of pretty much everything.

For many of these sectors, the current growth rates are unsustainable over the long run. So processors who supply these markets will need to monitor future inventory levels and production schedules on an ongoing basis. In the short-term, the strength in the recent retail sales data point to continued growth in the U.S. economy and manufacturing sector, and processors should plan accordingly.

Related Content

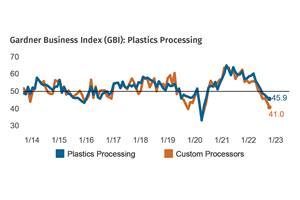

Plastics Processing Contracts Again

October’s reading marks four straight months of contraction.

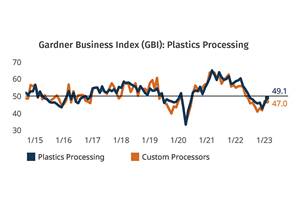

Read MorePlastics Processing Activity Near Flat in February

The month proved to not be all dark, cold, and gloomy after all, at least when it comes to processing activity.

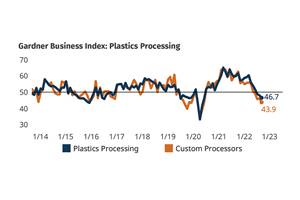

Read MoreProcessing Activity Contracts More Slowly in January

Despite contracting again in January, plastics processing activity rebounded a bit from a rather significant drop in December.

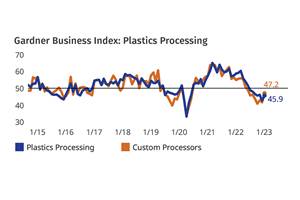

Read MorePlastics Processing Continues to Contract

The September Index signaled a second month of declining activity for plastics processors overall, while custom processors fared even worse.

Read MoreRead Next

How Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More

.png;maxWidth=300;quality=90)