Trouble in Toyland Puts Premium on Lean Manufacturing

For a century, the Hedstrom companies have produced millions of play balls and components for gym and swing sets, riding toys, and other juvenile products. Today, faced with intensifying competitive pressures, the group is hard at work putting the right bounce into its survival strategy for one of the toughest molding sectors.

“Toys are a challenging business where quick reaction to shifting demand and keeping distribution costs down are fundamental,” says Michael Johnston, president of Hedstrom Holding Corp. in Mt. Prospect, Ill. The company has two multi-process plastics operations in Bedford, Pa., and Ashland, Ohio, as well as ERO, in Mt. Prospect, a maker of sewn flotation devices and sleeping bags that was acquired by Hedstrom in 1997.

Feeling the pressure

In recent years, a shift to low-wage areas like China and Mexico has turned toy molding into a graveyard for many U.S. players. Mattel’s recent decision to close its last domestic molding shop in Murray, Ky., by 2002 is just one example. Hedstrom itself stumbled last year, due largely to a drain from ERO’s Amav Industries subsidiary in Montreal. That operation had 40 injection presses molding parts for air hockey, table tennis, and other table games. It was liquidated last year, but not before Hedstrom was forced to seek bankruptcy protection under Chapter 11.

On March 23, Hedstrom filed a reorganization plan with the court that details a way out of its difficulties. “We’re confident this will mean normalcy in the near future,” Johnston says. The plan is grounded in lean manufacturing and just-in-time inventory measures now being implemented across all divisions. “We benchmark every operation against offshore and domestic rivals,” Johnston adds.

One focus is a kaizen program, a team-based effort to engage the entire work force in finding ways to tap new efficiencies in manufacturing. Johnston says Hedstrom is counting on expanded automation to reduce labor costs, as well as productivity enhancement through machinery upgrades and end-product refinement.Hedstrom companies are also taking steps to react rapidly to shifts in market demand. Most toys are marketed through mass retailers like Wal-Mart, K-Mart, Toys R Us, and drug and supermarket chains. Retailers expect prompt delivery of items for which demand is variable and hard to predict.

Searching for savings

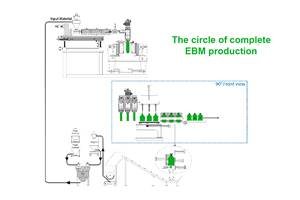

Hedstrom’s Bedford division does injection, blow, and rotomolding of parts for gym sets and large toys. Some of the largest parts, like 6.5-ft-long gym slides, were formerly custom blow molded by outside suppliers, but Hedwin switched to in-house production to avoid freight costs. Consolidation of some operations means that game-table molding has been relocated to Bedford, using new presses and some used Amav machines.

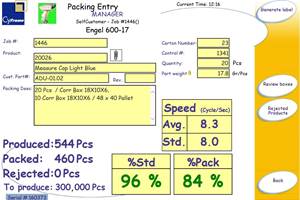

Bedford operates five dual-head accumulator blow molders (10- and 22-lb) supplied by Graham Engineering. Stan Olejarczyk, Bedford’s operations v.p., says better machine utilization is being achieved by reducing downtime and keeping machines running year-round despite day-to-day and seasonal changes in demand. Bottlenecks in color, mold, and head changes are being tackled. For instance, color changes that once consumed 5-8 hr, now take less than an hour.

Bedford also devised quick-disconnect methods for mold water lines and special locator devices to allow accurate and speedy alignment of molds during mold changes. New procedures and work aids that facilitate head changes are in development. The goal is to make any combination of mold and head changes in less than an hour.

Meanwhile, the Ashland plant annually rotomolds around 30 million PVC beach balls of 4-in. to 33-in. diameter using some 30 upgraded machines from McNeil-Akron (now Ferry Industries). In addition, Ashland blow molds around 40 million smaller (3-in.) polyethylene balls for play pits at fast-food outlets. Ashland is working to expand automation of play-ball lines from materials handling through final packaging. The unit also created satellite rotomolding centers in Dallas, Dothan, Ala., and Reno, Nev., to minimize shipping costs.

Print variety and quality are key determinants of sales in play balls, says Jim Braeunig, Ashland’s general manager. To enhance product appeal, Ashland recently installed 360° color printers and adopted high-gloss, water-based lacquers.

Related Content

Use Interactive Production Scheduling to Improve Your Plant's Efficiencies

When evaluating ERP solutions, consider the power of interactive production scheduling to effectively plan and allocate primary and secondary equipment, materials and resources on the overall production capacity of the business and conclude that this is a key area that cannot be overlooked.

Read MoreSolve Four Common Problems in PET Stretch-Blow Molding

Here’s a quick guide to fixing four nettlesome problems in processing PET bottles.

Read MoreGet Color Changes Right In Extrusion Blow Molding

Follow these best practices to minimize loss of time, material and labor during color changes in molding containers from bottles to jerrycans. The authors explore what this means for each step of the process, from raw-material infeed to handling and reprocessing tails and trim.

Read MoreAs Currier Grows in Medical Consumables, Blow Molding Is Its ‘Foot in the Door’

Currier Plastics has added substantial capacity recently in both injection and blow molding for medical/pharmaceutical products, including several machines to occupy a new, large clean room.

Read MoreRead Next

Processor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreHow Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read More