Will mold makers be calling the shots soon in automotive?

North American mold makers might soon enjoy something they haven’t had in a very long time: leverage.

North American mold makers might soon enjoy something they haven’t had in a very long time: leverage. Stationed at the bottom of the supply chain (and we all know which way muck flows), these small-to-medium sized businesses are entangled in at-times abusive relationships with OEMs and Tier suppliers, who fight plenty among themselves but can agree on one thing: it [‘it’ being anything gone awry with a model launch] was the tool maker’s fault. While trying to keep their customers, and at times their customers’ customers, happy, these same shops must also justify their cost structure in the face of quotes from low-cost-country tooling suppliers.

Pretty bleak, but maybe, just maybe, the dynamics are changing. Why? OEMs in North America are going to need a whole lot of new molds over the next five years, and they increasingly want to source them locally. That statement oversimplifies the findings of a fascinating new report by consulting firm Harbour Results Inc. (Royal Oak, Mich.), which is well worth a read.

In conjunction with the Original Equipment Suppliers Assn. (OESA; Troy, Mich.), Harbour undertook an automotive vendor tooling study that analyzes the entire vendor tooling value stream, including OEMs, Tier 1 and Tier 2 part suppliers and tooling manufacturers. HRI spent a year researching the study, conducting interviews with seven OEMs, almost 50 Tier 1 and Tier 2 suppliers, as well as more than 50 tooling suppliers.

Pending supply gap

So why might mold makers soon wield some leverage? Harbour noted that the current North American tool spend is approximately $9.25 billion, with total capacity of approximately $11.25 billion, which assumes a sustainable utilization rate of 79%. By 2018, Harbour estimates that total OEM tool spend in North America will jump 64% to $15.20 billion, creating a massive amount of mold demand and a maxed-out sector.

There are several reasons for the jump.

- OEMs might be launching fewer vehicle platforms overall, but now have more models with more trim packages and options than ever before (all of which require tools)

- German, Korean, and Japanese OEMs that settled in North America are looking to source less tooling from their home countries and more locally for new plants in the U.S. and Mexico

- Low-cost suppliers in China are becoming higher cost and can increasingly fill capacity with domestic automotive OEMs

Laurie Harbour, founder of Harbour Results, told Plastics Technology that as dynamic as the situation is, one fact is not likely to change. “We’re not going to stop launching vehicles,” Harbour said, “it’s just not going to happen, so we need these tool shops.”

Even without the aggravating factors listed above, these shops would still be needed just on the basis of a fully recovered automotive industry. Global auto sales in 2013 are once again on the rise, climbing 7% (18.4 million units) in North America and 5% (35.7 million units) in Asia, where China’s 11% growth and 21.3 million units set the pace. Globally, sales are expected to hit 83.4 million vehicles in 2014, rising by 4%. That sales growth is pushing capacity growth, which is expected to rise from 111.7 million units to 134.7 million from 2012 to 2017. New cars, of course, mean new tools.

A disproportionate number of those new tools will run here in North America, especially points south. In Mexico, light-vehicle production is forecast to more than double by 2020 from 1.9 to 4 million. In the Southeastern U.S. over the same time period, it will nearly triple, exploding from 1.6 to 4.2 million.

Have it your way

As that production increases, the composition of the fleets is changing. There will be fewer vehicle platforms, but more models and mass customization. “As a result, new model entries and designs will significantly outnumber drops in the coming years, which will lead to an increased need for vendor tooling,” the report noted. Common, unseen components will be duplicated across platforms.

“If it’s a shoot and ship plastic cap, why does it have to different for every vehicle,” Harbour asked rhetorically. “It’s about the ability to have more flexibility and to tailor and flex things that are customer facing. Fascia, door panel, pillar… that way that’s the stuff that the customer sees and it’s different.”

Call to action

If North American tool shops are to respond to the pending supply crunch, Harbour argues that OEMs and Tier suppliers will have to reconsider payment terms, in particular the payment schedule. Citing a “broken financial model”, the report notes that while tooling represents 100% of the tool supplier’s cash flow, it’s only a small portion (Harbour estimates less than 6%) of the cost for the OEM and Tier 1, placing a “significant cash-flow burden” on the tool supplier.

The study’s survey of OEMs found that eight of 10 utilize Production Part Approval Process (PPAP) payment terms, paying for a tool near vehicle launch, which can be 12-18 months after a mold maker would have “kicked off” the tools. Harbour advocates for progressive payments, paying for the tool in installments essentially, as it’s built, and lessening the cash-flow strain on the mold maker. Progressive payments were utilized in the wake of the 2008 recession for the simple fact that mold makers were cash strapped. Now OEMs are reverting back to PPAP, but Harbour asks if that’s wise, especially given how much they will need healthy tool shops in coming years.

“It’s like if we want a healthy industry, we have to do our part to make it healthy,” Harbour told Plastics Technology. “OEMs in particular are starting to really understand that that in order to work with their favorite shops and the best and the brightest, the ones that invest in R&D, advanced manufacturing, they’re realizing that, ‘I’ve got to figure out a way to guarantee capacity.’ How? ‘I’ve got to pay them better.’ It’s not going to happen overnight, we see some now, and some will continue to come. [The industry] just can‘t make a full swoop change; it has to implement it step by step. Everyone has to work at it together, and that’s how this industry is going to survive.”

Read Next

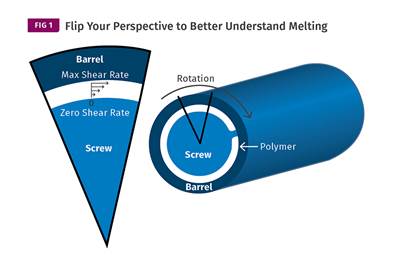

Understanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read More

.png;maxWidth=300;quality=90)