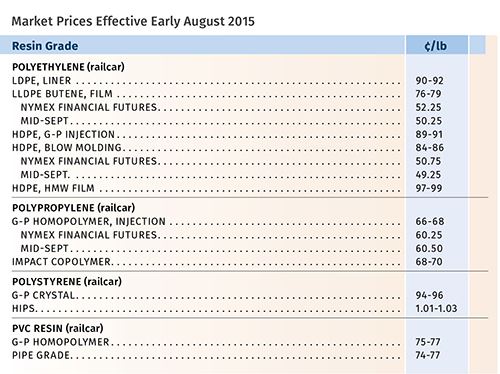

Commodity Resin Prices Soft, Except for PP

The price trajectory for PE, PS, and PVC appears to be downward but firmly steady for PP.

As feedstock and energy prices drop, lower global resin prices, along with good-to-ample domestic supplies of PE, PS, and PVC, have resulted in downward pressure on prices of these three commodities. The exception is PP, which continues to be in strong demand and in continuing tight supply. Prices for PP have been “firmly stable,” as suppliers have dealt with falling feedstock prices by issuing so-called “profit-margin” increases, similar to the scenario for PE in the last few years. These are some of the views of purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas, and CEO Michael Greenberg of Chicago-based The Plastics Exchange.

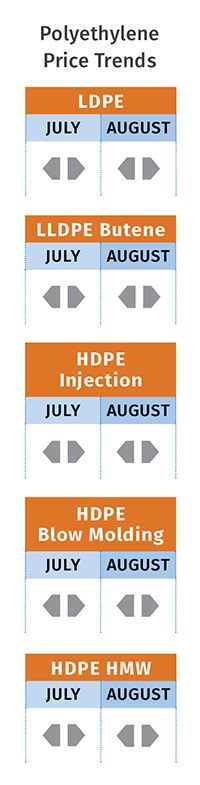

PE PRICES FLAT TO LOWER

Polyethylene prices were unchanged in July and were generally expected to stay put through August, despite a 5¢/lb increase announced for July. In fact, September PE contract prices could drop by as much as 3-5¢/lb, according to Mike Burns, RTi’s v.p. of client services for PE, and Greenberg of The Plastics Exchange.

Commenting on this downward trajectory in late July, Greenberg reported that PE spot trading had slowed and spot prices dropped another 1¢. “Purchasing habits seem to be shifting as processors anticipate lower prices ahead. We are seeing more cases of minimal procurement to fill in supply gaps while opting to work off inventories.”

Burns added that PE export prices also dropped, as global PE prices sagged. Domestic processors are buying as needed, with the expectation of lower prices and also because they restocked back in June prior to the announced July increase. U.S. demand continues to be good and will show an increase over 2014, but material availability is now ample. While PE suppliers might be expected to throttle back production, Burns said that’s not happening. “They will continue to run at high operating rates because their material is still the cheapest on the block, despite falling prices elsewhere.” He also adds that domestic suppliers must hold on to Latin American and Mexican export markets to avoid an oversupply situation.

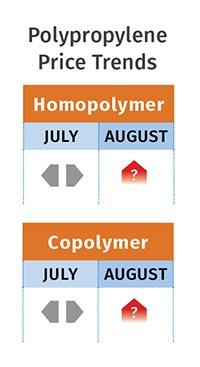

PP PRICES ‘FIRMLY FLAT’

Polypropylene prices remained flat through July, despite two key factors: July propylene monomer dropped 3.5¢/lb and PP suppliers aimed to implement a 5¢/lb margin expansion increase.

How things would shape up for PP in August and September was anyone’s guess. Some PP suppliers notified customers that they would split the July margin increase between August and September. “There is a possibility that suppliers will be able to implement some or all of that increase,” ventured Scott Newell, RTi’s director of client services for PP, because domestic demand has been very strong—up 6% so far vs. the same period last year.

Meanwhile, August monomer contracts were expected to settle flat to 2¢/lb lower, said Newell. According to Greenberg, after the July drop, traders were indicating that monomer prices would ease about a half-cent through the end of the year, before building monthly increases during 2016, rising almost 4¢/lb higher by the end of next year.

Most PP processors are not passing on any of the profit-margin increases implemented by suppliers because PP prices have actually remained largely flat since April. That’s because monomer prices dropped 6.5¢/lb, from 43¢ to 36.5¢/lb. Most processors have also not been buying resin, working off inventories. Greenberg reported that spot prices remained higher than premium contract levels through much of July. But Newell noted that spot prices had started to soften a bit and it appeared that while supply is still tight, it might be loosening a bit.

Meanwhile, the first new PP production plant to be built in the U.S. in many years has been announced by Formosa Plastics USA, Livingston, N.J. No details on capacity or anticipated completion date were disclosed. To be built at its Point Comfort , Texas, site, the PP line will be backward-integrated with Formosa’s new 1.3-billion-lb propylene monomer plant. Industry sources expect new PP capacity plans from other PP suppliers in 2016, if not sooner.

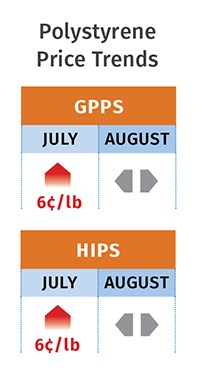

PS PRICES YO-YO UP/DOWN

Polystyrene prices reversed course in July, moving up by 6¢/lb, and in some cases 8¢, following the 80¢/gal increase in July benzene contract prices. However, August benzene contracts settled 25¢ lower at $2.80/gal, so PS prices have again swerved downward.

Prices for August and September were expected to be flat to lower, according to Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC. “I think we will see them go somewhat lower. If we look at it strictly from the benzene price perspective, PS prices ought to be 2.5¢/lb lower. However, there will be some negotiation taking place as PS suppliers may try to gain some margin because of the 5¢/lb they lost in June.” At the same time, Kallman noted that the lower oil and benzene prices have brought back imports. “If we sustain these lower feedstock prices, PS resin prices will drop more.”

PVC PRICES FLAT

PVC prices remained flat in July and the same was expected for August, for the sixth month in a row. Suppliers’ increases of 2-3¢/lb appeared to have fallen by the wayside.

PVC prices are unlikely to move this month as well, according to RTi’s Kallman. He characterized supply as ample, with exports down and no substantial increases in demand as the end of the construction season approaches. Ethylene contract prices dropped by 0.75¢/lb in June, and July contracts were expected to be flat or lower.

Related Content

Recycled Content to be Incorporated in PS Foam Packaging

Pactiv Evergreen and Amsty announced a collaboration that will bring ISCC plus certified product into select food packaging.

Read MoreNexkemia Acquires Polystyrene Recycling Assets

The polystyrene manufacturer finalized its purchase of Eco-Captation, a recycler.

Read MorePP Prices May Plunge, Others Are Mostly Flat

PP prices appear on the verge a major downward trajectory, with some potential of a modest downward path for others.

Read MoreSorting Mixed Plastics by Color and Type

Steinert will demonstrate plastic sorting technology at K 2022.

Read MoreRead Next

How Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read More