PS Prices Plunge, Others Appear to Be Bottoming Out

PS prices to see significant drop, with some potential for a modest downward path for others.

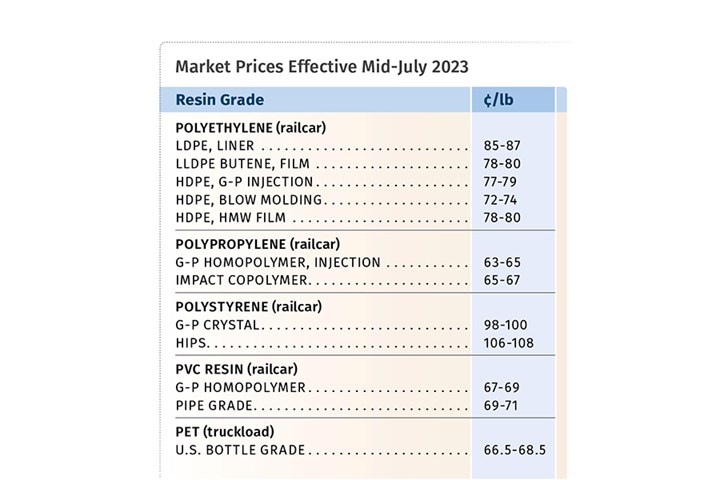

This year’s correction in prices of the five major commodity resins was well underway heading into the third quarter. While prices of PE, PP, PVC and PET appeared to be bottoming out, prices of PS were forecast to have a substantial, possibly double-digit, drop.

Barring major production disruptions during this hurricane season or other unplanned outages, prices were generally expected to be flat-to-lower for at least part of the third quarter, owing to continued sluggish demand, lower cost feedstocks and oversupply in the case of PET and polyolefins, particularly PE. In the polyolefins arena, spot market buying has been stronger due to much lower price offers that can be had. Domestic demand for both PE and PP through May was down nearly 9%.

These are the views of purchasing consultants from Resin Technology Inc. (RTi), senior analysts from Houston-based PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange and Scott Newell, executive v.p. polyolefins at distributor/compounder Spartan Polymers.

PE Prices Down

Polyethylene prices were largely expected to drop by 3¢/lb in June, with a similar decrease in July, followed by flat pricing in August, according to David Barry, PCW’s associate director for PE, PP, and PS, Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets, and The Plastic Exchange’s CEO Michael Greenberg. This, while PE suppliers postponed their June 3¢/lb increase to July. Greenberg noted that despite supply/demand conditions, it makes sense to have price increases nominated all during the hurricane season and this should also serve as a good reminder for processors to keep an inventory buffer on hand.

Says Barry, “Buyers were expecting a minimum price decrease of 3¢/lb in June. The situation was complicated by price decreases of 3¢/ to 5¢/lb granted on a case-by-case basis in recent months.” He notes that 2023 PE contract prices went up a total of 6¢/lb through June, while spot PE prices were down 6¢/lb to as much as 12¢/lb. RTi’s Chesshier notes that suppliers cost to produce PE had dropped by over 40% since the beginning of the year, with plant operating rates below 85%.

Greenberg confirms that some processors continued to engage the spot market for well-priced resin, and that by June’s end there was still plenty of it for both prime and offgrade in bulk railcars and packaged truckloads. Referring to ACC data for May, he notes that while domestic and export sales were a bit above average, it did not prove enough to move all the resin produced, “so collective producer inventories built for a third straight month to the highest level since July 2022.”

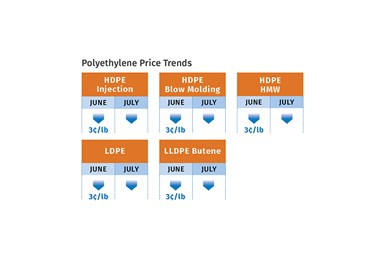

PP Prices Down, Then Bottom Out?

Polypropylene prices in June appeared to be heading down by 4¢/lb in step with propylene monomer, after dropping 8¢/lb in May, and a total of 19¢/lb since March, according to PCW’s Barry, Spartan Polymers’ Newell and The Plastic Exchange’s Greenberg. The three generally thought PP prices may have bottomed out, though they saw some potential for a bit further reduction in July-August.

“After rallying during the first quarter, spot PP prices have really taken it on the chin the past couple of months.”

Says Newell, “The sentiment on the street is still pretty bearish. This despite an increase in domestic demand of 7% in May over April. But, I’m not very sure that this was indicative of a real rebound starting to take place.” He noted that the market, overall, is negative. Production dropped in May, with plant operating rates approaching 70.3% ... the lowest yet in 2023. While this resulted in a resin supplier inventory draw of 73 million lbs, inventory days were still at a high of 43 days going into July.

PCW’s Barry notes that spot PP prices, which continued to be 2¢ to 3¢/lb lower than contract prices, were starting to stabilize, indicating that prices could be bottoming out.

Greenberg summarizes the spot market this way, “After rallying during the first quarter, spot prices have really taken it on the chin the past couple of months and have now become well discounted to contract levels, providing processors with excellent buying opportunities. Downstream resin and finished goods inventories have been reduced over the past three quarters, and we are seeing an effort to replenish these stocks now that resin prices have come back down again. Generally speaking, PP supply is sufficient and most grades can be found in railcar quantities and at favorable prices.”

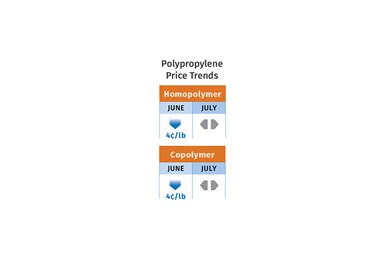

PS Prices Drop

Polystyrene prices were expected to drop 3¢ to 4¢/lb in June, after dropping 3¢/lb in May, and a pretty substantial decrease was projected for the July-August time frame, according to PCW’s Barry and RTi’s Chesshier. The key driver was lower-cost benzene, with spot prices by June’s end as low as $2.79/gal vs. the June contract price of $3.55/gal. Barry ventures that a PS price decrease of 5¢ to 6¢/lb was possible for July. Chesshier ventured that within July-August, there was the potential for an overall decrease in PS prices of 10¢ to 12¢/lb.

Barry notes that benzene values were pressured by high Asian import volumes and weak downstream demand. Both sources characterized PS demand as significantly down with plant operating rates in the 50% range.

PVC Prices Down, Then Flat

PVC prices dropped by 2¢/lb in May and were set to drop by another 2¢/lb in June, and projected to be largely flat in the July-August time frame, according to Paul Pavlov, RTi’s v.p. of PP and PVC and PCW’s senior editor Donna Todd. The latter reported that industry forecasts changed in the third week of June, with projections of flat pricing for July, up 1¢/lb for August, flat for September and October, and down 2¢/lb for November and down 1¢/lb for December. “Market participants were scratching their heads over the prediction of a 1¢/lb price increase for August, because traditionally demand is moribund in both the domestic and export markets during August,” Todd offers. She notes that these participants expected domestic downstream demand to rebound in the September-October time frame, and would have expected any price increase to take place at that time.

Pavlov states that demand was showing a bit of a rebound as housing starts looked better, indicating there was some drawdown of high supplier inventories. However, plant operating rates had been throttled back to the 60% range for most of the second quarter.

PET Prices Flat

PET prices were flat in June, after falling by 2.5¢/lb in May, and were expected to be flat in July, based on raw material formulation contracts, according to Mark Kallman RTi’s v.p. of PVC, PET and engineering resins. He ventures that prices in August could follow suit, though there was some potential for a decrease. He characterized demand as continued sluggish with resin availability on the high end, despite lower production rates. Moreover, there have been some even better offers for imported PET, which are ample and typically lower cost. Also, several attractive offers could be had in the spot market.

Related Content

Advanced Drainage Systems to Build New Florida Manufacturing Facility

New manufacturing facility will complement other ADS facilities in the southeast region.

Read MorePackaging Waste Will Become Composite Decking

New partnership will incorporate process waste into wood-alternative decking.

Read MoreArtificial Intelligence Enables Smarter Sourcing

Westfall Technik has adopted Arkestro’s predictive procurement software to wring savings and more reliable deliveries from a historically challenging supply chain.

Read MoreEV Chargers Made From Renewable PC

SABIC is enabling Charge Amps to manufacture electric vehicle (EV) chargers with a housing made from certified renewable PC, a first for the industry.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreTroubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read More

.png;maxWidth=300;quality=90)