Resin and Energy Costs Gradually Easing

Very high prices for materials and energy remain a vexing issue for most U.S. manufacturers, especially plastics processors.

Very high prices for materials and energy remain a vexing issue for most U.S. manufacturers, especially plastics processors. But after two years of a sharp uptrend in materials costs, the market fundamentals have finally shifted, and a gradual but steady downtrend should prevail in the prices for most types of plastics resins, basic steel products, and energy products for the foreseeable future.

Resin prices have closely followed the price of crude oil in recent years, so a downtrend in oil prices is a necessary prerequisite for a decline in resin prices. Crude oil prices have declined in recent weeks after surging during the second half of last year and the first two months of 2005. One reason for this is that the build-up in commercial crude oil inventories has continued at a strong pace. The Energy Information Administration's latest report shows that over the last four weeks, crude oil imports averaged 10.2 million barrels per day, some 100,000 bpd more than the already high levels seen over the same period one year ago. As a result of continuing strong imports, commercial crude oil inventories have reached their highest level in more than three years and stand above the upper end of the five-year average for this time of the year. Increasing inventories will eventually push oil prices even lower in the months ahead.

The inventory numbers confirm that crude markets remain well supplied and the same can also be said for the distillate product markets (gasoline and heating oil). The EIA reports that gasoline stocks stand about 6% above their level of one year ago and are rapidly approaching the upper end of the five-year average for this time of the year. Motorists should see some easing of prices at the pump, although strong seasonal demand will keep gasoline prices from declining sharply through the summer driving season. And lower gasoline prices will increase the amount of income consumers have to spend on other goods such as plastics products.

The recent decline of petroleum prices will also weigh on natural gas prices, although the weather will also determine the future direction of natural gas prices. Higher-than-average temperatures during the summer will increase the demand for natural gas and could send gas prices higher. For now, ample storage and a weaker petroleum complex are putting downward pressure on natural gas prices. Since most domestically produced resins are made from natural gas derivatives, a decline in gas prices will also contribute to a drop in resin prices.

At the present time, our Resins Price Index is off of its peak, and the trend in polyethylene and polypropylene components of the Index are clearly heading downward. The trends in the reported prices of polystyrene and PVC continue to rise, but a sustained decline in the price of feedstocks will eventually result in some price relief for these market segments as well. Our forecast calls for a continued gradual decline in the average prices of resins throughout the remainder of 2005 and through 2006.

One other material that has experienced a sharp price increase over the past two years is steel. And here too the news has been good so far in 2005. According to PPI data released by the Bureau of Labor Statistics, the price that manufacturers have paid for basic steel mill products has declined for three consecutive months. The amount of the decline so far has been modest relative to the prior increase, but a situation of stable to lower prices is decidedly preferable to a sharp uptrend at any price level, and prices should continue to moderate in the near to medium term.

Consumers of specialty steels, such as stainless and tool steel, will be amongst the last to benefit from the decline in basic steel products because the global prices for most of the alloy materials that are added to basic steel in order to make specialty steels remain elevated. But as in any market, the cure for high prices is high prices. Producers will increase production in order to take advantage of high market prices at the same time that consumers figure out ways to avoid paying the high costs. The inevitable result is that prices for these products will stabilize and then decline, perhaps as early as the second half of this year.

Read Next

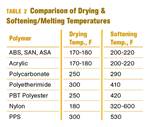

Processor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

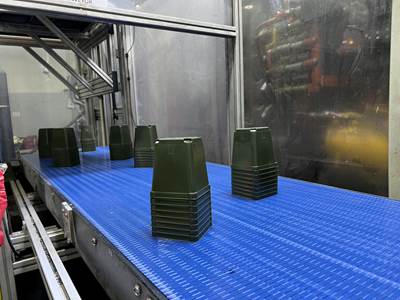

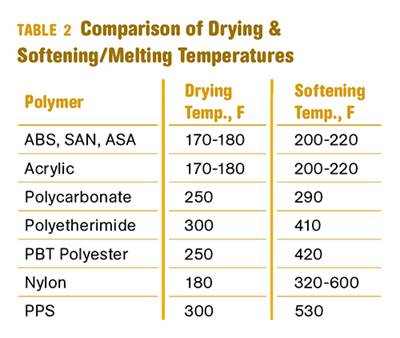

Read MoreWhy (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read More