Wood on Plastics: Making Cars Makes Money Again

The U.S. motor vehicle and parts industry reached a major milestone earlier this year.

The U.S. motor vehicle and parts industry reached a major milestone earlier this year. In the first quarter of 2010 (the last period for

which there is data), domestically based manufacturers of cars and parts reported combined profits of $7.2 billion (annualized), according to the Bureau of Economic Analysis. This was the first time in four years that this sector had reported anything other than staggering losses, and it was only the fourth time in the past decade that the quarterly total has been in the black. So the U.S motor vehicle industry is still a long way from where it needs to be, and one quarter of good news does not necessarily represent a trend. But still, that had to feel good.

And a closer look at some of the other data from the auto industry indicates that this time, the trend in overall profitability for U.S. manufacturers just might be sustainable. Total vehicle sales are the best indicator of market demand for motor vehicles, and here the news is pretty good and expected to get better later this year and beyond. After averaging annual sales of between 16 million and 17 million cars before the recession, sales plummeted to a cyclical low of just over 10 million units in 2009. The current forecast calls for a rise to between 11 million and 12 million units in 2010 which would be an annual gain of more than 10%.

This is still well below the pre-recession trend in auto demand, but market demand for cars correlates with the trends in consumer confidence and other big-ticket purchases such as housing starts. Consumers will continue to exhibit lackluster confidence until an uptrend in employment becomes better established. This will happen late this year and throughout 2011 and 2012. So for right now, sellers of cars must take heart in the fact that the bottom of the market is clearly behind us, and we will continue to head in the right direction.

There is yet another trend emerging that should bolster the spirits of North American plastics processors, moldmakers, and other suppliers to this industry. The trend in U.S. motor-vehicle assemblies is the best indicator of locally produced cars and parts. The assemblies data averaged around 12 million units/yr for most of the past decade, but it dropped below 6 million units in 2009. Through the first half of 2010, the number of vehicle assemblies is up nearly 70% from the same period last year. This rate of growth will abate in the second half of the year, but the annual gain for 2010 is still expected to be higher than 30% with an annual total of better than 8 million units. Again, this is still well short of where the industry would like to be, but if the total number of cars sold in the U.S. in 2010 rises 10% while at the same time the number of vehicles assembled and supplied domestically jumps 30% it means that the American manufacturers are enjoying a strong gain in market share.

It is still too early to predict the long-term implications of all of this data, and like I said before, one quarter does not a trend make. But for the first time in a long time, the news coming out of the U.S. auto industry is actually pretty good and there is strong reason to hope that it will continue to get better.

WHAT THIS MEANS TO YOU

- The future will demand vehicles that are lighter, smaller, safer, more efficient, and more capable, and the only way to get there is by using more plastic parts. If you’re in the business of supplying parts for new vehicles, you are very likely to be busier now than a year ago, and you’re going to get even busier.

- Support state and federal government efforts to promote higher levels of vehicle energy efficiency, recyclability, and emissions controls. These efforts will benefit the plastics industry (and society) in the long-run, but they are only achievable if everybody is made to comply.

- Encourage local initiatives to reduce congestion and improve the infrastructure in the major cities. These are beneficial to the plastics industry (and society) in the long-run because they improve overall productivity and put a premium on lighter, more efficient vehicles.

Related Content

Honda Now Exploring UBQ’s Biobased Material Made from Unsorted Household Waste

UBQ is aiming to expand its reach for more sustainable automotive parts as well as non-automotive applications.

Read MorePlastic Compounding Market to Outpace Metal & Alloy Market Growth

Study shows the plastic compounding process is being used to boost electrical properties and UV resistance while custom compounding is increasingly being used to achieve high-performance in plastic-based goods.

Read MoreGetting Charged Up About Electric Vehicles

Metal-to-plastics replacement stories are a classic of the genre for plastics publishing, and nowhere more so than in the automotive space.

Read MoreDesign Optimization Software Finds Weight-Saving Solutions Outside the Traditional Realm

Resin supplier Celanese turned to startup Rafinex and its Möbius software to optimize the design for an engine bracket, ultimately reducing weight by 25% while maintaining mechanical performance and function.

Read MoreRead Next

How Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

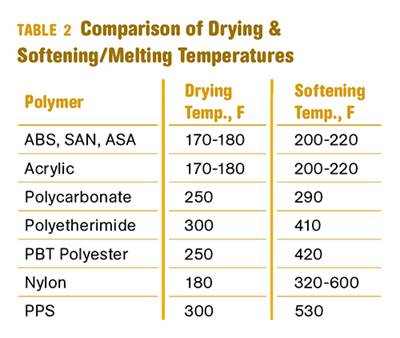

Read MoreWhy (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More