Your Business Outlook - February 2002

Medical Molding Grows at 2.5 Times GDP

With an annual growth rate of 8% or more, medical plastics molding in North America is sprinting toward a 1.2-billion-lb/yr consumption level.

With an annual growth rate of 8% or more, medical plastics molding in North America is sprinting toward a 1.2-billion-lb/yr consumption level. This is nearly 2.5 times the robust historical level of overall GDP growth experienced over the previous 10 years. Some may think that all plastics markets are under recessionary constraints and economic pressures, but Mastio & Company's latest injection molding market study forecasts continued outstanding economic times for single-use and reusable medical plastic products. Consumption is especially strong for polypropylene, polyethylene, and polystyrene.

The aging population is one major factor that continues to fuel this dramatic growth, while new point-of-care products, microsurgery techniques, and pharmaceutical delivery systems make plastics the preferred material in medical products.

Disposables dominate

Disposable, single-use medical devices dominate the medical plastics marketplace. In 2001, single-use medical plastic products achieved an 89% share of medical-market poundage, while reusable medical devices held an 11% share. By 2006, single-use disposable medical products will capture over 91% of the medical market. Disposables will grow at an average of 10.5% per year from 2001 to 2006, while reusables will grow 4.7%/yr. This is due in large part to the useful properties of PP and many new high-strength, custom-designed grades of PE and PS. Since 1997, PE use for medical products has more than quadrupled. Much of this increase has come at the expense of PVC.

PVC usage in this market shrank by 17.4%/yr from 1997 to 2001, due to environmental pressures and other issues such as waste disposal, residual monomer, limited recycling opportunities, and corrosiveness to molding equipment. Now it appears that displacement of PVC by polyolefins has reached a plateau. PVC will show good growth in the next five years.

By 2006, PP will have captured nearly 43% of the medical plastics market and will achieve over 500 million lb of resin consumption. Combined with polyethylene, polyolefins will account for nearly 650 million lb of molded medical plastics. Polystyrene resin consumption will continue to grow nearly as fast as polyolefins and pass the 180-million-lb mark by 2006. PS and polyolefins together will account for over 70% of resin consumption in medical molding.Numerous engineering resins are also used in reusable medical components. Even though their poundage is in the double-digit millions, it is still a very small fraction of the total. What's more, a number of medical applications are being switched from engineering grades to more cost-effective PP. Nonetheless, polycarbonate resin demand will increase nearly 40% from 2001 to 2006.

Top Five Injection Molders

Of Medical Devices1997 Rank 2001 Becton-Dickinson 1 Becton-Dickinson Abbott Laboratories 2 Tyco Healthcare-Kendall

(Tyco International Ltd.)Sherwood-Medical

(Sherwood-Davis & Geck)3 Abbott Laboratories Baxter International 4 Baxter Health Care

(Baxter International)Nypro, Inc. 5 Courtesy Corp.

Increasing concentration

Medical molding is dominated by OEMs, including the top five: Becton-Dickinson, Tyco Healthcare-Kendall, Abbott Laboratories, Baxter Health Care, and Courtesy Corp. Other major custom molders and OEM molders include Premium Plastics, Inc., Nypro Inc., Tech Group, and B. Braun Medical. Many of these companies are evolving, much like the automotive industry in the last 10 years, toward Tier 1, Tier 2, and Tier 3 suppliers of medical systems from design to finished products.

Today more than 75 companies participate in the medical plastics market. This group of molders is likely to face continued consolidations, mergers, and acquisitions as companies seek to dominate this lucrative business.

Mastio & Co., based in St. Joseph, Mo., is a well-known consulting firm specializing in industrial-consumer opinion research and market trends in the plastics industry. For more information visit www.mastio.com/medical.html.

Read Next

Understanding Melting in Single-Screw Extruders

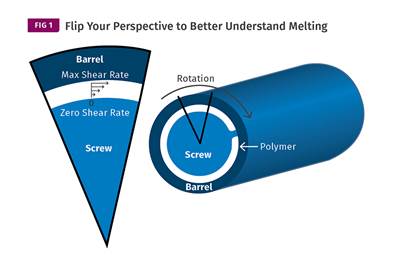

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

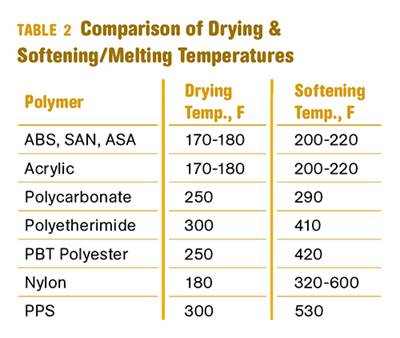

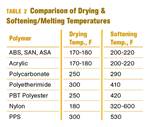

Read MoreWhy (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read More

.png;maxWidth=300;quality=90)