PE Prices Bottom Out? PP Prices Move Up!

Not a surprise: The volatility of PE and PP prices is on a roll.

So, here we are, at the beginning of the ‘Ides of March’, and perhaps that says it all, but most likely not when it comes to commodity resin pricing and particularly polyolefins!

Polyethylene prices dropped 5ȼ/lb in February, bringing the total decline in prices within a five-month period to 16ȼ/lb. This movement and, in fact, the global PE price movement has been linked to crude oil prices in terms of key drivers affecting pricing for the last four years, says Mike Burns, v.p. for PE at Resin Technology, Inc. (RTi). “The delta between global and domestic PE prices has shrunk…for example, China’s PE prices dropped by 20 ȼ/lb within a two-month period last year and domestic prices took longer to follow but are now sort of ‘good enough’… though another decline is possible in March, depending on crude oil price movement.”

In general, Burns sees PE resin prices as maybe having bottomed out. Globally, prices have started to rebound a bit and domestic secondary markets are showing the same trend. Burns, for one, expects to see the PE exports market start to pick up within second and third quarters—with 2015 potentially emulating 2014’s same time frame in terms of demand and pricing stability. Burns points out that last year, demand appeared to be up during the first quarter primarily due to pre-buying in anticipation of price increases that were implemented and driven by several production capacity issues affecting nearly every PE resin. In contrast, this year, processors have been buying ‘as needed’ in anticipation since end of 2014, of further price relief. In addition, PE supplier inventory levels are at their highest within the last six years, reflecting the loss of exports.

At the Plastics Recycling conference held last week in Dallas, Joel Morales, director of polyolefins for IHS noted that the key to lower domestic PE prices is the return of the exports market. (By the way, it’s interesting to note that one supplier—Dow Chemical, issued a 5ȼ/lb price increase, effective March 15..a move that has not been supported thus far.)

Meanwhile, PP prices appear to have moved up on average a total of 2ȼ/lb within the last two months, as PP suppliers succeeded in achieving margin expansions of 1ȼ/lb beyond the cost of propylene monomer. Tight supplies, driven by unplanned plant production disruptions at three suppliers—Ineos, Phillips 66 and Lyondell Basell, are one driving force, along with rising demand. The latter is being met to a small degree by imported PP available at competitive prices, according to CEO Michael Greenberg of The Plastics Exchange.

IHS’s Morales sees domestic PP pricing power as shifting to PP suppliers due to lack of new PP resin capacity… in essence, mirroring PE pricing trends of a few years ago. “While PP prices have declined in step with crude oil prices, planned and unplanned outages continue to be an issue. Also, PP suppliers have aimed to decouple resin prices from monomer, in order to expand margins..similarly to steps taken by PE suppliers with regard to ethylene monomer prices over the last four years.” Stay tuned…

Want to find or compare materials data for different resins, grades, or suppliers? Check out Plastic Technology’s Plaspec Global materials database.

Related Content

Breaking the Barrier: An Emerging Force in 9-Layer Film Packaging

Hamilton Plastics taps into its 30-plus years of know-how in high-barrier films by bringing novel, custom-engineered, nine-layer structures resulting from the investment in two new lines.

Read MoreReversing Logistics for Plastic Film Recycling

Learn how Mainetti built a circular supply chain for clear film packaging.

Read MoreFlexible-Film Processor Optimizes All-PE Food Packaging

Tobe Packaging’s breakthrough was to create its Ecolefin PE multilayer film that could be applied with a specialized barrier coating.

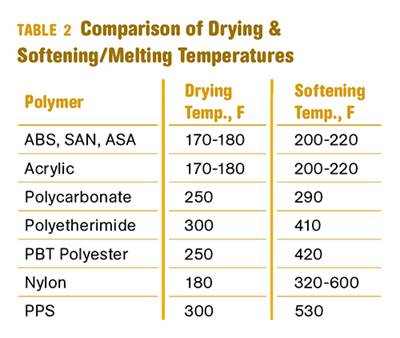

Read MoreBest Methods of Molding Undercuts

Producing plastics parts with undercuts presents distinct challenges for molders.

Read MoreRead Next

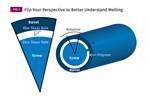

Why (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

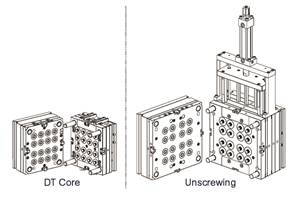

Read MoreUnderstanding Melting in Single-Screw Extruders

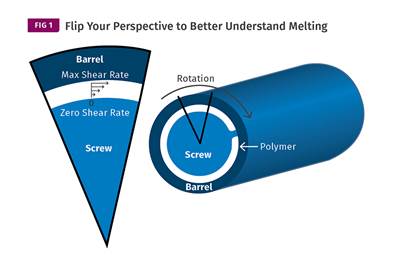

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read More