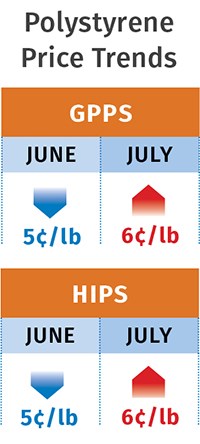

PP, PS Prices Up; PE, PVC Prices Flat

Prices moved up for PS and PP but stayed flat for PE and PVC, despite price increases on the table.

An upwards price surge for PS and PP may continue this month, although the driving factors are markedly different for the two resins: A spike in feedstock costs and tight supply for PS, strong demand for PP. At the same time, prices for PE and PVC have remained flat, despite price increases already on the table. Renewed attempts are being made by suppliers of both, and whether they have “legs” remains to be seen. These are among the views of purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas, and CEO Michael Greenberg of The Plastics Exchange in Chicago.

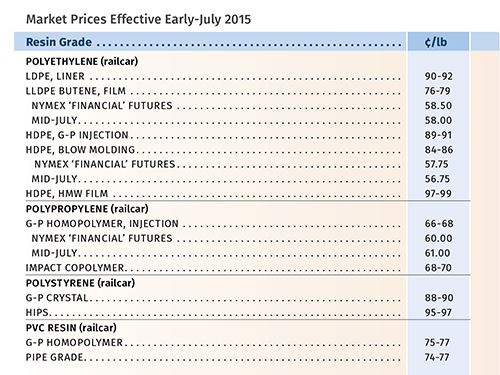

PE PRICES FLAT FOR NOW

Polyethylene prices were flat in June, following the 5¢/lb May increase. Although suppliers were aiming for another 5¢/lb bump in July, its implementation appeared unlikely by June’s end. Key market drivers do not support this increase at the moment, according to Mike Burns, v.p. of client services for PE at RTi.

At the same time, the increase is not likely to simply evaporate. Says Burns, “Suppliers are taking a firm stance on this increase and it will remain in the discussion into the fall.” Industry expectations were that ExxonMobil Chemical, which led this increase, would push it from July into this month. The delay could be even longer unless an unforeseen event occurs, such as unplanned outages, inclement weather as we enter the hurricane season, or a big spike in oil prices. Burns notes that a $10/gal oil price fluctuation equates to a 4-5¢/lb resin price movement.

As of June, Burns saw oil and naphtha prices as having bottomed out, which will keep resin prices firm. North American PE export prices have also bottomed out. At the same time, Southeast Asia and China prices have been dropping due to slowed demand in those regions, and PE supply constraints in Europe are being resolved. So it remains to be seen how PE prices will move as global PE inventories grow.

By the end of June, Greenberg reported that spot PE market activity was slowing after an active period. He attributed the stalling of demand to the fact that implementation of the July increase seemed very unlikely. He also noted that “several slugs of spot PE railcars” being offered into the domestic secondary market appeared to signal a waning export market. Also, resellers at month’s end still had some uncommitted railcars left to sell. According to Burns, PE suppliers’ inventories are now above average levels.

Both sources confirm that monomer spot prices remain firm near 36¢/lb. Said Greenberg, “The cracker turnaround season came to an end with all units back up and with expanded capacity in some cases. Ethylene’s forward curve remains fairly flat through the end of 2016.” But the key is that ethylene prices are firm only because domestic PE operating rates are in the high 90s. Without those high PE outputs, ethylene prices would drop, explains Burns.

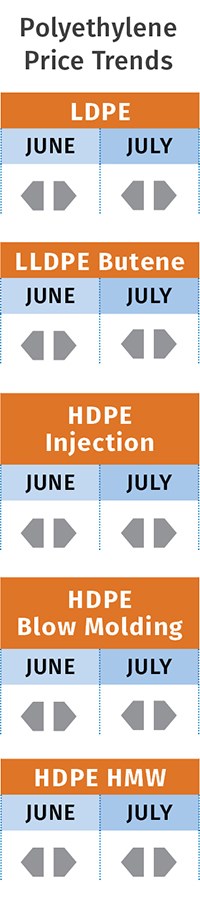

PP PRICES UP A BIT

Polypropylene prices moved up 1¢/lb in June with a possibility of another small increase in July or August. This slight upwards movement is indicative of PP suppliers’ continued efforts to decouple PP prices from propylene monomer prices, according to Scott Newell, RTi’s director of client services for PP.

June monomer contracts dropped 2¢/lb, but PP suppliers sent out letters announcing 3-4¢/lb increases. July monomer contract nominations were expected to be even lower. However, PP suppliers announced 4-5¢/lb margin expansion increases for July or August.

At the end of June, Greenberg reported that spot monomer prices were the lowest they had been in six years, dropping to 36¢/lb and expected to go lower. Even so, PP prices not only won’t drop, but could increase another 1¢/lb or so, according to Newell. He says suppliers are noting that total demand was up 4.8% through May, domestic demand up 5%. Plant operating rates are now above 91% and the market is tighter. “So, suppliers have the pricing power. Most processors know that they have no leverage. And, overall, PP prices have not gone up that much. We’re still the most competitive in PP globally for the first time in many years.”

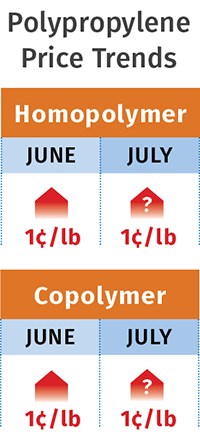

PS PRICES REVERSE COURSE AGAIN

Polystyrene prices dropped 5¢/lb in June, in step with the 59¢/gal drop in June benzene contracts, but this downward movement ended abruptly. July benzene contracts rose a whopping 80¢/gal to $3.05 and PS suppliers issued 6-8¢/lb price increases for July 1.

Improved overall demand for benzene coupled with a drop in benzene imports resulted in snugger domestic supplies, which will likely persist through August, according to Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC. He anticipates some relief in September with the potential return of imports. Says Kallman, “I think the implementation of the July price increases will be closer to 6¢/lb.” Seasonal demand continues to be good.

PVC PRICES FLAT

PVC prices in June remained flat for the third month in a row, despite suppliers’ announced price increases of 3¢/lb for June and 3¢ again for July. At least one supplier dropped its July hike to 2¢, but even that is likely to come to naught.

Market fundamentals do not support an increase, according to RTi’s Kallman. Domestic demand has picked up as the construction season strengthened, and the PVC construction market is showing some modest improvement from 2014. But countering this is the lack of any major cost pressure from feedstocks to support a PVC increase. More importantly, domestic PVC supply is becoming more ample as exports have dropped.

Related Content

Melt Flow Rate Testing–Part 1

Though often criticized, MFR is a very good gauge of the relative average molecular weight of the polymer. Since molecular weight (MW) is the driving force behind performance in polymers, it turns out to be a very useful number.

Read MoreResin Prices Still Dropping

This downward trajectory is expected to continue, primarily due to slowed demand, lower feedstock costs and adequate-to-ample supplies.

Read MoreFundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreRead Next

Advanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreWhy (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More