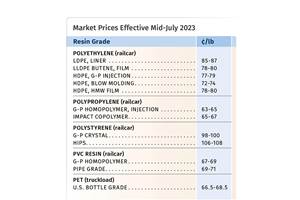

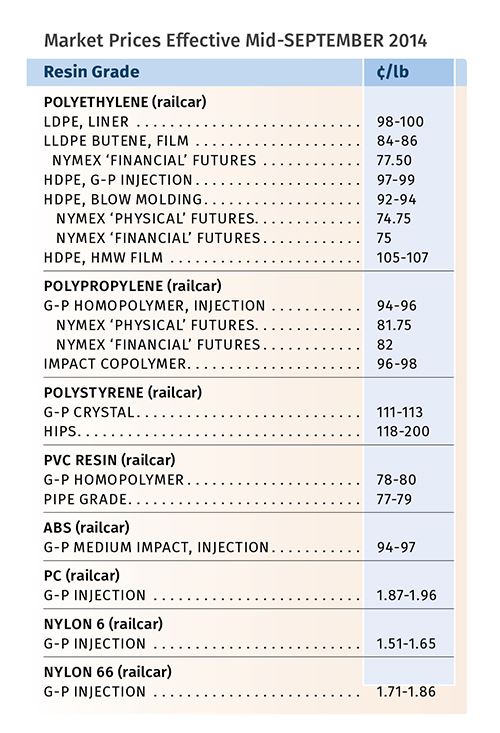

PE, PP, PVC Prices Move Up; PS, Engineering Resins Flat-to-Down

Tight monomer supplies put upward pressure on polyolefin and PVC prices, while the reverse is true for PS and ‘commodity’ engineering resins.

Feedstock shortages due to planned and unplanned shutdowns will continue to place upward pressure on prices of PE, PP, and PVC. In the case of polyolefins, tight resin supplies compound the issue. In contrast, falling prices and ample availability of feedstocks, as well as competitive activity among resin suppliers and, in some cases, attractively priced imports, are holding prices flat or slightly lower for PS, ABS, PC, and nylons 6 and 66. Those are the current assessments of purchasing consultants at Resin Technology Inc. (RTi), Fort Worth, Texas, and CEO Michael Greenberg of The Plastics Exchange, Chicago.

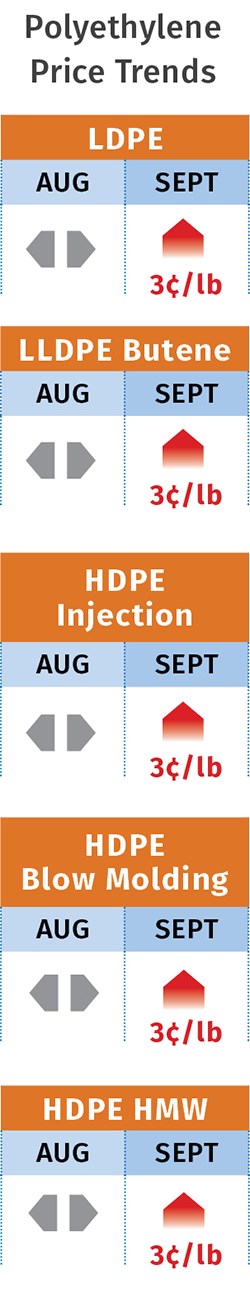

PE PRICES HEADED UP

Polyethylene prices were flat in August, which capped six consecutive months of no changes in prime market prices. Suppliers came out with a 3¢/lb price increase for Sept. 1, which is likely to be implemented, according to both Greenberg and Mike Burns, RTi’s v.p. for PE.

“One thing that might cause suppliers to back off is if global PE prices continue to fall even farther,” says Burns. Barring that, the drivers supporting this increase are tight PE supply due to good domestic demand and tight supplies and higher prices of ethylene monomer, caused by unplanned outages at three major producers. Burns sees this feedstock squeeze continuing into next March. Spot ethylene hit a 28-month high of 70¢/lb. According to Burns, unplanned cracker outages and upcoming scheduled maintenance may keep spot ethylene at that level, nearly 20% higher than in the first half of 2014.

Greenberg adds that at the close of August, “The polyethylene market was slower, hampered by limited material availability and high spot prices relative to contracts. PE film resins, across all HDPE, LLDPE, and LDPE grades, rose 1¢/lb. While HDPE supplies for injection and blow molding are also snug, those processors exhibited staunch resistance to price hikes, leaving their markets steady.”

Suppliers are running their plants above 90% capacity utilization to meet demand, which this year appears to be exceeding last year’s 3% growth.

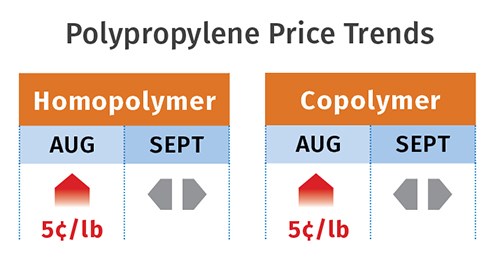

PP ALREADY RISING

Polypropylene contract prices moved up in August as suppliers implemented increases averaging 5¢/lb, in step with propylene monomer hikes. In some cases, suppliers got 7¢/lb—or the extra 2¢ they were seeking to boost their margins, according to Greenberg.

In early September, PP prices showed signs of increasing by another penny, in step with early monomer contract price nominations, according to Scott Newell, RTi’s director of client services for PP. Total was the only PP supplier who came out with a 3¢/lb price hike for Sept. 1, which includes that added 2¢ for margin expansion. Newell concurs with Greenberg that only a fraction of non-contract PP buyers—such as those that buy month-to-month or on a “handshake” deal—had to pay for that 2¢/lb margin increase.

But he expects that by January, with new contract negotiations drawn, the “industry would have caught up,” though the magnitude of the hike could range from 1¢ to 4¢/lb. PP plant operating rates have averaged 88% and topped 90% in the last two months.

Following strong demand in the June/July and even August time frame, some of which was needed for restocking or was purchased in advance of anticipated price hikes, PP demand appears lackluster, as evidenced by the spot market. Newell expects merely “average” demand for the rest of the year. Exports are negligible, owing both to limited resin availability and to high U.S. PP prices. As the end of third quarter approached,

Newell said that PP demand this year was flat relative to 2013. How prices trend from now on will depend on balancing propylene monomer supply issues with downstream demand for PP. Newell said he’s concerned about propylene supply restrictions—for example, CP Chem may not bring on its propylene splitters until the year’s end, after a fire caused a shutdown in July. Moreover, LyondellBasell’s on-purpose propylene unit is down because ethylene has been both very tight and costly, making the economics of on-purpose propylene production unfavorable. (Most propylene is a refinery byproduct.)

Add to that seasonal scheduled refinery maintenance turnarounds this fall, and the PP supply situation could be precarious.

PS PRICES FLAT TO LOWER

Polystyrene prices were flat in August and trending downward for September. Driving this trend is a nearly 60¢/gal drop in combined August and September benzene contract prices, according to Mark Kallman, RTi’s v.p.of client services for engineering resins, PS, and PVC. American Styrenics was the sole supplier to attempt a 5¢/lb PS increase, effective Aug. 15. At press time, the company had yet to lift its force majeure action that went into effect Aug. 1, based on concern for styrene monomer availability.

Monomer producers have throttled back production as domestic PS demand has slowed and exports have dried up. Kallman notes that late settlement of July ethylene contracts was up 1.75¢/lb and August contracts were also likely to settle higher. (Ethylene and benzene are the two main feedstocks for styrene monomer.) Ethylene supply is very tight and there are three crackers scheduled for maintenance shutdown this fall. Kallman ventures that ethylene supply tightness could last until the end of year, with prices firm to higher. That upward pricing pressure is likely to be offset by the drop in benzene prices and more projected to come as domestic supply is good, supplemented by aggressively priced imports.

PVC PRICES FLAT TO HIGHER

PVC prices remained flat through August and were likely to trend flat-to-higher last month and into this one, according to RTi’s Kallman. Suppliers were unable to implement their Aug. 1 increases of 2-3¢/lb, with one delaying it to Sept. 1. Kallman characterizes domestic PVC availability as good due to a seasonal slowdown but notes that any relief from tight ethylene feedstock supplies and higher ethylene prices will be gradual.

ABS PRICES SOFTEN

ABS prices remained flat through the third quarter, despite the 80¢/gal jump in July benzene contract prices and 5¢/lb hike in propylene monomer prices. ABS tabs are now trending flat-to-down, depending on global demand, according to RTi’s Kallman.

Key drivers include the drop of 60¢/gal in Aug./Sept. benzene contracts with further reductions projected due to ample availability, highly competitive activity by domestic suppliers, availability of Taiwanese and South Korean imports, and falling prices of butadiene for suppliers who use that production route.

PC PRICES FLAT

Polycarbonate prices saw modest increases in July and August owing to the spike in both benzene and propylene contract prices. However, PC prices are trending flat through the year’s end, according to RTi’s Kallman. Driving this trend is ample domestic resin availability and a glut in global supplies. However, Kallman does not see lower prices in the near term, as the domestic market is in transition—moving from three major suppliers to two as Styron exits the commodity PC business at year’s end. This move could serve to create a more balanced domestic supply/demand situation. Kallman notes that imports could also become a factor to influence pricing in the downward direction.

NYLON PRICES FLAT-TO-DOWN

Nylon 66 prices remained flat through the third quarter, despite the rise in benzene and propylene feedstock contract prices in July/August. The fourth-quarter trend is likely to be flat-to-down, as benzene and butadiene prices are now trending lower and competitive pricing among suppliers continues, according to RTi’s Kallman.

Nylon 6 prices, meanwhile, moved up a fractional amount from suppliers’ efforts to implement 9-10¢/lb hikes in July. Kallman ventures that prices will be mostly flat for the remainder of the year, as both benzene and ammonia prices are dropping.

Related Content

Prices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MoreRecycled Content to be Incorporated in PS Foam Packaging

Pactiv Evergreen and Amsty announced a collaboration that will bring ISCC plus certified product into select food packaging.

Read MorePS Prices Plunge, Others Appear to Be Bottoming Out

PS prices to see significant drop, with some potential for a modest downward path for others.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreRead Next

How Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read More

.png;maxWidth=300;quality=90)