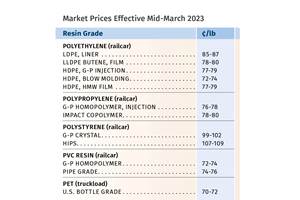

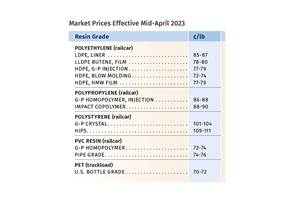

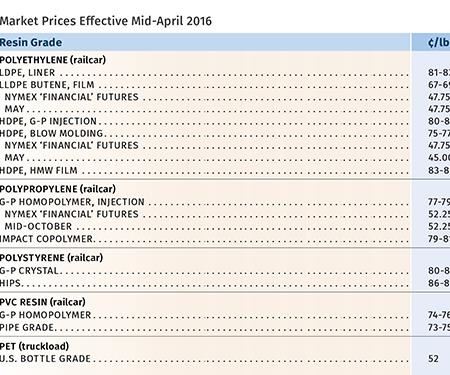

Resin Prices Up, Except for PP

In a reversal of recent trends, PP prices may head down while prices of the other three large-volume commodity resins head up.

After six months of quiet, higher global feedstock and resin prices, and several planned cracker turnarounds, have resulted in upward pricing for PE, PS, and PVC. But in a reversal of the last several months, there is a flat-to-downward trend for PP driven by somewhat less tight supplies, but more by an influx of lower-priced imports.

Those are among the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas, CEO Michael Greenberg of Chicago-based The Plastics Exchange, and Houston-based PetroChemWire.

Starting with this issue, we’re providing bottle-grade PET pricing offered by senior editor Xavier Cronin of PetroChemWire’s Daily PET and Weekly Recycled Plastics reports.

PE PRICES UP

Polyethylene prices went up 5¢/lb in March, and suppliers aimed for another 4¢/lb in April. Barring a surge in oil prices—approaching $50/bbl—or some other global disruption, the second hike will be delayed, predicts Mike Burns, RTi’s v.p. of client services for PE.

Driving this reversal of months of soft pricing are a rise in exports along with domestic prebuying, domestic ethylene cracker turnarounds in March and April, and higher PE prices in Southeast Asia and China. Burns ventured that PE prices will remain relatively flat through the second quarter unless oil prices surge. Looking as far ahead as August, he does not anticipate any fallback in PE prices.

In the first week of April, PetroChemWire reported that PE spot prices ended higher as spot availability remained limited, and one PE supplier announced an additional 5¢/lb price hike for May. PetroChemWire also reported that though there were no unplanned outages, indications of tight supply were seen for LDPE and LLDPE.

The Plastics Exchange’s Greenberg noted that limitations on ethylene and PE production both here and in Asia kept upward pressure on both regions’ prices and brought healthy export demand for North American PE. Greenberg says, “This has helped U.S. PE producers regain pricing power, creating the growing possibility that the April 4¢/lb increase can also be secured, at least partially.”

PP PRICES FLAT-TO-DOWN

Polypropylene prices held even overall, though a lot of mixed activity took place, says Scott Newell, RTi’s v.p. of PP markets. There was turmoil connected with a 1.5¢/lb increase in March propylene monomer contracts, even while some PP suppliers were making moves to decrease resin prices. “Some processors were getting the 1.5¢/lb increase, some were up 1¢/lb, some were offered a rollover, and some were offered a decrease,” Newell notes.

Newell anticipated further decreases in PP prices and suppliers’ margins last month, driven by the influx of lower-priced imports from Korea, Colombia, Brazil, the Middle East, and other regions. Buyers now have more options and suppliers are starting to respond.

Demand by the end of the first quarter appeared to be flat, holding onto the 6% increase last year. The supply situation is much better balanced, compared with the extreme tightness of last year, as processors are buying minimum orders and considering the option of lower-priced imports, says Newell.

PetroChemWire reported, “The balance of supply was perceived to be less tight than in January-February, and there continued to be a considerable price spread between spot and contract business, in some cases as much at 10¢/lb.

PS PRICES MOVING UP

PS prices in March were flat after the February drop of 2-3¢/lb and were on the way up in April as suppliers aimed for increases of 5-6¢, driven by higher global feedstock prices and supply constraints.

Mark Kallman, v.p. of client services for engineering resins, PS, and PVC, noted that a 3-4¢ increase was more realistic and in line with the feedstock hikes. March benzene moved up 40¢/gal and both ethylene and butadiene prices were on the way up—by 5¢/lb in March/April. PS spot prices were higher in the first week of April, in anticipation of the contract increase, as reported by PetroChemWire. The publication noted that demand for prime material was seasonally strong, particularly for GPPS, with adequate supply to meet it.

Kallman projects further price increases ahead, as a drop in benzene imports will contribute to tightness.

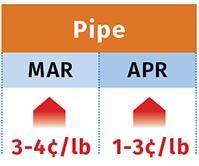

PVC PRICES RISE

PVC prices moved up 3-4¢/lb in March, a partial implementation of that month’s 5¢ hike, with further increases ahead, as suppliers aimed for an April 3¢/lb hike. They also posted a May 6¢/lb hike.

RTi’s Kallman ventured that suppliers would likely get the rest of the March increase and 1¢/lb at most from the April hike, for a total of 1-3¢/lb. “I don’t see this one having any legs unless something were to go horribly wrong—such as unplanned outages.”

Late-settling March ethylene contracts were expected to move up 5¢/lb. Domestic PVC demand was largely flat, with some indication of mild demand from an early construction season, which Kallman sees as determining how the second quarter shapes up.

PET PRICES FLAT

Domestically produced PET bottle-grade prime resin moved up 1¢/lb in April from 51¢/lb in March. The typical price of imported PET in early April was 48.25¢/lb, according to PetroChemWire’s Cronin. “Import PET is available from around the world. In January, for instance, PET was imported from 17 countries,” he notes.

Cronin expected prices for domestic and imported PET to remain stagnant at April levels, due to a glut in supply. He attributes this to both over-production by the four U.S. suppliers and to ample availability of imports. He expects a continued supply glut, partly due to imminent startup of the world’s largest PET plant (2.4-billion lb/yr) being built by M&G Chemicals in Corpus Christi, Texas, and due on stream by year’s end.

Related Content

Sorting Mixed Plastics by Color and Type

Steinert will demonstrate plastic sorting technology at K 2022.

Read MorePrices of Volume Resins Generally Flat or Lower

Exceptions in early March were PP and PS, which moved up solely due to feedstock constraints, along with slight upward movement in PVC and PET.

Read MoreNexkemia Acquires Polystyrene Recycling Assets

The polystyrene manufacturer finalized its purchase of Eco-Captation, a recycler.

Read MorePP Prices May Plunge, Others Are Mostly Flat

PP prices appear on the verge a major downward trajectory, with some potential of a modest downward path for others.

Read MoreRead Next

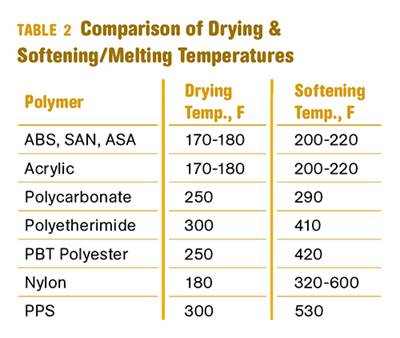

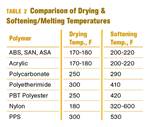

Why (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

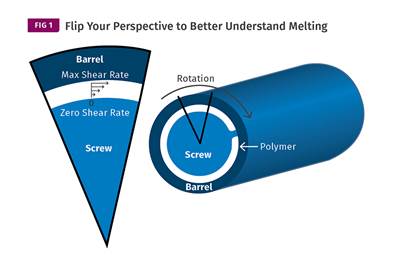

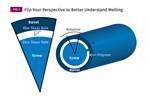

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read More

.png;maxWidth=300;quality=90)