Articles

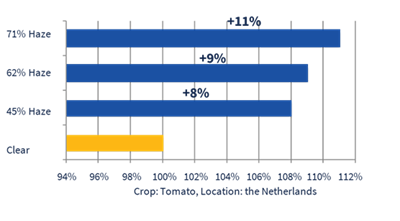

Delivering Increased Benefits to Greenhouse Films

How Baystar is helping customers deliver better, more reliable production methods to greenhouse agriculture.

Read MoreConnectivity for Material Handling Offers Greater Visibility

NPE2024: Motan solutions integrate data connectivity.

Read MoreIn the Zone: MAPP Pavilion

NPE2024: Network with industry leaders and learn new technology at the MAPP Pavilion.

Read MoreNPE2024 Offers Students Career-Advancing Opportunities

NPE2024: the Student Career Development Workshop offers students with career opportunities and advice.

Read MoreEducating the Next Generation of Plastics Professionals

These schools and local industry are working together to close the workforce gap in the plastics industry by offering hefty plastics curricula and training programs for degree-seeking students as well as current plastics employees looking to upskill.

Read MoreSensing Instrumentation for More Sustainable and Automated Polymer Processing

NPE2024: Dynisco solutions support move to nontoxic materials and adds feedback control capability.

Read MoreKiefel Showcasing New Equipment and Sustainable Solutions

NPE2024: Kiefel is demonstrating its Speedformer KMD 90.1 Premium machine and cutting-edge technology for efficient polymer cups and fiber sip-lid production.

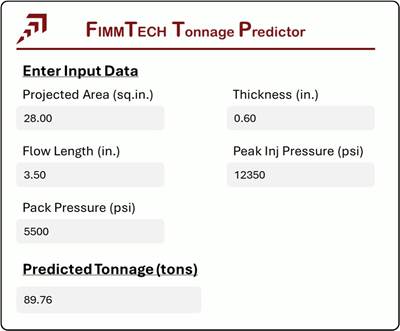

Read MoreThe Fundamentals of Artificial Intelligence and Machine Learning and Their Application to Injection Molding

As AI and ML continue to develop, they can eventually play a role in helping molders predict more accurately and, perhaps someday, model very close to the actual process results.

Read MoreBest of Fattori, Tooling Know How

In this collection of articles Jim Fattori offers his insights on a variety of molding-related topics that are bound to make your days on the production floor go a little bit better.

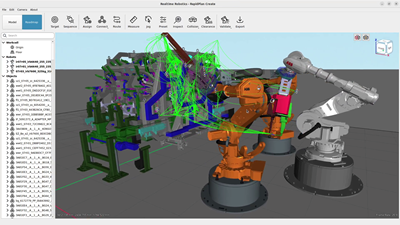

Read MoreDigital Twin Creates New, Virtual Paths for Robots with Real-World Cycle-Time Impacts

Realtime Robotics seeks to get more robots involved in manufacturing by addressing the biggest current barrier: programming costs.

Read MoreAddressing Supply Chain Leakage in Plastics

NPE2024: Ultratech offers spill containment solutions customized for handling plastic pellets.

Read MoreHow to Configure Your Twin-Screw Extruder for Mixing: Part 5

Understand the differences between distributive and dispersive mixing, and how you can promote one or the other in your screw design.

Read More

.png;maxWidth=300;quality=90)