Articles

Welcome to our NPE2024 Show Issue

Megatrends such as sustainability are the driving force behind a slew of new product introductions at the May show. Catch up on what’s in store on the show floor right here.

Read MoreReduce Downtime and Scrap in the Blown Film Industry

The blown film sector now benefits from a tailored solution developed by Chem-Trend to preserve integrity of the bubble.

Read MorePHA Compound Molded into “World’s First” Biodegradable Bottle Closures

Beyond Plastic and partners have created a certified biodegradable PHA compound that can be injection molded into 38-mm closures in a sub 6-second cycle from a multicavity hot runner tool.

Read MoreFour Industry 4.0 Tech Adoption Insights from Indiana Plastics Manufacturers

As more plastics manufacturers step into the Fourth Industrial Revolution, insights have emerged about how best to approach the digital transformation journey.

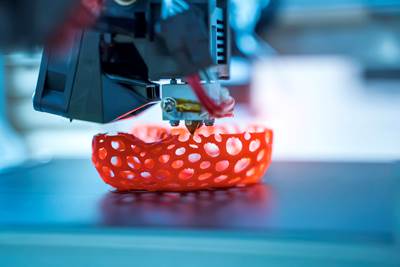

Read MoreEducation at NPE2024: 3D Printing Workshop

Learn about the emerging possibilities for part production via 3D printing/additive manufacturing.

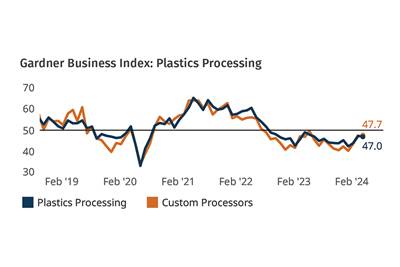

Read MoreFebruary Index Dips a Tiny Bit

Index holds steady as optimism about future business conditions continues to increase among processors.

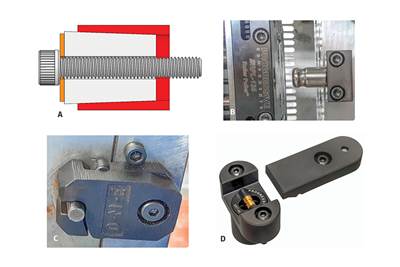

Read MoreHow To Design Three-Plate Molds – Part 4

There are many things to consider, and paying attention to the details can help avoid machine downtime and higher maintenance costs — and keep the customer happy.

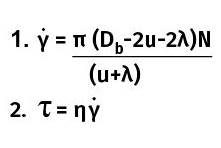

Read MoreWhat You Need to Know About the Design and Operation of Maddock Mixers

Designed properly, all entering solid polymer fragments and certain types of PE gels entering the Maddock mixer can be trapped and dispersed into the matrix resin. But many are not properly designed. Here’s what to look out for.

Read MoreIn the Zone: Advanced Manufacturing

The Advanced Manufacturing Zone in the place to experience the latest in tooling and automation.

Read MoreEducation at NPE2024: More Reasons Than Ever to Attend

NPE attendees will learn about the future of plastics, the important part they play in our evolving industry and how plastics contribute to our daily lives and our circular economy.

Read MoreIn the Zone: Recycling & Sustainability

The Recycling & Sustainability Zone is the place to learn about new technologies and strategies for a greener plastics economy.

Read More

.png;maxWidth=300;quality=90)