Processing Activity Contracts More Slowly in January

Despite contracting again in January, plastics processing activity rebounded a bit from a rather significant drop in December.

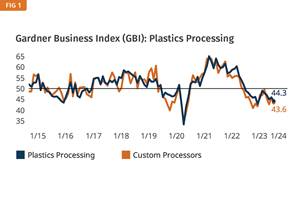

The Gardner Business Index (GBI): Plastics Processing closed January up three points to 45.9, putting it back in line with December’s index. The index is based on survey responses from subscribers to Plastics Technology. Indices above 50 signal growth; below 50, contraction.

FIG 1 Plastics processing activity showed evidence of slowing contraction for both total plastics processing and custom processing.

Most of the GBI components that make up the overall index stayed about the same in January, still contracting, but disrupting what has been faster contraction each month for the past eight to 12 months, depending on the component. New orders, exports and production slowed contraction just a bit in January. Backlogs and employment activity stayed the same while supplier deliveries continued to shorten at a faster rate. Supplier deliveries are either getting back on track or becoming less problematic because expectations have been adjusted and/or workarounds have been implemented.

Overall business activity for custom processing slowed contraction in January, recovering five points from December and surpassing the index for total plastics processing, which includes captive operations.

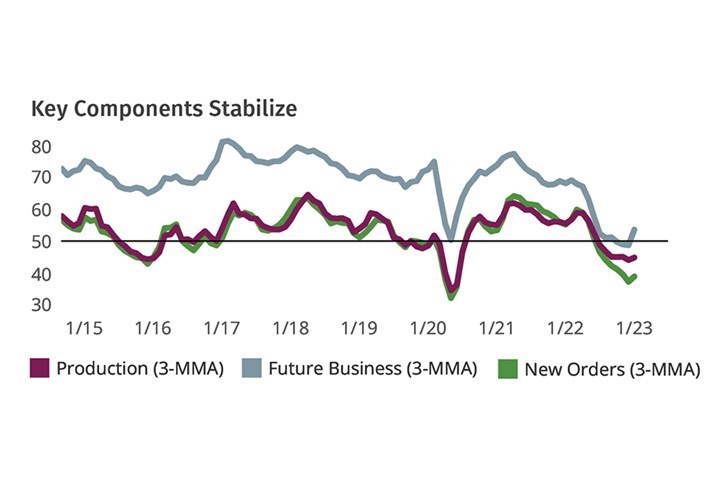

FIG 2 Most components stayed in decline in January. The future business index supports hints that plastics processing activity may be starting to look up.

Supporting plastics-processing activity’s slowed contraction is a separate, forward-looking business “sentiment” index (better/same/worse) for the next 12 months that is not part of the GBI calculation. January’s future business index was up nearly five points from December, moving from slight contraction into low-level expansion.

EDITOR’S NOTE: Finding reliable and relevant data to help guide your business is always important, but especially so during challenging economic times. For this reason, the GBI Plastics Processing Index serves as a great tool for making data-driven decisions. Thank you to everyone who has previously completed GBI surveys. Your participation helped increased response in 2021-2022, making the GBI better than ever because of your involvement. Thank you for your time and efforts and for trusting us to provide you with the latest industry and business insights both in the past and in the future.

If you are a North American plastics processor and would like to participate in this research, click here to begin the process by subscribing free to Plastics Technology magazine.

ABOUT THE AUTHOR: Jan Schafer is director of market research for Gardner Business Media, parent company of both Plastics Technology magazine and Gardner Intelligence. She has led research and analysis in several industries for over 30 years. She has a BA in psychology from Purdue University and MBA from Indiana University. She credits Procter & Gamble for 15 years of the best business education. Contact: (513) 527-8952; jschafer@gardnerweb.com.

Related Content

Plastics Processing Business Index Contracts Further

All components dip as index hits low point of 2023.

Read MoreNPE2024 and the Economy: What PLASTICS' Pineda Has to Say

PLASTICS Chief Economist Perc Pineda shares his thoughts on the economic conditions that will shape the industry as we head into NPE2024.

Read MorePlastics Processing Contracts Again

October’s reading marks four straight months of contraction.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreWhy (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read More