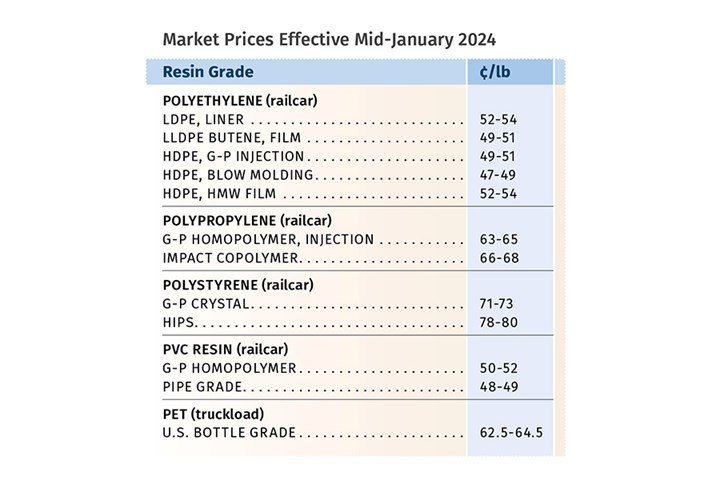

Prices of the Five Commodity Resins Largely Flat

While price initiatives for PE and PVC were underway, resin prices had rollover potential for first two months of 2024, perhaps with the exception of PET.

Prices of the five commodity resins were heading into 2024 at a lower point, but typical moves to reverse the overall downward trend of the fourth quarter were underway. This was particularly the case for PE and PVC, with suppliers issuing early first quarter price hikes. Such attempts are facing slowed domestic and global demand, higher supplier inventories and generally lower prices of key feedstocks. PET resin prices might differ just a bit if key raw materials move up.

Some industry insiders anticipate the first quarter may well see commodity resin prices relatively flat and perhaps a bit down. Certainly in the case of PE and PP, some of these pros see 2024, at least for the first half, as being a buyer’s market or as one put it — “anticipate market share battles.”

These are the views of purchasing consultants from Resin Technology Inc. (RTi), senior analysts from Houston-based PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, Scott Newell, executive v.p. polyolefins at distributor/compounder Spartan Polymers, and resin pricing expert Robin Chesshier.

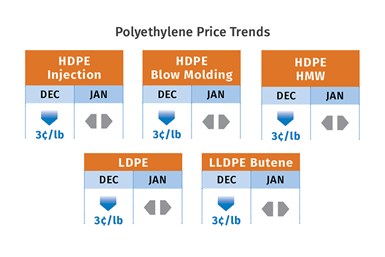

PE Prices Drop, Then Flat-to-Up

Polyethylene prices in December appear to have dropped by 3¢/lb while suppliers cancelled their 3¢/lb increases and issued new 5¢/lb increases for January, according to David Barry, PCW’s associate director for PE, PP and PS, The Plastics Exchange Greenberg, and resin pricing expert Robin Chesshier. They view this latest move by suppliers as intended to stop any further price erosion.

Chesshier ventures that PE prices in January-February could either be flat but with potential for an increase, particularly if the exports market strengthens. Similarly, Barry saw potential for an increase, as he expected exports to pick up, but was not quite certain of domestic demand. He noted that processors had stocked up due to lower pricing at the end of 2023. These sources also point to the impact of new capacity, particularly from major new player Shell as well as NOVA Chemicals and Baystar, leading Barry to say, “2024 will see a “market share battle.”

Barry noted that Nova Chemicals has begun PE production at the new 992 million lbs/yr AST2 unit near Sarnia, Ontario, with initial output of wide spec injection molding homopolymer HDPE. Eventually it is expected to produce a range of octene copolymers, including film grades. Shell was restarting the ethane cracker at its Monaca, Pennsylvania, site on the evening of Dec. 25, according to a social media post, while Baystar was in the process of starting up a production unit at Pasadena, Texas, on the afternoon of Dec. 28, according to a flaring notification.

Greenberg characterized spot PE prices as selling at deep discounts through December, and reported that transactional prices were well below levels reflecting the 9¢/lb increases reported by the major indices in 2023. Quoting November supply/demand results from the ACC (American Chemical Council), he reported, “PE production was almost identical to October, as reactors again ran just shy of 85% capacity and PE exports were above 2 billion pounds for the seventh straight month and comprised nearly 47% of total PE sales.”

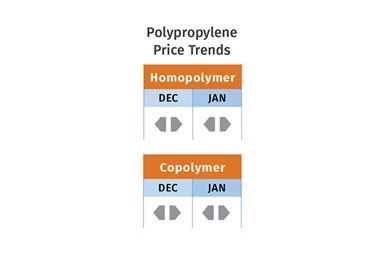

PP Prices Flat, Then Down?

Polypropylene prices in December were flat, in step with propylene monomer; this despite that the anticipated recovery of monomer tightness had yet to occur due to two unplanned shutdowns, according to PCW’s Barry, Spartan Polymers’ Newell and The Plastic Exchange’s Greenberg. Said Newell, “As long as monomer inventories remain tight, there’s some volatility.” He notes that domestic PP demand ended badly in 2023, and he expected suppliers would likely have to further cut production rates from the low 80s percentile to the mid-70s for an improved supply-demand scenario.

PCW’s Barry, somewhat in contrast, ventured further price correction of PP and the monomer through January and February, noting that spot monomer prices were well below contract prices and that domestic PP resin tabs were still too high compared to global prices. Characterizing 2024 as a year of “market share battles,” he reports that with no anticipated near-term uptick in demand, some traders were positioning for PP prices to move lower in first quarter.

Citing ACC results going into December, Greenberg reported that PP suppliers ran their reactor a bit higher in November, at about 80%. He noted that exports were a bit stronger, but representing only 6.6% of sales. “Domestic processors were turned off by the steep cost-push price increase last month (November) and slowed their purchases to only 96.5% of the trailing 12-month average,” Greenberg added. “Total production outstripped the weak sales and consequently, upstream inventories built for the second straight month back to levels not seen since April.”

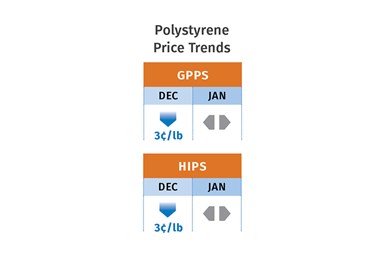

PS Prices Drop, Then Flatten

Polystyrene prices dropped another 3¢/lb in December, following a 4¢/lb drop the previous month, but flat prices for the January-February time frame were ventured by both PCW’s Barry and resin pricing expert Robin Chesshier. This scenario is primarily attributed to improved benzene supply due to plenty of Asian and European imports underway. Barry did add that while there was a likelihood of January benzene contracts dropping 10-20¢/gal, it would translate to only 1-2¢/lb for PS resins.

Chesshier noted there was no real cost push from any of the key feedstocks, including styrene monomer, ethylene and butadiene, with continued lackluster demand for PS resins. Reported Barry, “Supply remained ample amid a generally gloomy demand outlook. The implied styrene price based on a 70% benzene/30% ethylene spot formula was down 1¢/lb by end of December.

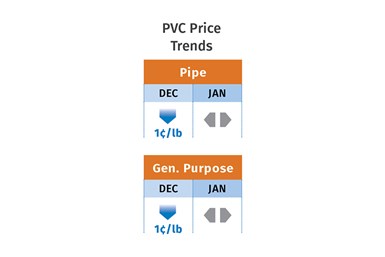

PVC Prices Down, Then Flatten?

PVC resin prices dropped by another 1¢/lb in December, following a similar drop the previous month, but suppliers were out with January price increases ranging from 2¢/lb to 5¢/lb, according to Paul Pavlov, RTi’s v.p. of PP and PVC and PCW’s senior editor Donna Todd. The former ventured that prices in the January-February time frame were likely to remain flat, noting, “These price initiatives are a knee-jerk reaction and aimed at stemming the bleeding.” He saw potential for some uptick in March.

Reported Todd in December, “With January increases of 2¢/lb, 3¢/lb and 5¢/lb, customers were wondering how the price would be implemented and at what level.” She also noted that Westlake, with the lower price hike, announced that it would issue another price increase for February. “As such, it appeared that the January price uptick will be limited to 2¢/lb, with a further increase of undetermined size in the cards for February. Some PVC converters think the January price hike would be pushed back and implemented in February.”

PET Prices Down, Then Up?

PET prices in December dropped 1¢/lb, following drops of 2¢/lb and 4¢/lb the two previous months driven primarily by lower raw material formulation costs as well as seasonal slowed demand for PET in the Northern Hemisphere, according to Mark Kallman, RTi’s v.p. of PVC, PET and engineering resins. He anticipated a bit of a rebound in PET prices of 1¢/lb to 2¢/lb in the January-February time frame as a result of forecasted increases in key raw materials. Kallman continued to characterize the market going into first quarter as domestically well supplied along with continued attractively priced imports.

Related Content

Prices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MoreFundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MoreRead Next

Understanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MoreWhy (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read More.png;maxWidth=970;quality=90)

.png;maxWidth=970;quality=90)