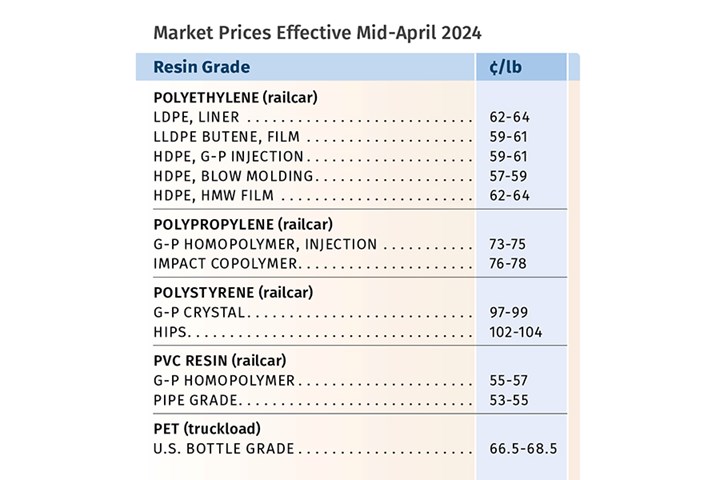

Prices for PE, PS, PVC, PET Trending Flat; PP to Drop

Despite price increase nominations going into second quarter, it appeared there was potential for generally flat pricing with the exception of a major downward correction for PP.

Going into the first month of second quarter, prices of at least three if not four of the five commodity resins had a likelihood of rolling over, despite price increase nominations for all. PP was an exception, where a long-awaited downward correction appeared to be underway as propylene monomer supply shortages were coming to an end. While higher prices of key raw materials were behind the resin price hikes issued for PS, PET and PP, there was a downward trajectory forecast, barring any major production or logistical disruptions. But, the overall ‘thread’ was that a recovery in demand for key markets was not yet evident.

These are the views of purchasing consultants from Resin Technology Inc. (RTi), senior analysts from Houston-based PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, Scott Newell, executive v.p. polyolefins at distributor/compounder Spartan Polymers, Mike Burns of Plastic Resin Market Advisors, and resin pricing expert Robin Chesshier.

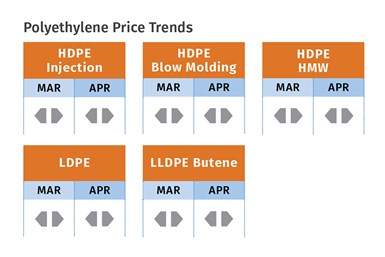

PE Prices Flat

Polyethylene prices in February were a rollover and it appeared that March and April could well ‘follow suit,’ despite suppliers aiming to push through a 3¢/lb hike in March, and some who had issued another 3¢/lb for April. This according to PCW’s associate director for PE, PP and PS David Barry, The Plastics Exchange Greenberg, Mike Burns of Plastic Resin Market Advisors and resin pricing expert Robin Chesshier. Still, as PCW’s Barry put it, “While increases are unlikely in second quarter, PE prices could stay firm due to shipping issues. This barring a big spike on crude oil prices or a major change in Chinese demand.” Resin pricing expert Chesshier conceded on this.

According to Plastic Resin Market Advisors’ Burns, any additional increase to the January price increase will swiftly face market challenges due to the discounted resin available in the secondary market. “Downward prime price pressure from the improved offgrade market availability should begin in April. How much of the January 5¢/lb increase is returned? Contract prices could remain unchanged until NPE2024 in May. Processors should focus on recouping as much of the January increase as possible before August and the Hurricane season. The resin markets could potentially achieve two non-market decreases of 2¢/lb to 3¢/lb before August. Exports combined with favorable pricing will limit secondary market price declines.”

Noting that PE spot prices were dropping from week-to-week as March came to a close, The Plastic Exchange’s Greenberg ventured that suppliers would have more of a challenge in negotiating March contracts. He noted that there were plenty of lower offers for LLDPE and injection molding HDPE, and that while blow molding HDPE and HMWPE film remained snug, supply was expected to recover as second quarter turnarounds end.

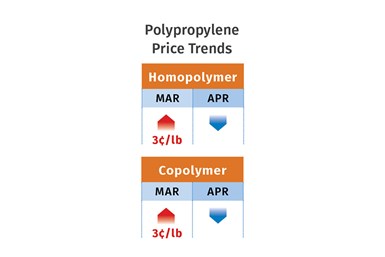

PP Prices Up, Followed by Expected Drop

Polypropylene prices moved up 4¢/lb in February, followed by a 3¢/lb increase in March, both in step with propylene monomer, which settled at 58¢/lb for March, but a transition was expected, according to PCW’s Barry, Spartan Polymers’ Newell and The Plastic Exchange’s Greenberg. These sources generally anticipated that a major price correction in monomer, which was expected to take place in late 2023 fourth quarter or at least within this year’s first quarter, was soon underway. This due to monomer unplanned and planned shutdowns coming to an end.

Barring any major disruptions, Barry ventured that PP prices, in step with the monomer, could drop by as much as 8¢/lb in April, and a few more cents in May. This based on falling spot monomer prices, down nearly 10¢/lb. While Spartan Polymers’ Newell sees a correction coming, he thought that April could prove too soon noting that monomer inventories were still tight and demand was not great. He ventured that monomer spot prices could still move up a bit more. Both sources noted that while January-February were pretty decent months for demand, it was more likely due to processors restocking. They noted that March appeared to be way off in demand and that a recovery of the market did not appear to be taking place as yet. This was particularly the case for the consumer goods market sector.

Addressing the PP spot market, The Plastic Exchange’s Greenberg noted that while April monomer prices were pointing to a decrease, monomer supplies are still generally tight and prices could still move up if there’s any production hiccup. “We do expect relatively good ongoing PP demand along the way as processors procure spot material to get them by while they wait for contract levels to subside.”

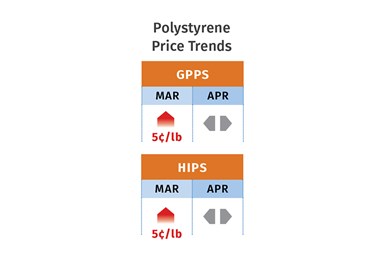

PS Prices Up

Polystyrene prices were moving up in March as suppliers sought increases of 5¢/lb-to-7¢/lb, primarily based on increases in benzene prices. This, following the 5¢/lb February increase, according to PCW’s Barry and resin pricing expert Robin Chesshier, both of whom ventured that prices were likely to be flat in April and perhaps May, as spot benzene prices were trending downward.

Styrene monomer prices, meanwhile, were dropping after they spiked up due to planned and unplanned production shutdowns. Chesshier ventured that some relief was possible in May, if benzene prices dropped further. According to Barry, the implied styrene monomer price based on a spot formula (30% ethylene, 70% benzene) was up about 1 cent at 44.7¢/lb moving into the end of March.

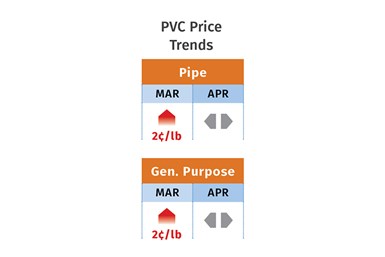

PVC Prices Up, Then Flat

PVC prices were moving up in March by another 2¢/lb-to-3¢/lb on top of the February 3¢/lb increase, and most suppliers were out with a 3¢/lb hike for April, according to Paul Pavlov, RTi’s v.p. of PP and PVC, and PCW’s associate director PVC & pipe Donna Todd. Both sources noted that the market was still adjusting as there has not been a month-after-month upward pricing move for a very long time.

RTi’s Pavlov noted that while first quarter overall was stronger than that of 2023, production was still outpacing domestic demand, despite some increase from the infrastructure sector. He also noted that global demand appeared to have peaked, with some Asian imports coming into the U.S. at competitive prices. PCW’s Todd reported that suppliers were hoping to implement a March increase of 3¢/lb, despite market forecasts showing prices rising by only 2¢/lb. Moreover, some suppliers had doubts the April increase had a chance, as forecasts were for flat pricing that month. “Others, however, said that demand has been growing incrementally each week, and they believe that demand will be strong enough in April to push prices higher regardless of what forecasters have said up until now,” she noted.

PET Prices Up

PET prices moved up another 1¢/lb-to-2¢/lb in March, after moving up a total of 3¢/lb the two previous months, all based on raw material formulation costs, according to Kevin Mekaru, RTi’s senior business unit leader, commodity plastics. Meanwhile suppliers were out with increases of another 1¢/lb-to-2¢/lb for April, again based on higher feedstock costs, though one major supplier was seeking 5¢/lb, citing logistical concerns. Mekaru ventured flat-to-up pricing for the April-May time frame, noting that paraxylene costs typically go up as the driving season approaches. He characterized demand as flat, with not much of an upside underway, and noted that lower-cost imports continue to be an issue for domestic suppliers.

Related Content

Volume Resin Prices Move in Different Directions

PE, PP, PVC, and ABS prices slump, while PS, PET, PC, and nylons 6 and 66 prices rise.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreStill an Up-and-Down Picture for Commodity Resin Prices

Supply/demand imbalances or sharply rising feedstock costs account for the mixed pricing trajectory for the five biggest-volume resins.

Read MoreRead Next

How Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read More

.png;maxWidth=300;quality=90)

(2).jpg;maxWidth=300;quality=90)