Your Business Outlook - September 2007

The Federal Reserve Board provides a monthly index of U.S. production of motor-vehicle parts.

The Federal Reserve Board provides a monthly index of U.S. production of motor-vehicle parts. According to the Fed, the monthly average for this index (which has a base of 100 for the average month in 2002) through the first half of 2007 is just slightly below 100, which is almost exactly the same as it was in the same period a year earlier. Our forecast calls for this flat (or perhaps slightly downward) trend to continue through the remainder of 2007, but we expect moderate growth in 2008.

For the manufacturer of plastics auto parts, these data contain both good and bad news about the current state of the industry. The good news is that the output of parts has held relatively steady over the past 12 months despite a drop of 8% in U.S. motor-vehicle assemblies. As the chart indicates, the growth rates for these two indicators (parts production and auto assemblies) were very closely correlated until last year, when the assemblies data started to fall precipitously while the parts data just flattened out. This divergence should be short-term, and we expect the curves to start to converge in the near future. Since it appears that the assemblies curve is just past its cyclical low point, this convergence will be mainly the result of a gradual recovery in assemblies.

Turning around?

One possible explanation for the recent disparity between auto-parts output and auto assemblies is that parts manufacturers have unwisely kept producing despite the slower demand, and that there is an expanding inventory of auto parts that will soon have to be dealt with. There is some evidence that this was partly the case. The Census Bureau reports the monthly value of inventories of auto parts, which hit a peak in the first quarter of this year, several months after the assemblies total started to sink. Fortunately, inventories began to decline in the second quarter, at the same time that two other important indicators generated by the Census Bureau—shipments and unfilled orders for auto parts—both started to increase.

So the net effect of all of these short-term indicators of activity in the auto-parts industry is that it looks like the worst is over and business levels will soon start to recover gradually. We will likely be well into 2008 before this recovery feels like it has any real vigor, but for now we can at least say that production levels for the domestic auto sector will not get any weaker.

In a rut?

There is also some bad news in this recent data. In spite of several years of steady U.S. economic growth since 2002, the monthly volume of domestically produced auto parts has not changed. The Fed’s monthly index value has hovered very near 100 for the past five years. When this volume data is compared to the data on value of shipments, the news is not any better. The value of average monthly shipments so far in 2007 is virtually the same as in 2002. What really makes this bad news is that the average cost of materials has jumped dramatically since 2002. Average resin prices are up 76% and steel prices were hiked 74% during this time.

In the longer term, the U.S. auto-parts industry is now, and will continue to be, a huge player in the market for plastics products. But there is no getting around the fact that it is no longer a growth market. There is also no denying that the costs of production such as materials, labor, and energy will in all likelihood continue to rise. To be competitive, U.S. manufacturers will have to be on the forefront of technical advances in design, materials, and production for the auto-parts sector. There will be a huge opportunity for suppliers who can meet the market’s needs for autos that address the increasing pressures of rising oil prices and (perhaps) reducing carbon dioxide emissions. Therefore, one should not come to the conclusion that “no growth” is synonymous with “no opportunities” or “no excitement.”

Bill Wood, an independent economist specializing in the plastics industry, heads up Mountaintop Economics & Research, Inc. in Greenfield, Mass. He can be contacted by e-mail at BillWood@PlasticsEconomics.com. His monthly Injection Molding and Extrusion Business Indexes are available at www.ptonline.com.

Read Next

Troubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

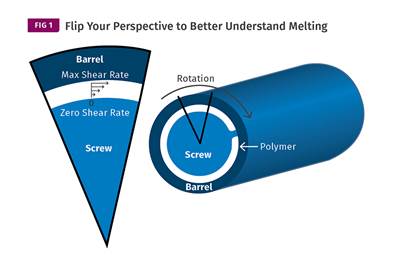

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read More

.png;maxWidth=300;quality=90)