‘Digital Manufacturing’ Evolves from Prototyping to ‘On-Demand’ Short Runs

Protolabs has built a business on speed. Today its “digital manufacturing” model is accelerating from rapid prototypes and first-run production parts to “on-demand” short-run manufacturing.

It was just a year ago that Protolabs announced that it was upgrading its capabilities for short-run, “on-demand” manufacturing in addition to its well-known rapid injection molding prototyping services. Says Rob Bodor, v.p. and general manager for the Americas, “With a name that suggests ‘prototyping’ and ‘laboratory,’ it’s a challenge to convince people that you’re also a production molding and contract-manufacturing house.”

Apparently, Protolabs has met that challenge successfully: According to Bodor, one-demand injection molding of thermoplastics and silicone rubber outpaced its prototyping business for the first time. “Our CNC machining business has become huge, too.”

Bodor points out that this evolution in the company’s business model was not as abrupt as it might seem. Protolabs had offered short-run manufacturing for some time, but did not actively promote it until last year. Supporting this short-run service, the company outfitted its first metrology lab for enhanced inspection reporting on production parts. This lab has a range of standard inspection equipment, as well as 3D laser scanners that provide an automated 360° look at parts within minutes. “This is what customers had been asking us for,” says CEO Vicki Holt.

With this enhanced metrology capability, Protolabs now offers a full suite of inspection reports, including conventional first-article inspection (FAI) and PPAP reports required in industries like automotive and aerospace. Also new are digital inspection reports based on laser-scan data, which provide a direct comparison to the original CAD data, including a colored “heat map” to identify dimensional variances.

Other new services related to on-demand manufacturing include guaranteed lifetime maintenance of the mold and customer ownership of the tool.

ADDING FACILITIES & TECHNOLOGIES

As Bodor points out, Protolabs has been reshaping itself steadily over the last few years. In the last five years alone, he notes, the firm has expanded its range of services from two to 10—including new processes within injection molding and CNC machining, along with five different additive manufacturing (3D printing) technologies, and most recently, sheet-metal fabricating. Also, the company is exploring the potential of offering not just parts but sub-assemblies and perhaps complete products.

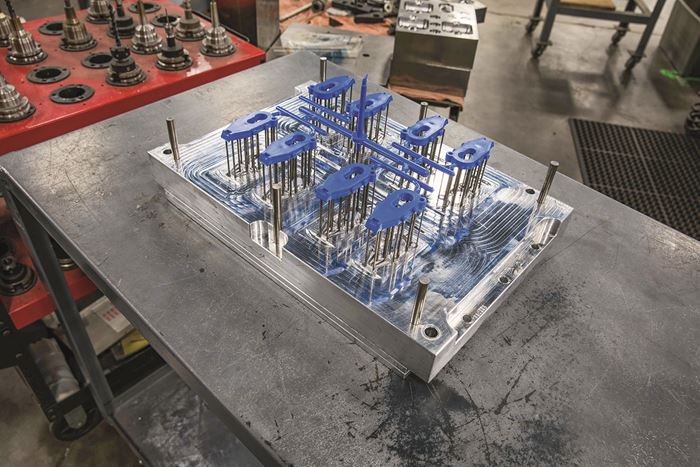

Headquartered in Maple Plain, Minn., the company now has seven production facilities in the U.S., five in Europe, and one in Japan. It has a moldmaking plant in the Minneapolis area that builds 800 to 1000 molds a month and operates two dozen injection presses for sampling and tryout. Protolabs has 110 injection presses in the Twin Cities region available for short-run molding if anywhere from a handful to 10,000 or more parts, and close to 200 globally, with 33 to more than 500 tons clamp capacity. It has more than 2000 employees worldwide and served more than 37,000 customers last year.

Late last year, Protolabs acquired Rapid Manufacturing Group in Nashua, N.H., a specialist in quick-turn sheet-metal fabrication and CNC machining with a 140,000-ft2 plant and 300 employees. And just two months ago, the firm bought a new 152,000-ft2 plant in Brooklyn Park, Minn., which will be used primarily for CNC machining and will enable an expansion of injection molding capacity at the Plymouth, Minn., location.

Over the past year, Protolabs has purchased 25 injection machines and more than 75 CNC mills for its U.S. facilities, and another six injection presses and CNC machines for its plant in Telford, UK.

As Bodor explains it, all this activity reflects the company’s three-pronged strategy for business expansion:

- Grow revenue by expanding the customer base and deeper penetration with existing customers.

- Enhance capabilities by expanding services.

- Increase the scale of operations.

The expanding range of services offered by Protolabs starts at the front end of product development. “We don’t do product design, but we do perform design-for-manufacturability (DFM) analysis,” says Bodor, “analyzing factors like cosmetics, mating surfaces, undercuts.”

Then comes rapid prototyping, the original core of Protolabs’ business. The company uses CNC machining to cut injection molds capable of producing fully functional, production-quality prototypes using the same material as the intended production part. Most molds are aluminum, unless use of higher-temperature resins requires a steel tool. Injection molded parts ship in 15 days or less—orders can be expedited to as little as one day. 3D-printed parts also ship in as little as one day in some cases.

For rapid prototyping, Protolabs also has an 80,000-ft2 plant in Cary, N.C., that Bodor says is “the largest contract 3D-printing operation in the U.S.” It operates more than 100 3D printers utilizing five different processes for thermoset, thermoplastic, and metal printing: sterelithography (SLA), Polyjet printing, selective laser sintering (SLS), the new Multi Jet Fusion (MJF) process from HP Inc., and direct metal laser sintering (DMLS).

“We’re about lowering the cost of tooling and taking out design risk, supply-chain risk, and the cost of stored inventory.”

Beyond prototyping, Protolabs offers short-run production capability for injection molded, CNC machined, 3D printed, or sheet-metal parts. This service is aimed at customers who need bridge tooling while they ramp up to high-volume production, who’ve encountered supply-chain disruptions, who have uncertain demand for a new product, or variable and unpredictable demand for existing products. It also makes it more economical for customers to enter markets with low-volume, tailored products.

Above all, it meets the need for speed. “Traditional high-volume manufacturing works well where products don’t change much over their life cycle,” explains Bodor. “But today’s OEMs deal with shorter life cycles, mass customization, SKU proliferation, and shorter windows of opportunity to launch new products.”

That’s the sweet spot for Protolabs’ “on-demand” service.

“In two weeks from receiving an order, we’re ready to ship parts,” says Bodor. “Our injection molds start at $1495, versus $30,000 for a relatively simple conventional tool. We don’t do 96 cavities—eight is our maximum. And aluminum tools can be quite durable. We have functioning aluminum molds that are 18 years old. And we will replace a mold at no cost if it wears out during the life of a project.”

“On demand” means Protolabs has no minimum order volume and no maximum. “We have done runs into the millions of parts,” notes Bodor. “In fact, we run millions of injection molded parts a month—three million a month in the Twin Cities area alone. We have many customers for whom we do all their production.” These are suppliers of products required in limited volumes—special surgical devices, aerospace products, and other industrial, consumer, and electronic equipment.

Protolabs’ short-run manufacturing has somewhat different goals from those of high-volume molders. “We’re not so concerned with shaving every second off cycle time,” says Bodor. “We’re more about lowering the cost of tooling and taking out design risk, supply-chain risk, and the cost of stored inventory.”

DIGITAL MANUFACTURING

What makes everything possible in Protolabs’ ecosystem is its commitment to “digital manufacturing” as an end-to-end operating philosophy. “We focus on software for automating and digitizing the front end of manufacturing from the CAD file to the first part—increasing the speed and reducing the cost of making that first part.” Protolabs, he notes, was started in 1999 by a software developer. It currently employs more than 125 software developers and has “reinvented the wheel” in many respects—creating its own systems for mold simulation and CAM for machining molds.

The digital process starts with the Request for quote (RFQ). When a customer sends in its requirements, Protolabs responds with an online quote within three or four hours (if the quote is for 3D printing, it’s instant). The quote includes a 3D rendering of the virtually manufactured product showing potential deviations from the CAD model, based on the company’s home-grown mold simulation. Interactive screens allow the customer to adjust parameters such as critical tolerances, and see those changes reflected instantly in the project pricing.

Protolabs produces 3000-4000 digital quotes in a typical day. From the CAD file (Protolabs accepts all major formats), the next steps are to precalculate all the steps to manufacturing—virtually making the product, as Bodor puts it. Protolabs uses its custom software to determine how to orient the part in the mold, where the parting line should be, the overall size of the mold, the need for any inserts or cams, and design of the ejector system, followed by choice of end mills to use in machining, tool paths, and 3D geometry development. “It’s an integrated digital manufacturing process, not something you can buy commercially,” says Bodor, noting that the company’s software runs on large parallel-computing clusters.

“With these capabilities,” Bodor says, “medical-device customers, for example, can ask us to produce eight to 10 competing designs, build 10 molds simultaneously, and mold hundreds of each part variety—all in a few weeks. We can do a whole production run in less time than an average molder takes to set up a new mold and get its first good parts.”

Protolabs’ digital processes produce injection molding quotes in 3-4 hr and 2000-3000 quotes a day.

3D printing is the epitome of digital manufacturing, since the process goes directly from digital file to physical part. The potential for 3D printing to go beyond prototyping to short-run production is still being explored. Last year, Protolabs became one of the first few firms to adopt HP’s Multi Jet Fusion process. Protolabs has three MJF machines.

At Plastics Technology’s Molding 2018 Conference in February, Jeff Schipper, Protolabs’ director of special operations, said this MJF technology is especially promising because it uses production-grade thermoplastic materials, delivers durable parts with properties closer to those of injection molded parts than with other 3D processes, and can print parts incorporating multiple colors and durometers.

Although HP is eagerly promoting MJF as an alternative to injection molding for runs of 10,000 or even 100,000 parts, Protolabs is taking a wait-and-see position on that potential. “We haven’t seen cannibalization of injection molding by 3D printing yet,” says Schipper.

Related Content

Get Better at Using Foam for Your Molded Parts

Machine performance and process speeds are critical when using foam to reduce part weight while retaining part integrity.

Read MoreThe Protection Business

The humble combination cap and plug gave Caplugs a cornerstone product and a name, but 75 years later the company has grown to encompass so much more.

Read MoreLSR Cold Deck Features Valve Gates

NPE2024: Recent updates to Mastip’s Aquilo platform highlight how its design — from consistent thermal profile to uniform cooling — has made it successful for medical industry projects.

Read MoreHow 3D Printing Supports Toolmaking Workforce at This Multiscale Molder

At more than a century old, General Pattern has seen multiple evolutions in its business — the latest of which is the embrace of additive manufacturing technologies for mold tooling and beyond.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More