How Will the Shale-Gas Boom Affect Plastics Processors?

Though the U.S. will have a long-term advantage in production and pricing of olefin feedstocks, other factors may have greater impact in the short term. Nonetheless, industry analysts paint a favorable pricing and supply outlook for resin buyers in this NPE year.

“Plentiful shale gas promises to keep domestic polyolefin production costs the lowest in the world. What that will mean for resin prices is an open question.” That was the lead-in to Plastic Technology’s November 2013 cover story, which sought to shine some light on the question of whether processors of PE, PP, and possibly other plastics were likely to see direct benefits from shale-gas development in terms of lower or, at least more stable, resin pricing. Four years later, to see whether the answers have become any clearer, PT once again turned to expert analysts and consultants at Resin Technology Inc., Fort Worth, Texas (rtiglobal.com), and IHS Markit (ihsmarkit.com) and PetroChemWire (PCW; petrochemwire.com), both of Houston.

By end of 2013, U.S. natural-gas prices had dropped to only a fraction of those in other countries—the result of accessing natural gas trapped in shale rock formations via technologies such as hydraulic fracturing (“fracking”) and horizontal drilling. Natural gas, which costs about one-third as much as crude oil on an energy-equivalent basis, can be used as a feedstock to make ethane, which is then used to make ethylene. In fact, the impact of the upsurge in gas production is most strongly evident in ethylene, considered the workhorse of petrochemical building blocks, particularly for PE production, ethylene dichloride used in PVC, and ethylbenzene/styrene used in PS and ABS resins.

IHS Markit studies in 2013 stated that availability of a long-term supply of low-cost feedstock derived from unconventional sources was revitalizing the petrochemicals industry in North America, making it not only more competitive, but also attracting significant domestic and foreign investment and adding capacity that’s resulting in more high-quality, well-paying U.S. jobs.

It was also logically asserted that polyolefins and the vinyls chain, including PVC, are two of the nine value chains on which U.S. chemical investment would be largely focused. In the petrochemicals sector, ethylene and propylene are two of the four segments that are and will be further impacted by unconventional oil and gas development. Major capacity announcements have been made for ethylene as well as for capacity expansions in PE. Announcements were also made for on-purpose propylene (propane dehydrogenation—PDH) units, though new PP capacity plans are still lagging.

So far, we’ve seen major new PE capacity (including LDPE, LLDPE, HDPE, mLDPE, and UHMW-PE) coming on stream from companies such as DowDupont (dow-dupont.com); ExxonMobil Chemical (exxonmobil.com); Nova Chemicals (novachemicals.com); ChevronPhillips (cpchem.com), and Braskem (braskem.com); with others underway from such as LyondellBasell, (lyondellbasell.com). Foreign investors have included a joint bimodal HDPE venture between South Africa’s Sasol Chemical N.A. (sasolnorthamerica.com) and Ineos Olefins & Polymers (ineos.com).

Also to use Ineos’ HDPE technology is a new petrochemical complex planned near Dilles Bottom, Ohio, from Thailand’s PTT’s affiliate PTTGC America LLC (pttgcgroup.com).

Even more new capacity is slated to come on stream within the next few years, including a proposed petrochemical joint venture project to be built in Texas by ExxonMobil and SABIC (sabic.com), Houston, that would include two PE units and a petrochemicals complex. Yet another ambitious petrochemical complex is planned for Potter Township, Pa., to be owned and operated by Shell Oil Co., (shell.us). Shell selected the site due to its prime location within the Marsellus Shale and has cited that its proximity to both supply and markets will provide regional plastics manufacturers with more flexibility and shorter supply chains. Plans call for 3.3 billion lb/yr of ethylene and three PE units with combined production of 3.5 billion lb/yr.

PE Price Trends Look Rosiest

Asked how he sees things shaping up for PE processors in terms of demand, David Barry, senior editor at PCW, replies, “By all accounts, PE demand was very robust in 4Q 2017. Some of this was post-hurricane restocking, but processors at large appear to have good momentum going into 2018.”

In fact, the 2018 PE market outlook is one in which processors will have the edge, according to Mike Burns, RTi’s v.p. of client services for PE. He ventured that the 10¢/lb price increases implemented after Hurricane Harvey would go away within first quarter of this year.

Similarly, Nick Vafiadis, VP, global polyolefins and plastics, at IHS Markit, expects to see PE prices move lower as some of what was called the “hurricane premium” caused by supply constraints is removed from the current PE contract-price level. “Now that those production constraints have been mostly resolved, we expect to see that premium begin to be removed. In addition, we are currently seeing more than 3.5 million tons of new PE production capacity in start-up or ramp-up mode. This new production capacity is expected to directly affect global PE prices and indirectly impact domestic price levels.” He expects the combination of these two factors to have started impacting contract prices as early as December 2017.

Adds PCW’s Barry, “The new PE capacities that started up at the end of 2017 will result in a more competitive resin market, and it seems likely that domestic PE prices will give back all their second-half 2017 gains in the first quarter.”

However, Barry notes that further erosion could be limited by other factors. Some of the huge steam crackers that were intended to supply ethylene monomer for these new PE units have not been completed—more specifically, CP Chem’s Cedar Bayou expansion and ExxonMobil’s Baytown expansion. PE suppliers will be unable to run their expanded capacity at full throttle until the new crackers are up and running—not likely until mid-year. Barry muses that it will be interesting to see how ethylene inventories and spot prices respond to this “juggling act” as ethylene producers try to spread the available monomer around the expanded PE production base.

Barry also noted that Asia could prove to be a “giant sponge for North American PE exports next year, given growing consumption abroad and a tight ethylene supply. “Chinese demand for virgin resin will also get a kick from the implementation of their scrap import ban,” he says

A key takeaway from most industry pros is that the new PE capacity will not be a key determinant for domestic prices. RTi’s Burns says oil prices will continue to dictate PE pricing, as 65 percent of global PE is made from oil-derived naphtha. “North America will have to price PE resins within 10¢/lb of the global price to keep a balance between imported finished products (particularly plastic bags and shrink films) and exported resins.” Following the market correction after the post-hurricane price increases, he sees the RTi oil/pellet formula to remain a useful pricing gauge: Every $10/bbl change in oil price equates to 4-5 ¢/lb change in PE prices.

Furthermore, expanded PE capacity will dampen the effects of future production disruptions. Says RTi’s Burns, “The impact from disruptions will not be as bad as previously. Suppliers will not be able to raise resin prices by 10¢/lb in 45 days.”

PP Pricing Outlook More Mixed

IHS Markit’s Vafiadis notes that while the PE price forecast is more closely related to supply/demand issues associated with PE resin, the PP price forecast is more closely linked with propylene monomer movements and the arbitrage with Asia. PP prices were largely projected to start dropping this year. Scott Newell, RTi’s v.p. of PP markets, expected monomer prices to top out, possibly in December if the new Enterprise Product Partners propylene unit ramped up production at that time. Though unconfirmed, some industry talk had it that as 2018 contract negotiations were underway, the market was becoming somewhat more competitive, and some suppliers were backing out of margin expansions and even offering some margin erosion.

IHS Markit projected lower PP prices as early as January, according to Vafiadis. “We expect this downward price trend to continue through the summer, as PP prices track propylene prices. Propylene has to come down enough for PP suppliers to attempt to expand their margins without affecting the price arbitrage with Asia.” He ventures that suppliers will seek margin expansion in the second half of the year. PP demand was expected to start off slow, waiting for prices to correct before demand accelerates.

Both Vafiadis and Newell expect PP imports will be needed to keep the market supplied but will not be as large as in 2015. “Although some PP has come in from abroad, I don’t expect a flood of imports, though a lot will depend on domestic PP pricing, says Newell.

PCW’s Barry also expects the PP market to continue to be affected by volatility in monomer prices. He notes that a tightening in propylene occurred at the end of 2017 resulting from: refinery outages after Hurricane Harvey, as well as low cracker output due to rising propane costs, and continued difficulties in starting up and running on-purpose propylene (PDH) units. “High propane prices aren’t going away anytime soon; and even if the PDH issues are resolved, it will take a while to rebalance the propylene market. I expect PP prices will decline in tandem with propylene monomer in the early part of 2018, but the resin market should remain balanced-to-tight. The drop in propylene costs will play out gradually, but that’s one market that often throws the forecasters a curveball!”

Asked how he sees PP demand shaping up, PCW’s Barry says, “PP could be more of a mixed bag (versus PE) if automotive demand tapers off, or if finished-goods imports pick up due to sustained high propylene costs (U.S. propylene prices as of mid-December 2017 were the highest in the globe).”

PVC Pricing Mixed

Prices of PVC were moving downward by the end of 2017, with further reductions expected through the first quarter, according to Mark Kallman, RTi’s v.p. of engineering resins, PS, and PVC. He attributes this trend to a build-up of supplier inventories and slack export business.

“Although the supply/demand balance has been more dominant in 2017, lower ethylene pricing from added capacity will help influence the market leading into the summer construction season. After that, it will depend on what promises to be a strong construction season, along with global GDP growth, which could drive PVC pricing higher due to a tighter market.”

Kallman anticipated expansions of existing PVC capacity to continue—especially for export. “Low-cost ethane/ethylene will benefit PVC suppliers for the next several years as global growth continues and higher carbon emitting processes are subject to pollution controls in China.”

Impact on Styrenics, Engineering Resins

RTI’s Kallman notes that shale-gas production tends to favor lower-cost light feedstocks for crackers, which reduces the output of benzene, propylene, and butadiene. This can contribute to higher prices for these key feedstocks at times of heavy demand, reduced refinery operations, or lower imports. Kallman sees the impact of resulting higher feedstock costs to be greatest at the commodity end of the scale, namely for PS and ABS.

Kallman says nylon 6 prices are strongly influenced not only by supply and demand, but also by benzene price swings. In the case of PC and nylon 66, Kallman points out that they are more strongly influenced by supply/demand dynamics. Strong demand growth for both resins is led chiefly by the automotive sector. But even though PC suppliers were seeking price increases of 14¢/lb in the first quarter, Kallman predicted that most buyers would be able to negotiate a significantly lower hike. This is owing to supplier inventories growing from improved plant production and continued significant PC imports, due to major capacity expansions in Asia, making for a more competitive environment.

Related Content

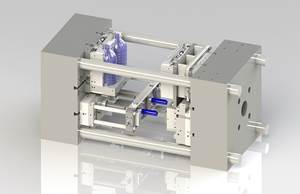

Absolute Haitian Brings Next Generation of Presses to Orlando

Absolute Haitian says Generation 5 of the servo-hydraulic Haitian and electric Zhafir machines lines emphasize efficiency, performance and intelligence.

Read MoreAt NPE, Cypet to Show Latest Achievements in Large PET Containers

Maker of one-stage ISBM machines will show off new sizes and styles of handled and stackable PET containers, including novel interlocking products.

Read MoreInside the Florida Recycler Taking on NPE’s 100% Scrap Reuse Goal

Hundreds of tons of demonstration products will be created this week. Commercial Plastics Recycling strives to recycle ALL of it.

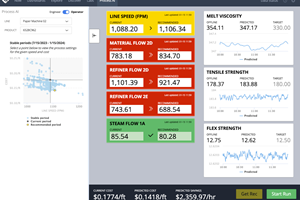

Read MoreUse AI, Machine Learning to Take Variability Out of Manufacturing

Variability has always created insurmountable challenges for manufacturers. However, in the last decade, impact has been more painful due to a lack of experienced workforce. By leveraging technological advancements, particularly in AI, manufacturers can gain a transformative competitive advantage in both cost reduction and workforce development.

Read MoreRead Next

Why (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read More