Move Over BLOW MOLDING: Make Way for Thermoformed Gas Tanks

On the surface, the technology free-for-all feels like 1992 all over again. That was the first time makers of blow molded gas tanks faced California emissions standards that their technology couldn’t meet. The six-layer blow molded gas tank won that round, but today’s tanks won’t pass far tougher emissions standards coming in 2003 and 2004.

Gas-tank providers are frenziedly testing everything from quick fixes of blow molded designs to the first twin-sheet thermoformed gas tanks. Thermoforming is said to reduce emissions by enclosing fuel-system components inside the tank. Meanwhile, steel tanks, some made with brand-new technology, are back in contention.

A lot of business turns in the balance—53 million tanks a year globally. “I suspect that everybody in the gas tank industry is looking at their investment right now and asking if they’re on the right horse,” says Tom Mathues, v.p. of advanced technology at TI Group Automotive Systems Corp. in Auburn Hills, Mich.

There’s one big difference between 1992 and today. Gas-tank makers back then were purely blow molders selling parts to car makers, who built fuel systems. In the meantime, the big gas-tank makers evolved into Tier One suppliers contracted to design, test, and assemble entire fuel systems.

Over the last three years, gas-tank makers have hired whole teams of testing experts and fuel-system design engineers from the auto makers. They also invested millions to build new test facilities with rows of hot and cold chambers; test-drive simulators; maxi, mini, and micro emission-test chambers; sound chambers (to hear sloshing); and explosion-proof rooms to test gas tank filling.

Blow molding is now only a part of what the Tier One processors do. As fuel-systems providers, the big gas-tank blow molders are more receptive to alternative technologies like steel and twin-sheet forming than blow molders were eight years ago when passive emissions standards first came out. That explains why several European gas-tank molders are developing programs for 2004 cars using steel tanks as well as plastic to meet the new emissions standards. “The OEMs don’t want to go back to steel because steel solutions are very expensive, but some of our customers are actually ordering metal tanks for the 2004 model year,” says Dr. Klaus Esser, v.p. of R&D at Kautex Textron in Bonn, Germany (U.S. office is in Troy, Mich.).

“Today, just as in 1992, steel is the only proven ‘zero-evaporation’ tank material,” says Mike Harrigan, staff technical specialist at Ford Motor Co. in Dearborn, Mich.

It’s also worth noting that major gas-tank blow molders such as Visteon Corp. in Dearborn, Inergy Automotive Systems in Paris (U.S. office in Troy, Mich.), and TI Group are all participants in a new group formed under the American Iron and Steel Institute in Washington, D.C. Called the Strategic Alliance for Steel Fuel Tanks, it will explore using steel tanks for high emissions barrier.

At least one plastics processor is bringing new steel technology into the gas tank market. Pilot Industries Inc. in Dexter, Mich., a plastics processor of coextruded fuel lines and other fuel-system components, is taking the next step of making tanks targeting the PZEV niche market. (See sidebar for background on PZEV.)

Pilot has developed technology with hde GmbH in Menden, Germany, for hydroforming stainless-steel tanks. Pilot describes the process as resembling blow molding except that it starts with a tubular or flat blank of stainless steel and expands it into a mold cavity using high-pressure water. Hydroformed parts can be contoured like blow molded tanks, which are similar in cost and weight, Pilot says.

Blow molded and steel tanks have a dramatic lead over upstart competition from twin-sheet thermoforming, but Visteon and Delphi Automotive Systems both say they have sold thermoformed gas-tank programs for 2003 and 2004 model-year cars.

First twin-sheet programs

The first two prototype twin-sheet thermoformed gas tanks appeared at auto shows in the U.S. and France earlier this year, signaling the arrival of a potentially industry-altering technology. Delphi brought a clear PTFE thermoformed tank to the Society of Automotive Engineers show in Detroit last February, illustrating how twin-sheet forming can enclose all fuel-system components inside a car gas tank and thereby reduce emissions.

At the Paris Auto Show in October, Visteon showed a large twin-sheet tank that was black on one side and white on the other. The tank replicated a “saddlebag” blow molded tank for a Lincoln LS sports car by having a parting line that mirrored the blow molding pinch-off line. “We felt that if we could be successful with this part, which has a 5-in. height difference in the parting line, we could do anything,” says Paul Luft, department manager in the fuel-system engineering center at Visteon.

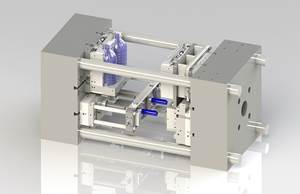

Delphi is already producing pre-production six-layer test tanks for several OEM customers at Tawas Industries in Oscoda, Mich., on a large rotary twin-sheet machine from Modern Machinery of Beaverton. The six-layer sheet is extruded by Delphi in Wisconsin.

Delphi’s next proving ground for thermoformed tanks will be for a 2003 model-year car in Australia, where emissions are becoming an issue. Delphi will gain production experience making a six-layer barrier tank there. Rotary twin-sheet machines for that project are being built by J.C. Smale, a custom machine builder in Melbourne, Australia. They are said to be similar to Modern Machinery’s but are modified for robotic insertion of fuel-system components that go inside the tank. Delphi also is developing thermoformed tanks for the U.S. and Europe to meet 2004 specs.

Meanwhile, Visteon says it has nearly a dozen thermoformed gas-tank programs in development for 2003 and 2004 model-year cars in the U.S. and in Germany. They range from 11- to 12-gal tanks for small cars up to 35- to 37-gal tanks for big trucks.

Visteon and Delphi both say their thermoformed tanks are the only plastic tanks that will be able to meet California’s LEV II and PZEV emissions standards for 2003 and 2004, respectively. But blow molders are seeking to patent some new ways to enclose fuel-system components in order to meet the new standards.

It’s no accident that the first two makers of thermoformed gas tanks, Visteon and Delphi, were both recently spun off from auto makers—Visteon from Ford and Delphi from General Motors. Their thermoformed tank programs started before they became independent, so their former parents have at least some understanding of this alternative approach. Visteon notes that none of its new thermoformed gas-tank programs have parallel programs in another technology as back-up.

Visteon and Delphi came to twin-sheet forming from very different perspectives and are likely to apply it differently. Delphi previously made only steel tanks and had no plastic forming experience. Its development program took longer than Visteon’s, even though it started earlier.

“For Delphi, thermoforming is a way to leapfrog over blow molding and get into plastic tanks with a lower cost of entry,” says Mohammed a Moiz, senior product engineer for Delphi’s twin-sheet program. “Depending on tank size, twin-sheet formed tanks can be made two-, three-, or even four-up, giving production cycles that may be as fast as blow molding.”

Visteon, on the other hand, has been a blow molder for decades and has made a big investment in six-layer blow molding machines. “Our depth of experience with blow molding allowed us to do things with thermoforming that other companies couldn’t have done in the same time,” says David Frey, Visteon’s fuel-system product marketing manager for twin-sheet gas tanks. “Blow molding helped us to know the pressures and the temperatures.” Visteon expects to use both technologies—thermoforming for PZEV and new tank opportunities, and blow molding for LEV II applications, Frey says.

Meanwhile, a third gas-tank blow molder, Inergy, formed by the recent merger of Solvay Automotive in Brussels and Plastics Omnium in France, is picking through the combined companies’ technologies and developing a series of promising plastic solutions, says president and COO Laurent Hebenstreit.

Inergy’s options include new blow molding techniques, a new variation on twin-sheet forming, and a barrier injection molded tank that uses a new barrier material. Up to now, injection molding has been used only for small tanks and reservoirs. Laurent says, “We have developed alternative technologies for PZEV, but we’re waiting for patents to be issued before we announce them.”

Twin sheet’s edge

The big emissions advantage of twin-sheet forming is that it allows inserting fuel-system components into the tank, along with structural baffles, before the two sheets are sealed together. Fuel pumps and level sensors today are placed inside blow molded tanks through a service hole cut in the tank wall. But lots of tubes and vent valves are mounted outside the blow molded tank, requiring grooves and recesses and a half dozen holes. Putting these tubes inside the tank greatly reduces the number of holes in the tank’s barrier material.

“Ultimately, we want to thermoform tanks with only two openings—one to put gas in and one to take gas and vapors out,” says Visteon’s Frey. One hole, however, will still have to be large enough (3- to 4-in. diam.) to service the fuel pumps. Some European car makers like BMW are considering tanks without a service hole, which would mean exchanging the whole tank if a pump fails.

Better barrier, however, isn’t the real issue between blow molding and twin-sheet thermoforming for gas tanks. “The move to twin-sheet wasn’t done with PZEV in mind. Rather, we saw it as an efficient alternative to blow molding,” explains Visteon’s Frey. “But in the end, thermoforming provided us with technology to meet PZEV.”

According to both Delphi and Visteon, the primary advantages of twin-sheet forming are that it makes a lighter part with better performance using less expensive capital equipment, less expensive tooling, and more flexible production. Thermoformed tanks use 5% to 10% less material, even though trim scrap runs slightly higher than for blow molding, depending on tank design.

Putting components inside the tank reduces part weight 5% to 10%, Delphi and Visteon say, because blow molded walls are thicker and reinforced with ridges and channels to support holes and fittings. As a blow molded parison hangs momentarily before it is blown, the walls at the top thin more than at the bottom. A blow molded parison can be profiled to compensate, but thermoforming still has better overall wall distribution, Delphi says. The effective volume of a thermoformed tank is also 5% more than that of an equivalent blow molded tank because baffles replace the ridges and channels of blow molded tanks to reduce sloshing. Flat blow molded tanks also fail sometimes in suction mode, when the upper surface can pull down as much as 8 to 10 mm—enough to crush a fuel sender. “With thermoforming, the support structure prevents crushing,” notes Moiz.

Thermoforming equipment can be moved more readily to assembly plants to make tanks where needed, Visteon and Delphi say. This would save the cost of “shipping air” in blow molded tanks. Instead, thermoforming on-site would require shipping only pallets of cut sheets.

Both Visteon and Delphi say their twin-sheet forming processes aren’t machine dependent. “We can produce good tanks on rotary, in-line, or shuttle-type thermoforming machines,” Visteon’s Frey says. Visteon hasn’t settled on which type of production machinery it will use, but its lab line is a rotary from Brown Machine. A linear twin-sheet thermoformer is being designed by Kiefel Technologies, which specializes in automotive thermoformers. The machine will be built at Paul Kiefel GmbH in Germany.

Visteon has applied for several patents relating to the design and manufacture of twin-sheet tanks. Its process involves a profiled preblow. By putting more heat into areas of the sheet that will be deeper drawn, the sheet takes the contour of the final part with very light (20-psi) pressure in a preblow box.

Twin-sheet forming also allows sheet of different gauges to be used on top and bottom. Visteon has experimented with 7-mm sheet on the top and 8-mm on the bottom, where heavier gauge is needed to accommodate deeper draws and to pass a burn test in which a pan of burning gasoline is put under the tank.

Mimicking blow molding

Visteon and Delphi are positioning their twin-sheet tanks as identical to blow molded ones in order to gain faster acceptance. Clamping lines on the twin-sheet tanks are virtually identical to the pinch-off lines on blow molded versions, Visteon says. “If the temperature of the twin sheets is kept exactly the same as the temperature of a blow molded parison, and the tools close at the same pressure, and vacuum and blow pressures are comparable, the resulting parts should be the same,” says Visteon’s Luft.

Thermoformed prototypes from both companies have passed the 6-meter low-temperature drop test. “They don’t fail at seams on cold-temperature impact,” Visteon’s Luft says. “They behave just like blow molded tanks.”

Both thermoformed and blow molded tanks have six-layer walls with EVOH barriers of roughly equal thickness. More than 80% of emissions from both kinds of tanks come through the pinch-off and added components such as hose connections and closures, says Ford’s Harrigan.

Delphi has developed a method of accelerated barrier testing. Heating 3-in. discs of tank walls and seams helps speed up a “soak test,” explains chief engineer Matt Sheline. Delphi is now making prototype samples on production tooling. That’s usually done six months before production. “We’re one-and-a-half years early,” Sheline says. “That gives everyone high confidence and minimizes customer risk.”

A longer seam will pass more hydrocarbons, regardless of whether the tank is thermoformed or blow molded. So thermoformed tanks, which have a weld line around 100% of the circumference, may emit slightly more than blow molded tanks that have 50% to 100% pinch-off. For example, a long, tubular blow molded tank for a truck may be pinched off only at the ends. “If the blow molded tank has 75% to 100% pinch-off, thermoforming can compete,” notes a Delphi engineer.

There are also some critical design differences in the contours possible for a blow molded pinch-off versus a twin-sheet weld. An irregularly shaped tank with protrusions can have a curvaceous pinch-off that is too complex for twin-sheet forming. Smaller European cars, for example, with extreme saddlebag tanks, could never be produced by twin-sheeting, says Manouchehr Kambakhsh, v.p. of fuel-systems technology at TI Group in Rastatt, Germany.

Visteon chose to tackle a saddlebag-style tank with thermoforming, but it’s a relatively simple one with an angled pinch-off, not a curved one. On the other hand, advocates of twin-sheet forming say there are ultimately no design limitations to twin sheet and that virtually any shape that can be blow molded can be thermoformed.

Blow molding’s comeback

Blow molders of gas tanks are also launching new technologies to meet PZEV emissions by putting fuel-system components inside the tanks or under a cover. Six-layer plastic tanks are blow molded by Visteon, Kautex Textron, TI Group, Inergy, and ABC Group in Toronto. Most tanks are blow molded on six-layer continuous-extrusion machines from SIG Blowtec (formerly Krupp Kautex).

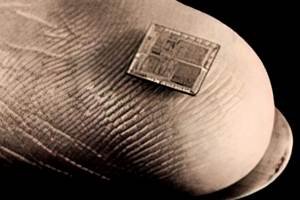

TI has developed a new “ship-in-a-bottle” blow molding technology, known as SIB, which puts all the fuel-system components inside the tank. The components are mounted on an injection molded carrier, which is inserted under the dropping parison, clamped in position with sliding tools, and welded to the parison before the molds close. The carrier provides rigidity and prevents sloshing, like the baffles in twin-sheet forming. SIB will be used on some commercial gas tanks for 2003-2004 model cars, TI says.

Another new way to reduce emissions is to cover up the external hoses and fittings on a blow molded tank. One such patented approach, which comes from technology-development firm AMTEC (Advanced Multilayer Technology), reportedly meets LEV II and PZEV standards. Called

CVR (Complete Vapour Recovery), it welds a six-layer, blow molded barrier jacket over the top of the tank to cover the fittings, openings, and pinch line. This system traps hydrocarbons in the air gap between the jacket and the tank and vents them to a canister and then to the engine for burning. CVR was jointly developed by AMTEC and SIG Blowtec. CVR reportedly lets a fuel system that was emitting 54 mg of hydrocarbons per day cut emissions to 24 mg/day. CVR adds cost and weight to a tank. However, the service opening for the fuel pump is now covered by the CVR jacket and does not need an expensive barrier seal.

Kautex Textron has a patent-pending approach that also allows current blow molded tanks to comply with PZEV and LEV II. Instead of jacketing the whole top half of the tank, Kautex Textron welds a flat six-layer cover of barrier sheet just over the fuel-system components. Kautex Textron doesn’t vent under this cover, but fills the air space with charcoal to trap hydrocarbons. The cover lid also lets Kautex Textron use less expensive non-barrier hoses and lines underneath. Several plastic tank makers are also testing the approach of welding a 2-in.-wide coex barrier strip around the entire pinch-off.

Emissions Limits: A Moving Target

Blow molded plastic gas tanks represent 60% of the U.S. market this year, up from only 30% two years ago. In Europe, plastic’s market share is 85% this year, up from 77% in 1998, according to Robert Eller Associates, a market-research firm in Akron, Ohio. New emissions levels, however, have already pushed some car makers in the U.S. and Europe back to steel tanks for 2003 and 2004 models.

Tighter emissions standards began nearly a decade ago when California first set passive-emissions limits of not over 2 g of hydrocarbons per 24 hr from a parked car. That standard, passed by CARB (California Air Resources Board) in 1990, became known as LEV (low-emissions vehicle), and applied to new cars from 1994 to 2003 model years. It also spelled the end of previous fluorination and sulfonation barrier technologies and brought in the six-layer blow molded tank with an EVOH barrier.

A whole series of CARB regulations have come out since then, covering both active (tailpipe) emissions when a car is moving and passive (evaporative) emissions from parked vehicles. LEV was followed first by ULEV (ultra-low-emissions vehicle), which applies to tailpipe emissions for 1997-2003 cars. Then came SULEV (super-ultra-low-emissions vehicle) for tailpipe emissions from 2004 on. They were followed by ZEV (zero-emissions vehicle), which set passive and tailpipe emissions at zero for 10% of car sales in California from 2003 forward. Only electric and hydrogen-fueled cars can meet that standard.

More relevant to internal-combustion vehicles is something called PZEV (partial zero-emissions vehicle), which goes into effect with 2003 cars and allows fuel-system emissions of 0.054 g/day. Fuel systems used with six-layer blow molded tanks are currently allowed to emit up to 2 g/day, though many are below that level.

Then came LEV II, which is a little more lenient than PZEV and was developed for the balance of vehicle sales in California. The LEV II standard has also been adopted by New York State and Massachusetts and is being considered by other New England states.

It requires no more than 0.5 g/day of total hydrocarbons to escape from a parked car in 24 hr. To guide its R&D programs, the auto industry allocated 150 mg of that emissions allowance to the fuel system and 350 mg to the rest of the car, primarily the tires and headliner.

LEV II calls for 40% of vehicle sales to comply in 2004 and 100% by 2010. It is believed that vehicles with higher sales volumes will comply first, especially those with less powerful engines. The durability requirement also got tougher. Where the first LEV required vehicles to meet the emissions standard for 10 years, LEV II will require 15 years.

Most recently, the U.S. Environmental Protection Agency added “Tier 2” to the list of national standards for the other 47 states that didn’t adopt LEV II. Also effective in 2004, Tier 2 sets evaporative emissions limits roughly twice as high as in LEV II.

European standards are still set at 2 g/day, but auto makers like Volvo (owned by Ford) and Mercedes Benz (DaimlerChrysler) that have major exports to the U.S. effectively must meet those standards for their whole fleets.

Related Content

At NPE, Cypet to Show Latest Achievements in Large PET Containers

Maker of one-stage ISBM machines will show off new sizes and styles of handled and stackable PET containers, including novel interlocking products.

Read MoreHow Inline Vision Inspection Can Minimize Scrap in Molding

Once viewed by injection and blow molders as a necessary evil, machine vision technology today can continuously monitor and improve production while reducing costs.

Read More50 Years...600 Issues...and Still Counting

Matt Naitove marks his first half-century in plastics reporting, with a few of his favorite headlines.

Read MoreMold Opaque White PET Bottles – Without Pigment

Trexel and Husky are cooperating on molding recyclable opaque white preforms for PET bottles, which provide a light barrier using foam instead of pigment.

Read MoreRead Next

Understanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More.png;maxWidth=970;quality=90)

.png;maxWidth=300;quality=90)