Prices Up, Except for PP

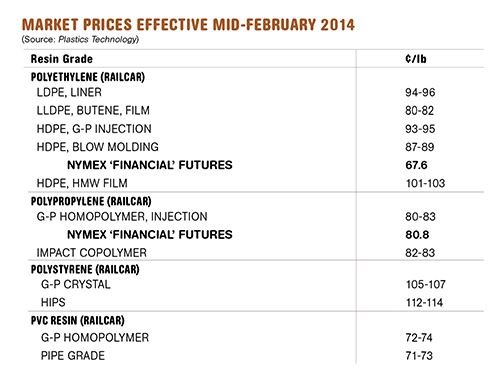

Prices of PE, PS and PVC were on the way up last month, while PP prices could be headed in the other direction.

Prices of PE, PS and PVC were on the way up last month, while PP prices looked set to remain flat if not sink a bit. But there is one cloud on the horizon: Refinery turnarounds for propylene monomer pose a supply risk that could eventually push prices upwards. Prices of PS rose a whopping 10¢/lb between December and January, driven by benzene price volatility and tight styrene monomer supply. PVC suppliers got one of their three increases in place in January and had a good chance of getting another one last month, prompted by tighter supply.

These are some of the views of purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas, and CEO Michael Greenberg of The Plastics Exchange in Chicago.

PE PRICES UP

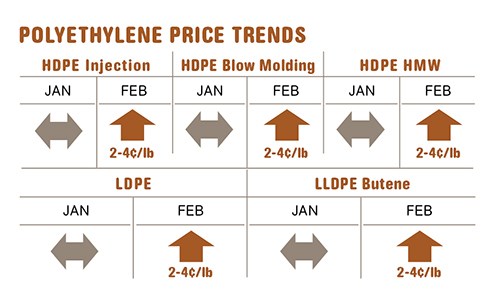

Polyethylene contract prices were poised to move up 4¢/lb last month. One supplier nominated another 6¢ for March, although further support for the move was considered unlikely to materialize. Both Mike Burns, v.p. for PE at RTi, and Greenberg warned that a portion, if not all, of the February increase could be implemented, despite the absence of any real major drivers.

The spot PE market was active through January, with prices up 1-3¢. On the higher end were HDPE blow molding grades, which became quite tight due to large exports and some production and/or weather-related logistical complications, according to Greenberg. HMW-HDPE also continues to be tight since last year, but most of this tightness is in the spot market, according to Burns, who says contract buyers have had no difficulty getting what they need.

Continued healthy demand and balanced inventories are keeping prices firm, according to Burns, who adds that any real upward push would come from PE production disruptions due to cold weather or because these plants are running at high capacities. He did not see scheduled ethylene cracker maintenance shutdowns through the first quarter into April having any adverse effect on PE prices, as monomer is plentiful and there is also new ethylene capacity due on stream.

Spot ethylene prices drifted 4.5¢ lower by the end of January, to 54.5¢/lb. According to Greenberg, market activity for forward months indicates that ethylene prices could gain a bit in April and then slide down by a couple of cents, with Dec. 2014 futures marked at 52.25¢/lb.

PP PRICES FLAT-TO-DOWN—FOR NOW

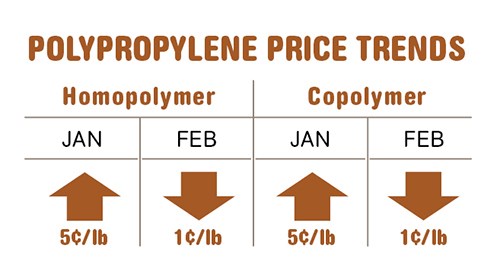

Polypropylene contract prices moved up 5¢/lb in January, reflecting 4¢ higher monomer contracts, along with a 1¢ “margin expansion” that suppliers had sought in January contracts. Although suppliers were trying to get another 1¢/lb in February, it appeared that prices would stay put or even drop by 1¢ or even 2¢, mirroring the settlement of monomer contract prices, according to both Greenberg and Scott Newell, RTi’s director of client services.

Newell anticipates that after this last increase, PP prices will follow the monomer penny for penny for most of the year, and possibly into next. Both sources cite improved PP availability.

Greenberg reports that PP spot volumes were above average through most of January, cooling a bit toward the end. Spot PP prices also began to drop. He and Newell agree that while PP prices could slip a bit more, a market free-fall is not in the cards. They pointed to resin plant turnarounds scheduled through February, March, and into April. Said Newell last month, “While PP availability has been improving, we are also seeing a soft spot in demand. However, we still expect some monomer supply risks during the scheduled turnarounds.”

Newell noted that many processors were in relatively good shape in terms of sufficient resin stocks following inventory build-up in late 2013.

PS PRICES UP AGAIN

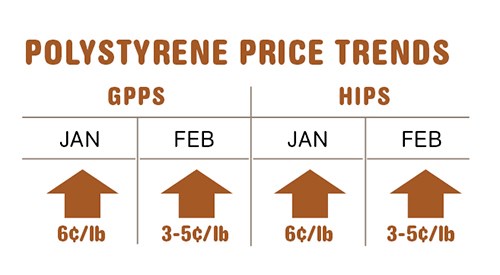

Polystyrene prices continued their ascent, with an average increase of 6¢/lb in January, following a 4¢ increase in December. PS suppliers were also seeking a 5¢ increase for February.

Driving the price hikes have been higher prices for benzene feedstock—up 5% in February to $5.09/gal, following increases of 8% and 9% in the two previous months, as well as styrene monomer tightness due to planned and unplanned production shutdowns. Although a seasonally slow period for PS, demand was up, although that was attributed largely to prebuying in anticipation of further increases.

Mark Kallman, RTI’s director of client services for engineering resins, PS, and PVC, ventures that 3-5¢ of the February increase might be implemented. He notes, however, that PS prices are likely to have peaked, as benzene spot prices have been dropping since late January, and benzene imports will relieve the supply tightness. Also, nearly all of the monomer plants were up and running again last month.

PVC PRICES MOVING UP

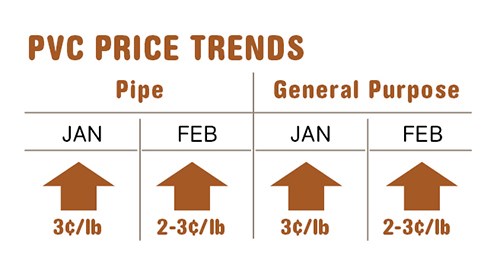

PVC prices rose 3¢/lb in January, and suppliers were looking to implement another two 3¢ increases in February and March. The February increase was amended from 2¢ to 3¢ due to an unexpected shutdown of a VCM plant, which tightened up supply, and that was followed by the issuance of the third increase.

Although PVC exports dropped due to higher prices, domestic demand was up as processors scrambled to buy ahead of emerging increases, said RTi’s Kallman. The price hikes were also fueled by ethylene contract prices settling 2¢ higher in January, the third consecutive increase.

While there is no expectation of ethylene contract prices moving up again, as spot prices have been dropping since January, Kallman ventures that PVC suppliers could well implement 2-3¢ of the February increase. The fate of the March increase will depend on market demand. Processors have already built up some inventories, and weather patterns do not suggest an early start of construction season, notes Kallman.

Related Content

Commodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreRecycled Content to be Incorporated in PS Foam Packaging

Pactiv Evergreen and Amsty announced a collaboration that will bring ISCC plus certified product into select food packaging.

Read MoreNexkemia Acquires Polystyrene Recycling Assets

The polystyrene manufacturer finalized its purchase of Eco-Captation, a recycler.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read More

.png;maxWidth=300;quality=90)