Pricing Update - November 2006

Commodity Resin Prices Weaken

After a brief surge upward, prices of polyolefins and PVC have softened again.

After a brief surge upward, prices of polyolefins and PVC have softened again. Falling monomer prices is one reason, as are processors’ year-end inventory reductions. PS is a different story, however, because benzene feedstock prices are soaring—but perhaps not for long. Meanwhile, price increases are hitting other thermoplastics and some thermosets.

PE prices down

Polyethylene prices were on the way down by October, following suppliers’ implementation of a 5¢/lb increase in August. As a result, processors recouped 2¢ of that hike in September and the rest by mid-October. Sources at resin purchasing consultant Resin Technology Inc. (RTI), Fort Worth, Texas, noted that further price declines were very probable before the end of October. Meanwhile, the London Metal Exchange (LME) November short-term futures contract for butene LLDPE for blown film was 52.8¢/lb, down from October’s 59.9¢.

Contributing factors: PE demand has remained steady but not strong enough to sustain the recent price hike. Suppliers’ inventories were rising in October. RTI sources said processors are looking to cut their own inventories by year’s end as “holiday production” slows down. One major PE supplier says demand for consumer packaging continues to be good though there has been a slowdown in industrial packaging such as liners and shrink wrap, making for a very competitive market.

Ethylene monomer prices were expected to move downward as the supply tightness of the summer months—due to planned and unplanned outages totaling 18% of domestic capacity—was starting to abate. September monomer contract prices were unchanged from August at 51.5¢/lb. And by October, spot prices dropped to 37¢/lb, and some industry sources expected that lower contract prices would follow.

PP prices up a bit

Polypropylene prices moved up in September by an average of 1.7¢/lb as resin suppliers pushed to implement a 4¢ hike pending since Sept. 1. But there were indications of some price softening by mid-October. And the LME’s November short-term futures contract for g-p injection homopolymer slid to 52.8¢/lb (identical to PE) from October’s 57.8¢.

Contributing factors: Propylene monomer contract prices, which rose 4¢/lb in August and 2¢ in September, then turned south. October contract prices looked set to drop 3.5¢ to 5¢/lb. PP resin demand was down a bit in August and September, though resin suppliers indicated some recovery in October. RTI sources indicate that PP processors have been buying cautiously and aim to reduce their inventories by year’s end.

PVC prices may erode

Resin producers and buyers expected PVC prices to lose 2¢ in October and 4¢ to 6¢ by the end of the year.

Contributing factors: Demand turned suddenly soft in October as prices of natural gas and ethylene retreated and pipe producers worked off inventories. Demand for small-diameter pipe for water and electrical conduit plummeted on expectations of fewer housing starts. Demand for larger water and sewer pipe is a bit less weak. Windows are holding their own.

PS prices volatile

Polystyrene producers were trying for 3¢/lb increases in October, part of a 5¢ hike delayed from Sept. 1, but they were meeting strong resistance from processors, who want PS prices to come down in line with oil prices. Meanwhile, EPS producers announced a 4¢/lb increase for Nov. 1.

Contributing factors: PS demand in September and early October was weak. Dow is shutting two PS trains in Sarnia, Ont., this month and next, taking 300 million lb/yr of capacity out of the market. The unsettling factor is benzene feedstock for styrene monomer. Contract benzene hit $4/gal for October, an all-time high, up from $3.55/gal in September. Cheaper benzene on its way from Asia could bring some relief this month.

Other price hikes

BASF, DuPont, and Ticona lifted tabs on various engineering resins between Oct. 15 and Nov. 1: Standard nylons rose 10¢ to 12¢/lb, specialty nylons 12¢ to 15¢/lb. BASF hiked acetals 10¢, DuPont 12¢, and Ticona only 7¢/lb. PBT and PET compounds went up 10¢ for BASF, 12¢ for Ticona, and 15¢ for DuPont. Polyester TPEs went up 12¢ to 15¢. And LCPs rose 15¢ for DuPont and 25¢ for Ticona.

Oct. 15 was also the date for a 15¢ increase on Topas cyclic olefin copolymer (COC) from Topas Advanced Polymers.

And Reichhold raised prices on unsaturated polyesters and vinyl esters by 5¢/lb on Nov. 6.

| Market Prices Effective Mid-Oct A |

|

|

KEY: Colored areas indicate pricing activity. An arrow () indicates direction of price change. aTruckload, unless otherwise specified. bUnfilled, natural color, unless otherwise specified. cBased on typical or average density. dNot applicable. eNovolac and anhydride grades for coils, bushings, transformers. fNovolac and anhydride grades for resisitors, capacitors, diodes. gIn quantities of 20,000 lb. h19,800-lb load. jLME 30-day futures contract for lots of 54,564 lb.. |

Related Content

The Fantasy and Reality of Raw Material Shelf Life: Part 1

Is a two-year-old hygroscopic resin kept in its original packaging still useful? Let’s try to answer that question and clear up some misconceptions.

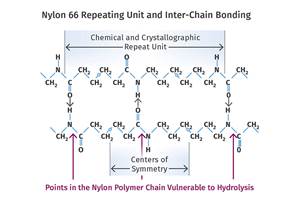

Read MoreWhat is the Allowable Moisture Content in Nylons? It Depends (Part 1)

A lot of the nylon that is processed is filled or reinforced, but the data sheets generally don’t account for this, making drying recommendations confusing. Here’s what you need to know.

Read MoreMelt Flow Rate Testing–Part 1

Though often criticized, MFR is a very good gauge of the relative average molecular weight of the polymer. Since molecular weight (MW) is the driving force behind performance in polymers, it turns out to be a very useful number.

Read MoreScaling Up Sustainable Solutions for Fiber Reinforced Composite Materials

Oak Ridge National Laboratory's Sustainable Manufacturing Technologies Group helps industrial partners tackle the sustainability challenges presented by fiber-reinforced composite materials.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More