PE Film Market Snap-Shot: Stretch Film

The six largest processors of stretch film accounted for more than 85% of capacity in 2017—product differentiation is essential for any newer, smaller players to enter the field.

With this blog we launch a series of articles based on 2017 research conducted by market-research firm Mastio & Co., St. Joseph, Mo. on key markets for extruders of polyethylene film. Each weekly blog will consist of growth projections, technology drivers, and key players in each of 10 different film segments. We’ll kick off the series with stretch film.

According to Mastio’ s research, the stretch film market continues to be one of the largest and most rapidly evolving PE film markets. Interview with processors conducted by Mastio reveal that stretch film processors remain optimistic about increases in demand for stretch film products, as stretch film continues to displace other conventional means of pallet unitization and product bundling.

Three distinct types of stretch films are commonly produced: hand-wrap, machine rotary or power-stretch wrap, and silage-wrap stretch films. However, within each category there are several highly customized sub-grades of stretch films designed for specific end-use applications, the Mastio report states. Stretch film application equipment is more cost-effective, faster, more user-friendly, more energy efficient and safer to use than shrink-wrapping equipment. Shrink film requires the use of heat lamps or hot-air guns, which use greater amounts of energy and labor than power stretch wrapping equipment. New applications for specialty grades of stretch film continue to be developed and commercialized in North America, and more sophisticated stretch films are being designed for existing applications.

Stretch film is offered in a wide variety of widths ranging from 1 in. to 100+ in. Hand-held grades of stretch wrap are typically marketed in narrower web widths of 1, 2, 5, 10, 12, 15, and 18 in., with 12 and 18 in. being the most common. The most common range of web widths for machine rotary stretch film is 18 to 30 in. Stretch films are most often wound on extended core rolls, allowing both hand and machine rotary application techniques. The extended core rolls aid in applying resistance to the film and stretching the film while it is being applied. Pre-stretching of the film is required to ensure good load retention during transportation and storage.

Stretch films are offered in many grades and gauges allowing applicators to use the most economical film for their specific applications. Unitized loads, which will be transported short distances or within a warehouse, require a lesser performing stretch film than loads being shipped greater distances. Stretch films can be further classified as being either yield films or load-retention films. Yield films are designed to provide the greatest amount of coverage during unitization. Yield stretch films are used for bundling products which are light weight or are intended to be shipped and moved short distances.

High yield or high percent stretch films provide the maximum coverage at the lowest cost. High load retention stretch films are designed to provide the greatest load retention, preventing large or heavy unitized products from shifting during transportation and storage. Load retention films provide greater resistance to stretch and have more “film memory” over time. Load retention stretch films are applied to heavier unitized loads that will be shipped greater distances. It should be noted that film thickness is a poor indicator of yield versus load retention abilities.

MATERIAL TRENDS

One of the most significant changes that continues to manifest in the stretch film market is increased use of metallocene single-site catalyst based linear low-density PE (mLLDPE) resin. When used in blends or in coextrusion with conventionally produced PE resins, mLLDPE resin greatly enhances the physical properties of the films in lower gauges.

In 2017, approximately 2.083.4 million lb of PE was consumed in the production of stretch film, making this sector one of the largest and fastest growing markets within the PE film industry. With an average annual growth rate (AAGR) of 3.7%, PE resin consumption to produce stretch film should reach 2.327.2 million lb by 2020, Mastio predicts.

TECHNOLOGY TRENDS

Current methods for producing stretch film include the following: monolayer blown film extrusion, multi-layer blown film coextrusion, monolayer cast film extrusion and multi-layer cast film coextrusion. During the past several years the stretch film industry has continued to experience a shift from the utilization of the blown film extrusion process to the cast film extrusion process and from monolayer construction to more multi-layer coextruded film constructions. According to Mastio, nearly 76% of all stretch film produced in North America was via cast film, while 82% of all films produced were coextrusions. Monolayer blown film extrusion is the most common method used to produce hand-held stretch wrap films.

MY TWO CENTS

According to Mastio, the six largest processors of stretch film (Berry Global Group Inc., Sigma Stretch Film Corp., Inteplast Group Ltd., Paragon Films Inc., Malpack Ltd., and Intertape Polymer Group Inc.) accounted for more than 85% of capacity in 2017. This is up slightly from Mastio’ s 2014 study, when the top six players accounted for 82% of the market. Patent disputes have restrained the development of more-sophisticated nano-layer structures that are more common in Europe. What’s more, unlike Europe, stretch film in North America is sold through distributors, separating the entity that produces the film from the entity that uses it. Product differentiation is essential for any newer, smaller players to enter the field. Ultimately the nano-structures that are prevalent in Europe will be produced in North America.

Read the Stretch Film Market Report.

Related Content

Medical Molder, Moldmaker Embraces Continuous Improvement

True to the adjective in its name, Dynamic Group has been characterized by constant change, activity and progress over its nearly five decades as a medical molder and moldmaker.

Read MoreYoung Stretch-Film Processor Bets on Nanolayers

Going up against companies with as much as double its capacity, young stretch-film processor Zummit believes that new technology — notably 59-nanolayer films — will give it a competitive edge.

Read MoreAutomotive Awards Highlight ‘Firsts,’ Emerging Technologies

Annual SPE event recognizes sustainability as a major theme.

Read More‘Monomaterial’ Trend in Packaging and Beyond Will Only Thrive

In terms of sustainability measures, monomaterial structures are already making good headway and will evolve even further.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

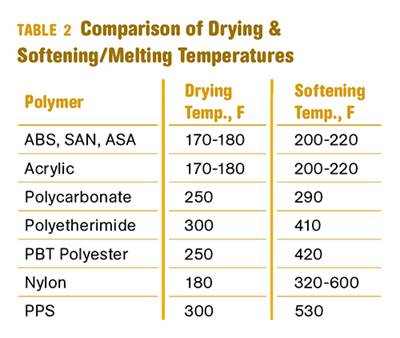

Read MoreWhy (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read More