3D Printers Lead Growth of Rapid Prototyping

Bringing rapid prototyping capabilities in-house is becoming a reality for many plastics manufacturers, thanks to more affordable, faster, and easy-to-use 3D printers.

Bringing rapid prototyping capabilities in-house is becoming a reality for many plastics manufacturers, thanks to more affordable, faster, and easy-to-use 3D printers. On the market almost seven years, these units use the ink-jet printer principle to deposit droplets of materials in successive, ultra-thin layers. Companies using CAD solid-modeling software in an office environment are finding that they can produce three-dimensional “form-and-fit” concept models, which are primarily used for visualizing and communicating early product design. A designer can now quickly “print” a prototype and show it to engineering, sales, and marketing groups as well as to toolmakers.

Rapid prototyping (RP) guru and consultant Terry Wohlers, president of Wohlers Associates, says sales of RP equipment reversed its downward trend in 2003. “Low-end machine sales soared to unprecedented heights, with 3D printers becoming the ‘crown jewel’ of the RP industry.”

In his Wohlers Report 2004, Wohlers estimates that the five suppliers of 3D printers sold 1032 machines worldwide last year, an increase of 57.3% over 2002, when sales jumped 34.2%. In contrast, sales of other RP systems grew by only 2.6% in 2003.

The five 3D printer makers include Z Corp., which now offers three models of 3D printers, including its flagship ZPrinter 310; and Stratasys, which offers two versions of its Dimension 3D printer. 3D Systems, which sells both the widely known high-end SLA (stereolithography) and SLS (selective laser sintering) RP systems, launched its first “true 3D” printer, called InVision, in late 2003. Objet Geometries in Israel supplies the higher-end Eden 333 PolyJet 3D printer in North America through Stratasys.

Faster and cheaper

Their favorable price/performance ratio is what drives growth in 3D printers, says Wohlers. “For a lot of companies, spending well over $100,000 for the more sophisticated RP machines is simply not an option.” Current prices for high-end RP machines are $180,000 to $500,000 for SLA, $270,000 to $325,000 for SLS, and $100,000 to $300,000 for FDM (fused deposition modeling).

Two companies now offer 3D printers for around $25,000—Stratasys’ Dimension BST and Z Corp.’s ZPrinter 310. Most other units sell for $35,000 to $55,000, although there are two higher-priced units: Z Corp.’s Z 810 ($180,000) is aimed at large prototypes and castings. Objet Geometries’ Eden 333 PolyJet ($115,000) can make high-quality patterns for silicone tooling and prototypes comparable to SL parts.

Industry sources generally concur that the 3D printers are best suited for early design and visualization of models, whereas the more sophisticated RP machines have a place in tooling patterns and functional prototypes subjected to rigorous testing. Says Wohlers, “Most parts produced by low-end 3D printers are throwaway models that allow you to see things you would not be able to see as well on a computer with a CAD system. People want to hold the proposed design, study it, and get a good feel for its shape.”

Adds John Cobb, v.p. and general manager at Stratasys, “When you give the toolmaker a prototype in addition to your CAD drawing, it allows them to give a more accurate price quote—typically a more attractive one. We have been told by users that you can save up to 6% to 8% of tooling costs with a prototype.”

Functional prototypes are also possible with 3D printers, but generally with the penalty of adding time and cost for post-processing steps. That defeats a major advantage of 3D printers—speed. Generally, they can make models in as little as one-tenth the time required for other RP systems—i.e., 30 min to 2 hr instead of 2 to 10 hr.

Also, functional prototypes that can be produced by 3D printers generally do not have the surface quality nor the physical properties offered by the other RP systems, such as SLA with its superfine surface resolution. Even the lowest cost machines, such as Z Corp.’s ZPrinter 310 and Stratasys’s Dimension, can be used to produce patterns for tooling, but Wohlers cautions that the surfaces of such parts need a lot of work to look good. “Typically, they would require such steps as filling and sanding of the surface so that it is not porous. Once you start doing that, the dimensional accuracy of the part declines,” Wohlers notes.

Typical size of prototypes made by most 3D printers are about 8 x 10 x 8 in., although Z Corp.’s model Z 810 can build parts as large as 16 x 20 x 24 in. SLA, SLS, or large FDM RP machines typically allow for somewhat larger build envelopes—up to 24 x 24 x 20 in. or more.

Still relatively new to the market, 3D printers are currently limited in the choice of materials that can be used—often one or two. In contrast, there are more than 50 different photopolymers available for the SLA that mimic properties of various thermoplastics. Likewise, SLS can use unfilled and glass-filled nylons, while FDM uses ABS, polycarbonate, and polyphenyl sulfone (PPSF). However, the range of 3D printer materials is growing, too.

3D printer news

Both 3D Systems’ InVision and Objet Geometries’ Eden machines use an inkjet-type print head to deposit their proprietary photopolymer materials. Z Corp.’s Z Printers also use an inkjet print head but they deposit a liquid binder onto a powder—typically low-cost starch- or plaster-based materials. Stratasys’ Dimension 3D printers are based on the company’s FDM technology, which uses a deposition head that melts a filament of ABS.

Objet Geometries has launched its third generation of photopolymers for the Eden 3D printer, and its new printer head can build super-thin layers of only 0.0006 in. These reportedly make parts with exceptional feature details and surface finish that rival SLA.

Models made with 3D Systems’ new $40,000 InVision system and its uv-curable, acrylic-based resin do not match the surface finish and detail of Eden parts, but the machine and materials are fast evolving, says Wohlers. InVision boasts resolution of 600 dpi and builds layers that are 0.0016 in. thick. Both machines can make patterns for silicone molds, though parts from the Eden machine require less post-processing.

Z Corp.’s printers boast the highest speed, depending on part geometry. “We are generally three to eight times faster than competitors. Also, the cost of our materials is dramatically lower,” says CEO Marina Hatsopoulos. According to Wohlers, Z Corp.’s starch-based material builds models twice as fast as the plaster material, but the plaster produces much better part quality. Such parts typically have a rough, porous surface not well suited to making silicone tooling. They can be impregnated with a liquid resin such as an epoxy to achieve a smooth finish, but the additional post-processing cost is unattractive for this application.

Z Corp. is the only supplier that currently offers machines that can make parts in full color. That is because its Z 406 color printer has multiple print heads that can spray not only the white powder “build” material, but also different colors of binder droplets in infinitely variable combinations, just like a standard ink-jet printer. The Z 406 sells for $57,000, while the monochromatic ZPrinter 310, which sprays only one binder color at a time, was recently reduced in price from $30,000 to $26,000. Another full-color machine is Z Corp.’s large model Z 810.

Z Corp. is introducing new materials. ZP 250 is a proprietary composite capable of simulating plastics’ properties better than the plaster system, which is strong but brittle. With the new material, parts can be sanded and painted and are suitable for snap-fits, according to Hatsopoulos. Cost is still lower than the competitors’ materials, she adds. By the end of the year, Z Corp. will launch a new thermoplastic powder that will not require infiltration to achieve good part strength.

A key advantage of Stratasys’ Dimension 3D printer is its ABS material, which makes prototypes that resemble the properties of plastics and can be tested for form, fit, and function. The original machine model, Dimension BST (Breakaway Support Technology), which sells for $24,900, requires the user to break away the supports once the part is removed. With the newer Dimension SST (Soluble Support Technology), once the part has been completed, it is placed in a water tank and supports dissolve in 30 min. SST is suited to complex parts with difficult geometries. It sells for $34,900. Both technologies make parts that require no post-processing.

Related Content

How to Start a Hot-Runner Mold That Has No Tip Insulators

Here's a method to assist with efficient dark-to-light color changes on hot-runner systems that are hot-tipped.

Read MoreHow to Select the Right Tool Steel for Mold Cavities

With cavity steel or alloy selection there are many variables that can dictate the best option.

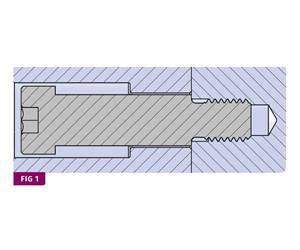

Read MoreWhy Shoulder Bolts Are Too Important to Ignore (Part 2)

Follow these tips and tricks for a better design.

Read MoreHow to Mount an Injection Mold

Five industry pros with more than 200 years of combined molding experience provide step-by-step best practices on mounting a mold in a horizontal injection molding machine.

Read MoreRead Next

Processor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read MoreWhy (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read More