Demand Surge Tightens PEEK Supply

The pace at which polyketone materials are replacing metals shows no sign of abating. Indeed, PEEK's potential in fuel cells, plus accelerated applications development in existing markets, suggest that supply tightness could persist through 2003, when more new PEEK capacity is expected to bring relief.

New Suppliers Ease the Crunch

A high degree of uncertainty plagues molders and end-users of polyketone engineering polymers, key candidates for replacing metals in semiconductor manufacturing, energy production, and chemical-processing equipment. The immediate concern is short supply of polyetheretherketone (PEEK) resin, whose sole commercial-scale producer is Victrex PLC in the U.K. As a result, Victrex USA in Greenville, S.C., has put many domestic customers on allocation. By late this year, Victrex expects a sizable capacity expansion to restore market equilibrium, at least temporarily.

The longer-term outlook is positive, in part because two alternatives to Victrex PEEK have emerged and are expected to be commercially proven and available by early 2003. These are a PEEK family supplied by Gharda Chemicals Ltd. in Mumbai, India, and a polyetherketoneketone (PEKK) variant supplied as a compound by Oxford Performance Materials in New Britain, Conn.

Meanwhile, the pace at which polyketone materials are replacing metals shows no sign of abating. Indeed, PEEK's potential in fuel cells, plus accelerated applications development in existing markets, suggest that supply tightness could persist through 2003, when more new PEEK capacity is expected to bring relief.

Demand outpaces supply

In recent months, PEEK users have been put on strict allocation, which has slowed new application development. An 80% allocation rate is being applied in many markets and some have experienced more severe restrictions. The shortage has been accompanied by a rise in PEEK prices, industry sources report. Observers estimate global PEEK demand stands at around 4 million lb/yr, and prices average around $35-40/lb.

Kevin Jennings, general manager at Victrex USA, says current PEEK shortages are not the result of glitches in resin or monomer production, but rather stem from soaring demand. "A recent growth spike has resulted in demand for PEEK outrunning capacity for making it," he says. Victrex USA supplies PEEK made by Victrex PLC in Thornton-Cleveleys, England. Industry sources rate the U.K. plant's capacity at 4.5 million lb/yr. The primary monomer used to polymerize PEEK (made for Victrex by LaPorte PLC) also faces capacity restraints.

After rising at an average 20%/yr during the 1990s, PEEK growth shot up 40% in 2000, and has remained at that rate, Jennings says. One reason is a leap in demand by semiconductor manufacturers, the largest market, where PEEK is used in fixtures, pipe, wafer-handling rings, and other components for wafer and chip manufacture.

Another growth driver, Jennings says, is surging demand for PEEK in energy-related applications. PEEK is used in downhole oil-drill parts and also in components of newer energy-saving models of compressors, generators, and heating and ventilation equipment.

Demand is also emerging in the nascent fuel-cell market, in which PEEK has potential as a membrane material. Victrex recently forged an exclusive agreement with Ballard Power Systems in Burnaby, Vancouver, B.C., to make two types of proton-conductive polymers that were jointly developed by the partners. Ballard is a leader in zero-emission proton-exchange membrane fuel cells intended for transportation and electricity generation. Victrex will build pilot plants for making the fuel-cell polymers.

Victrex PLC is planning a series of capacity expansions to ease the PEEK supply crunch. The initial phase calls for debottlenecking that would increase polymer and monomer capacity by 20% at Thornton-Cleveleys by late this year. Jennings says that would eliminate the current shortage. More debottlenecking next year would be followed by construction of a new plant at Thornton-Cleveleys by early 2003.

Other polyketone options

For PEEK users, help is on the way from other sources as well. Gharda currently operates a 120,000-lb/yr semi-works plant in Panoli, Gujarat, for polymerizing its version of PEEK. By August, that capacity will be doubled. Moreover, construction of a full-scale unit in Panoli is under way, with start-up scheduled for early 2003. Since Gharda's process is reportedly simpler and less energy consuming than Victrex's, and uses only one monomer that Gharda makes itself at Panoli, Gharda officials see potential to sell the resin at a lower price in the future.

Seeding U.S. markets with Gharda PEEK is the responsibility of JLM Marketing of Tampa, Fla. "Timing is right for the arrival of another PEEK supplier," says Jeff Ulbrich, sales and marketing v.p. at JLM's Performance Polymers & Chemicals unit. Most Gharda PEEK is going to compounders, especially compression molders.

Ulbrich says the Gharda process for making PEEK yields consistent powder forms that make the material highly processable. Properties are said to be comparable to those of Victrex PEEK resins. On the other hand, the Gharda material has a darker base color and relatively high sodium levels, according to some industry sources. According to Ulrich, these issues are natural artifacts of starting up a new process. "Significant improvement is being made by Gharda on a weekly basis," he says.

A second new option in polyketones surfaced a year ago with the creation of Oxford Performance Materials (OPM) by parent company Oxford Polymers. "We're primarily looking at markets in which PEEK does not perform as needed," says Scott DeFelice, OPM's president and CEO. His firm's Oxpekk PEKK compounds utilize copolymer base resins made by Cytec in West Patterson, N.J. Both crystalline and amorphous resins are used. The compounds are distributed by Infinite Polymer Systems, State College, Pa.

According to OPM, the glass transition temperature of its semi-crystalline version of PEKK is around 335 F, or 40° F higher than for PEEK. Other advantages are said to be a lower coefficient of thermal expansion and superior dimensional stability.

OPM plans to invest $3 million for dedicated PEKK compounding capacity and laboratory equipment for new applications work. The project is due to be completed late this year. Meanwhile, OPM is sampling a slate of PEKK compounds, including reinforced grades with 30% and 40% carbon or glass fiber. A filled compound, Oxpekk BG (Bearing Grade), is tailored to provide superior abrasion resistance for bearings.

No shortage of new uses

The pace of new applications development for polyketones remains high, stimulated by new base resins and higher-performance versions of existing compounds. In semiconductors, a recent introduction is E-grade Victrex PEEK, in which sodium residuals are reduced to about 25 ppm, a tenth of the levels for conventional PEEK. This reportedly provides the purity needed in wafer and chip handling systems, putting PEEK ahead of PPS in this regard and closing the gap versus fabricated Vespel polyimide thermoset shapes offered by DuPont Engineering Polymers, Wilmington, Del. Vespel shapes have negligible sodium levels, but cost more than PEEK and are less design-friendly.

Victrex shortly expects to introduce an even cleaner PEEK with sodium levels of around 10 ppm. This would open potential for replacing thermosets in semiconductor etch-chamber applications.

LNP Engineering Plastics in Exton, Pa., supplies a wide variety of PEEK compounds, including glass-reinforced and carbon-fiber reinforced conductive compounds. To support advances in PEEK resin cleanliness, LNP implemented its Clean Compound System (CCS), a program designed to sustain PEEK's purity through the supply chain, including compounding and packaging steps. Reinforcing fibers, for instance, are chosen to minimize particulation (i.e. creation of airborne devris) and optimize purity.

RTP Co. in Winona, Minn., has introduced versions of PEEK (and other polymers) that utilize carbon nanotubes as static-dissipative medium. These "nano-size" particles bring benefits to semiconductor applications, states Scott Koburna, product manager for conductives. He cites precise surface resistivity, superior ability to fill intricate parts, better surface properties, and reduced particulation.

Design innovation is also spurring the PEEK market. For instance, Entegris Inc. in Chaska, Minn., has developed an advanced handling system for semiconductors in which an RTP 2200 Series PEEK compound is overmolded on polycarbonate. The static-dissipative PEEK provides a grounding path, while also lining the PC carrier at points of contact between the wafer and equipment.

BP Amoco Engineering Polymers, Alpharetta, Ga., supplies Kadel polyketone compounds based on a polyaryletherketone (PAEK) resin made by another company. A spokesman reports strong growth in two areas. One is compressor valves, where carbon-filled Kadel is said to offer excellent dynamic fatigue resistance. The other is components for circuit-board manufacture, which use a modified, 40% glass-filled Kadel.

Related Content

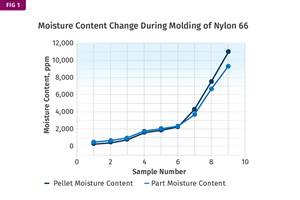

What's the Allowable Moisture Content in Nylons? It Depends: Part 2

Operating within guidelines from material suppliers can produce levels of polymer degradation. Get around it with better control over either the temperature of the melt or the barrel residence time.

Read MoreTracing the History of Polymeric Materials: Acetal

The road from discovery in the lab to commercial viability can be long, and this was certainly the case for acetal polymers.

Read MoreResins & Additives for Sustainability in Vehicles, Electronics, Packaging & Medical

Material suppliers have been stepping up with resins and additives for the ‘circular economy,’ ranging from mechanically or chemically recycled to biobased content.

Read MoreMelt Flow Rate Testing–Part 1

Though often criticized, MFR is a very good gauge of the relative average molecular weight of the polymer. Since molecular weight (MW) is the driving force behind performance in polymers, it turns out to be a very useful number.

Read MoreRead Next

Troubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreWhy (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read More