In-Mold Lamination: U.S. Auto Market Is Catching Up

Although more widely used in Europe, in-mold laminating is gaining a foothold in U.S. automotive interiors. Molders can choose from a handful of different process technologies that promise labor and other cost savings.

Low-pressure molding is the basis of several approaches to laminating fabrics or carpets onto a plastic substrate inside a mold. These in-mold laminating techniques, using molding pressures no higher than 1000 psi, are gentle to the laminate cover stock. The various process technologies utilize a diverse range of equipment, including horizontal and vertical injection machines with a range of clamp styles, as well as vertical compression presses with movable extruders to deposit the melt.

Why are in-mold laminating applications growing in automotive interiors? “Adding a laminate to what is normally a hard plastic shape can enhance its appearance and quality with a soft-touch feel, an aesthetic texture, or a durable carpet,” says Rahul Mukerjee, senior manager for advanced manufacturing engineering at Visteon Corp., Southfield, Mich.

Advantages of one-step in-mold laminating (or “back molding”) versus conventional post-mold lamination include the elimination of multiple process steps and use of messy adhesives, reduced labor and parts handling, and the achievement of a stronger melt bond than adhesives can provide. Ability to decrease clamp tonnage requirements relative to standard injection molding could allow use of smaller presses and provide other savings in machine construction. “The lower pressure eliminates the need for thick platens,” says Jim Moran, sales manager at Engel. Overall, machine suppliers estimate that their in-mold systems reduce production costs by 15% to 30% versus conventional methods.

In-mold laminating usually eliminates the need to preform the cover stock prior to bonding it to the rigid substrate. “Preforming may still be done with deep draws,” says Mark Kennedy, v.p. of Tier One molder Andover Industries in Troy, Mich. However, Kennedy says his company has in-mold laminated parts up to 7 in. deep without preforming the cover stock.

Molders should expect slightly longer cycle times for in-mold laminating. However they can be rewarded with a finished part right out of the mold. New in-mold cutting tools can eliminate secondary trimming of laminated parts, says Helmut Eckardt, technical director for low-pressure molding at Battenfeld Injection Molding Technology in Germany.

An exception is carpet laminating: The thicker material is difficult to cut cleanly in the mold. Post-mold trimming would still be required in most cases.

In-mold laminating is well established in Europe, where automotive molders are using it for door panels, consoles, instrument panels, glove boxes, knee bolsters, rear shelves, pillar covers, and trunk liners. “The benefits are proven in the field in Europe,” says Ralf Liese, general manager for Krauss-Maffei in the U.S.

The scenario is different here. “In the U.S., door trim is the dominant automotive application for in-mold laminating, but I am seeing more uses coming up,” says Jim Moran. “Emerging applications are arriving here for instrument panels, cockpits, and rear shelf trays. Anything below the headliner has become a potential opportunity for in-mold laminating over the last five years,” says Dave Dooley, senior engineer in the interior trim division at Lear Corp., Southfield, Mich. “There is also activity in pillars, which for American cars is a brand-new concept. Pillars have been laminated on European cars for many years now,” Dooley adds.

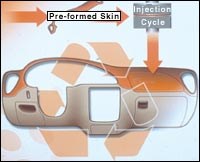

Visteon won awards from the SPE Automotive Div. in 2001 and from the Society of Automotive Engineers in 2002 for its fully recyclable instrument panel, which has a soft TPO skin laminated in-mold to the top section and a hard, internally colored polypropylene lower section. This instrument panel was a first for in-mold laminating in the U.S., says Mukerjee.

“Overall, there may be about 20 companies in the U.S. producing 85% of these large, flat, in-mold laminated parts,” says Mark Elsass, technical service supervisor with Milacron. Two Tier One molders, Andover Industries and Visteon, have devised their own approaches to in-mold laminating. Other North American automotive molders with experience in this field include Collins & Aikman, Delphi, Johnson Controls, and Magna.

Slow U.S. embrace

Why have U.S. auto makers been slow to embrace in-mold lamination technologies? “The reasons run the gamut from already having an established base of molders with secondary laminating capability to the economic climate that discourages large capital expenditures,” says Robert Eller, president of Robert Eller Associates, consultants to the plastics and automotive industries. Molders are also concerned that the technological learning curve may be long and that the process will require specialized or dedicated machinery. “In order justify the capital expenditure, molders in the past needed the promise of a long job run, or at least the knowledge of having another job waiting in the wings to utilize the capacity of the press,” says Eller.

Advocates of in-mold laminating say the climate has been improved by changes in substrate and cover-stock materials. A major factor is Detroit’s move away from ABS and PC/ABS substrates laminated to vinyl cover stock with urethane foam backing. The trend now is toward lower-cost polypropylene substrates and TPO cover stocks. “The main thrust behind this move is to address recycling issues,” says Lear’s Dooley. But the processing consequences are advantageous to in-mold laminating: “Molding the ABS backing requires higher temperatures and pressures than does PP,” Dooley notes. These process temperatures and pressures, as well as bonding issues, would create problems if a molder attempted in-mold laminating of a conventional ABS/vinyl structure. High injection pressures and temperatures for molding the ABS substrate could show through the cover stock.

In addition, Dooley says, “TPO material formulations have really improved in the last few years. In the past, TPO was poor in handling the stretching during back molding, but now it can handle sharp contours and high strains. In the future there will be many more TPO skin applications for interior trim programs,” he predicts.

Despite a slow start, there is evidence that in-mold laminating has started to take off in this hemisphere. U.S. moldmaker Delta Tool says it has built more than 50 molds for in-mold laminating in the past three years. Delta is the North American partner of Georg Kaufmann Corp., a Swiss toolmaker that was one of the first to get involved with in-mold laminating in Europe.

Closed or open mold?

As in-mold laminating gains momentum in North America, the available process technologies are proliferating. At least eight machinery makers—Battenfeld, Dieffenbacher, Engel, Husky, Ferromatik Milacron, Hettinga, Krauss-Maffei, and Ube—offer systems for in-mold laminating with modified versions of their equipment. Some of the new technologies can use conventional presses, so molders need not buy a dedicated machine. Milacron, for example, supplies off-the-shelf components that allow users to run at low pressure on a conventional press.

In-mold laminating techniques fall into two categories: either closed-mold or open-mold types. They can utilize injection, injection-compression, or compression molding.

“A lot depends on the geometry of the part, the thickness of the cover stock and the substrate, and other factors,” says Jeanine Hettinga, president of Hettinga Technologies, one of the first firms to commercialize a low-pressure molding process in the U.S. High injection temperatures and pressures can create a “sunshine spot” on the cover stock opposite the gate area, so the cover stock may require some type of scrim or barrier behind it.

That barrier can make the part more expensive, but it also gives molders more choice of the type of in-mold method they wish to use. A general rule of thumb, explains Lear’s Dooley, is that using a foam-backed cover stock without a barrier requires an injection/compression or open-mold process. “The foam of this bi-laminate (TPO skin and foam backing) would burn away if there were injection molded resin shot behind it,” says Dooley. If a tri-laminate construction (cover stock with foam and protective PP backing) is used, then any of the open or closed in-mold laminating approaches can be used.

Closed-mold techniques

Hettinga developed a closed-mold process called In-Molding that prevents damage to the laminate by precisely profiling injection parameters. In-Molding incorporates Hettinga’s Inverted Force Molding (IFM) technique, which profiles speed and pressure of the melt front as it enters the mold cavity. Hettinga’s IFM software controls injection pressure, speed, screw rpm, and backpressure in real time at over 4000 points in the process.

Hettinga has just come out with a special in-mold process that allows users to produce a part with up to three different cover stocks in one step. This Three-in-One process is aimed at side-door trim that has a soft-touch surface at the top of the panel, a decorative textile in the middle, and a carpet at the bottom. The process completely eliminates secondary operations and produces little scrap, says Hettinga. Proprietary aspects of the process prevent any shifting or movement of the different cover stocks during injection and generate a smooth, blemish-free part. Users are required to obtain a license for the specialized equipment.

Because of the low pressures involved, Hettinga also offers the option of in-mold laminating with the firm’s self-clamping mold that requires no clamp station. Small cylinders surrounding the mold provide closing pressure.

Ube’s Dieprest in-mold laminating process is a closed-mold injection-compression technique, which prevents damage to the cover fabric by precisely adjusting the spacing between the mold halves during molding. The system features unique clamp-position control and a special mold design. Ube’s Multi-Step Clamp Control first injects the melt under low pressure into a partially open mold cavity, which is then closed in a compression step. Dieprest then adds another step—opening the mold a small amount after compression. “This helps ease the pressure on the cover stock to prevent surface damage and allows the skin material to recover to its original surface condition,” says Jason Forgash, technical manager. “The opening step is extremely useful when a foam backing is used, as it will not crush the foam.”

Ube offers Dieprest technology on its line of toggle-clamp machines in either hydraulic servo-valve or electric servo-motor models. “Control of the mold gap is very important,” says Forgash. “If the gap is too small it can ruin the skin surface, and if it’s too large it could cause material-distribution problems.” Ube sources say the extremely high precision of electric servo drive is advantageous in Dieprest molding. Dieprest reportedly can preserve the cover stock’s foam-backing layer at 70% of its original thickness in the finished part, compared with only 15-28% of original thickness when a conventional molding system is used.

Ube offers the process in a C-mode, in which the mold is partly open during injection and decompression, and a P-mode, in which a shear-edged tool allows the mold to remain sealed throughout the process, with clamp motion merely changing the effective volume of the cavity. The C-mode can handle cover stock with a foam layer or relatively thick sheet. Dieprest P-mode is suited to jobs using thinner fabrics and non-wovens. Ube says Dieprest does not add to existing cycle times. “Users can change from Dieprest to conventional molding with a flip of a switch,” adds Forgash.

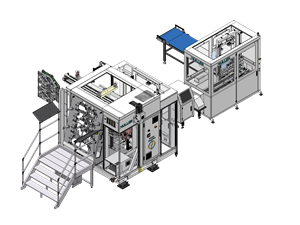

Controlled Pressure Injection Molding (CPM) is a low-pressure, closed-mold technique developed for horizontal injection presses by Andover Industries, a Tier One supplier to DaimlerChrysler, Ford, and GM. The company purchased low-pressure molding equipment in the 1980s, but years of proprietary process improvements since then have led the company to design and/or build its own machinery and specialized controllers. Andover’s system uses Milacron machines modified for faster production of large laminated parts. The system uses a pair of two-platen clamps served by a single injection unit on a turret. “We didn’t want to have material burning up in the barrel while waiting for the molded part to cool, so we designed the injection unit to service two clamps,” says Kennedy. Separating the injection unit from the clamp was a big design break. “We can mate a wide-platen clamp with a smaller injection unit for better control.”

The cover stock is placed in the mold cavity by a robot and held in place with clamping brack ets. The brackets are mounted on the exterior of the mold, so extra laminate material is needed. “Some secondary trimming is required; however, bonding the cover stock and substrate in the mold results in a better laminate while eliminating the use of adhesive,” says Kennedy. In order to achieve consistently tight process control, Andover focused on digital control of screw position during injection and on valve gating. Andover uses standard 3-mm cover stocks with a barrier layer to protect the “show side” from the molten plastic.

Andover has used this approach to mold interior-trim parts as large as 40 x 36 in. and up to 7 in. deep. Door panels, knee bolsters, claddings, and seat backs are some of the parts made with CPM. “We produced several million parts for GMC’s large truck program, including the Tahoe, Escalade, Yukon, and Denali,” Kennedy says.

Battenfeld demonstrated its patented IMCmore cell for in-mold laminating at last year’s K 2001 show in Germany. This closed-mold process eliminated secondary trimming by means of a laser that cut a pattern from a roll of textile cover stock. A Battenfeld robot placed the fabric in a shear-edged mold from Summerer Technologies of Rimsting, Germany. The fabric was clamped in place by a special device that ensured exact positioning. The modified Battenfeld HM-series hydraulic press had a second injector that molded a TPV sealing lip. A cutting mechanism inside the mold trimmed off any excess material.

Visteon developed its own process, dubbed Visteon Laminate Insert Molding (VLIM), to produce auto-interior parts. “We have used VLIM for door panels for nearly a decade, but most people aren’t aware of our patented instrument-panel LIM process,” says Mukerjee. VLIM operates with a vertical injection-compression system, which injects while the mold is partially open to keep pressures on the part low. Visteon’s award-winning instrument panel was produced with VLIM on a conventional press with specialized tooling. Visteon also developed a negative forming method that preforms the cover stock, imparts a grain to it, and trims it to size.

Milacron and Husky both offer conventional horizontal injection systems capable of low-pressure molding. Servo-valves, position transducers, and high-performance controls reportedly allow the machines to be used for injection-compression or standard injection.

Open-mold approaches

Three companies offer open-mold approaches to in-mold laminating. Benefits are said to include absence of molded-in stresses and weld lines.

Engel’s vertical-clamp Tecomelt process allows for insert molding, which can further reduce downstream operations. The injection unit continuously extrudes a ribbon of melt through a special deposition head onto the lower mold half. Servo drives control head movement in x, y, and z axes for consistent melt distribution. The melt is extruded under 800-psi pressure and is molded under low pressure with Engel’s bridge-type hydraulic clamp. The system uses high-resolution position transducers for clamp positioning. Engel’s robotic automation is integrated into the machine for smooth and accurate positioning of inserts. A horizontal version of Tecomelt is also available with standard or tiebarless presses.

According to Engel’s Moran, “We have supplied all but one of the commercial in-mold laminating applications done on a vertical machine in North America. Tecomelt makes up 5-7% of our business.”

Dieffenbacher, a maker of vertical compression presses, developed its Melt Compression Molding technology originally for molding auto-exterior parts with fiber-reinforced substrate backing. It has a movable extruder that feeds melt through a slot die onto the lower mold half of the open press. The extruder die then retracts from the press, and cover stock is deposited in the cavity manually or robotically. Then the part is clamped under low pressure. “This system can produce up to four parts per cycle and leaves a consistent soft-touch effect, even on large parts,” says Manfred Bruemmer, sales manager.

Krauss-Maffei’s Decoform process is an injection-compression approach suited to use on horizontal injection presses. It requires adding special software to a conventional machine, according to technology v.p. Paul Caprio. The cell features an integrated robot that inserts the cover stock and removes finished parts from the mold.

Ins & outs of processing

Heat is one consideration in making the choice of process, Moran points out. “There are issues related to heat in the gate area and its effect on the cover stock. How long will the cover stock be exposed to the heat of injection, and what is the effect of injection speed—fast or slow—on the skin? Sequential valve gating may help reduce heat issues, but it creates a risk of folds because the skin is stretched during filling. Engel has done extensive research on this topic.”

Moran points to cooling as another critical concern. “The cover stock acts as an insulator. So the trick is to get effective cooling in the mold in order to keep cycle times down.” Lear’s Dooley concurs: “You have to ‘tune’ your cooling water so as to equalize the heat-transfer rate throughout the mold. The main thing is to eliminate the potential for part warpage due to the imbalanced cooling effect in the mold caused by the cover stock.”

Rob Esling, Delta Tool’s sales and marketing manager, makes some other points about tool design for in-mold laminating. “You have to eliminate sliders or lifters, which can cause witness lines on the surface of the part.” And putting a cover stock on the cavity side of the mold means that all other functions, including hot-runner manifolds and the valve gate system, must be located on the core side.

Related Content

Completely Connected Molding

NPE2024: Medical, inmold labeling, core-back molding and Industry 4.0 technologies on display at Shibaura’s booth.

Read MoreNew In-Mold Labeling System Launches at K 2022

Muller Technology’s IML production cell will produce a round container in an 8-cavity mold with vison inspection and downstream automation.

Read MoreNew In-Mold Labels Enhance Recycling of PP Containers

New PP IML labels from MCC Verstraete separate from PP containers during mechanical recycling to preserve the color and transparency of the container resin.

Read MoreBorealis and Bockatech Showcasing Ultra-Lightweight Reusable PP Cups

Use of Borealis PP and Bockatech’s EconCore next-generation foaming technology yields thin-wall, robust and fully recyclable cups.

Read MoreRead Next

How Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read More