Prices Up for PE, PP, PS

An upward pricing trajectory could be short lived. PVC and PET prices are flat or lower.

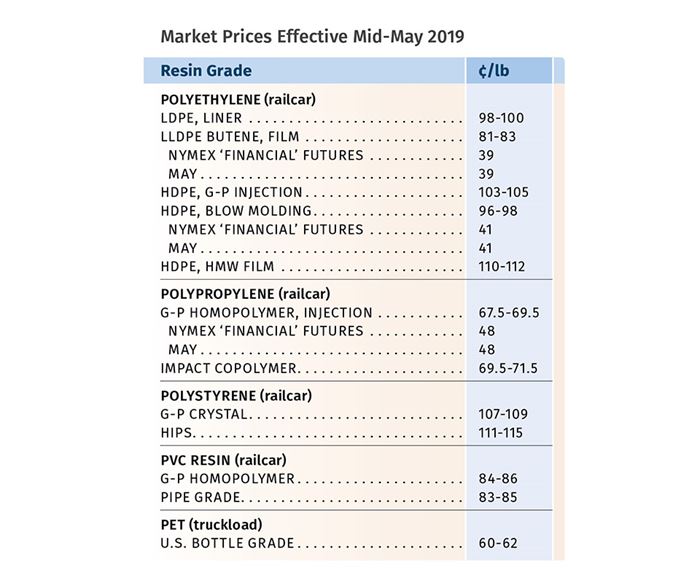

“May Day” arrived with price increases underway for PE, PP, and PS, and softening for PVC and PET. While higher global oil prices may have supported some price initiatives, domestic market fundamentals weighing against higher prices included ample resin supplies, relatively sluggish demand and, in most cases, lower feedstock costs.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas; senior editors from Houston-based PetroChemWire (PCW); and CEO Michael Greenberg of The Plastics Exchange in Chicago.

PE PRICES UP

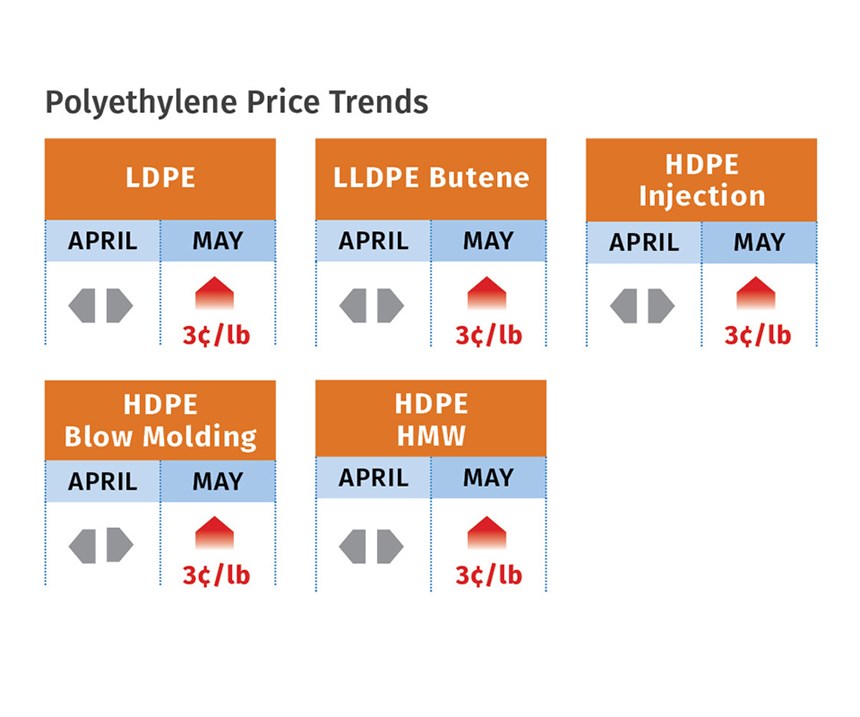

Polyethylene prices were reported to have been mostly flat in April, but in early May they moved up 3¢/lb. Said Mike Burns, RTi’s v.p. of PE markets, this hike succeeded while global oil prices were at a six-month high and global ethylene prices were at a four-month low. He noted that supplier inventories in March grew by 117 million lb, with no reported unplanned shutdowns in PE production.

Looking ahead, both Burns and PCW senior editor David Barry noted that suppliers’ record-high resin inventories could serve to keep prices flat. Said Barry, “There is a lot of resin around and this is still a buyers’ market and will be more so as the year progresses.” All sources noted that that spot PE prices moved up in April by at least 1¢/lb. Burns noted that the delta between contract and spot prices, which is typically around 4¢/lb, stood at closer to 10¢/lb in April. The Plastics Exchange’s Greenberg reported, “Spot polyethylene trading activity was very good as April marched on. Completed volumes were a bit above average as buyers, feeling that prices were starting to tick higher, came looking for deals. HDPE and LLDPE film resins added a half-cent, while LDPE for both film and injection and LLDPE for injection were all up a full penny. Prompt availability tightened as resellers’ inventories have thinned, and some suppliers withheld offers in anticipation of a better selling environment in May.”

The strength of domestic demand by the end of April was unclear. Said PCW’s Barry, “Domestic demand indications were mixed—some market sectors were reporting that demand was below expectations but by no means bad.” He noted that recent PE capacity additions continued to be felt most acutely in the film sector, an arena for ongoing market-share battles. Higher oil prices and the resulting upward pressure on international naphtha-based PE values were seen as the primary driver for the domestic PE contract increase. In contrast, exports were very clearly on the rise, and Greenberg reported that they now have reached 33% of all U.S. PE sales—a trend that will continue to grow and remain crucial to soaking up new production that will come online.

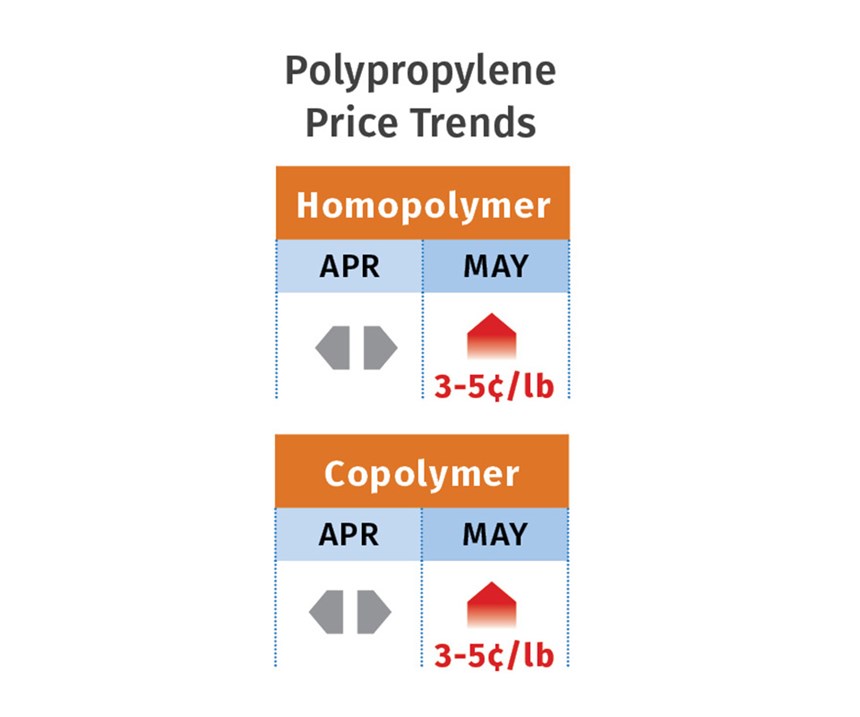

PP PRICES BOTTOM OUT

Polypropylene prices held even for a second month in April, but change was on the horizon come May. Both Scott Newell, RTi’s v.p. of PP markets, and PCW’s Barry saw PP prices bottoming out and ventured that May PP prices had potential to move up 3-5¢/lb. This was driven solely by upward movement in spot propylene monomer—moving from a low of 35.5¢/lb to 38.5¢/lb. Said The Plastic Exchange’s Greenberg, late-settling May monomer contracts were likely to rise by as much as 5-6¢/lb,

Barry reported that PP spot prices were up 1-2¢/lb by the end of April and demand began to pick up with news of higher propylene monomer spot prices. That uptick made it clear that PP contract prices would rise in May. PP supply was balanced to snug. While some suppliers were dealing with planned and unplanned maintenance outages, others were reported to be regulating output to avoid building inventory. Said Barry, “The feeling about PP demand is rather bullish for the second quarter.”

Newell noted that by early May it was still not clear whether domestic demand had strengthened. “Demand has been struggling all year. One variable was strong PP imports—most were higher priced than current domestic PP, but domestic processors that had committed to these import purchases did so in late fourth-quarter 2018, when domestic PP prices were very high.”

Yet another variable these industry pros are watching is higher oil prices. Newell observed, “There is plenty of monomer and PP resin inventories, so it’s hard to know if this upward pricing movement has any legs.” Industry rumors had it that some suppliers would be issuing price-increase letters and it was unclear if a margin expansion would be included. Said Newell, “I just don’t see the market fundamentals supporting a margin increase.”

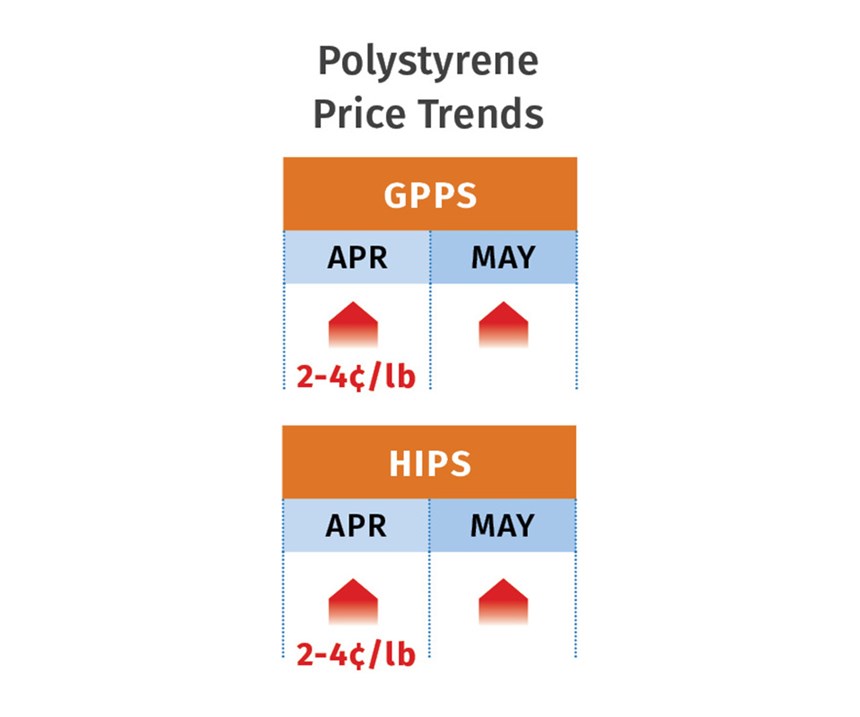

PS PRICES UP

Polystyrene prices moved up 2-4¢/lb in April, depending on contract terms, following a 2¢/lb increase in March, according to both PCW’s Barry and Robin Chesshier, RTi’s v.p. of PE, PS and nylon 6 markets. Barry reported that nominal styrene monomer cost, based on a 30/70 spot ethylene/benzene formula, moved to 26.3¢/lb by April’s end, up from 23.7¢/lb the previous month. He reported that there were indications that the higher prices were impeding April sales and driving an uptick in import business

Both industry pros said that PS suppliers were aiming to get 4¢/lb, but processors were pushing back, noting that feedstocks had not risen as much. Suppliers, in turn, said that part of that increase was due to the Ohio and Mississippi Rivers flooding, which required moving more material via trucks, which increased logistical costs, according to Chesshier. She noted that May will be “interesting,” as the flooding has subsided, benzene prices dropped after a brief spike in response to oil prices, and seasonal domestic PS demand was good. She added that industry figures for March showed PS plant utilization rates dropping under 70%, a rare occurrence, while demand remained on a normal pace. Still, she said it would not be a surprise to see suppliers attempt yet another increase in May.

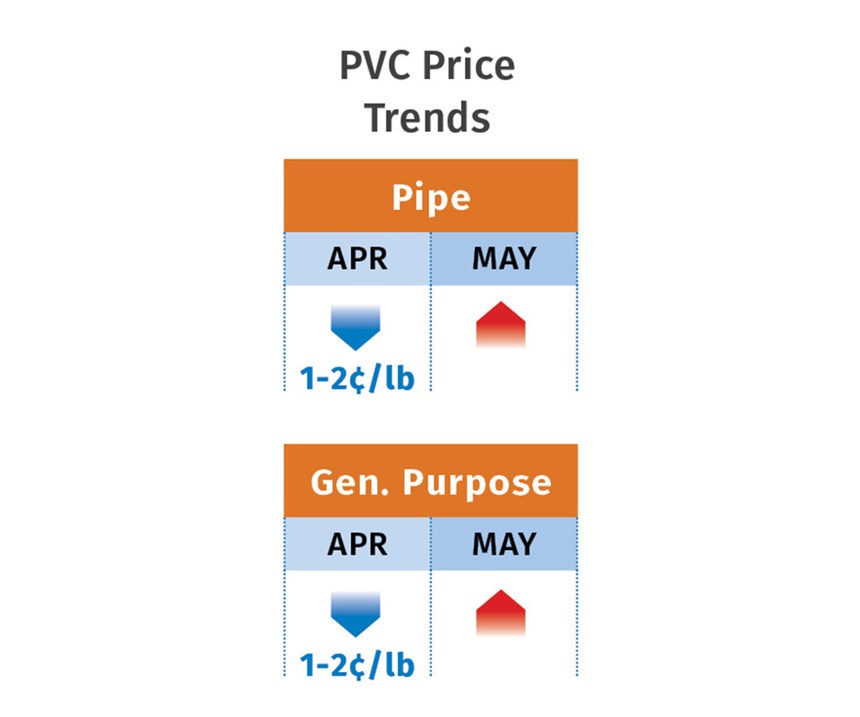

PVC PRICES FLAT TO DOWN

PVC prices by the end of April appeared to be flat to slightly down. PCW senior editor Donna Todd reported that one industry pundit was predicting a drop of 2¢/lb by April’s end, twice as much as previous predictions. “Were this to take place, it would wipe out the 2¢/lb hike implemented in February,” she reported.

Mark Kallman, RTi’s v.p. of PVC and engineering resin markets, considered a 2¢/lb reduction unlikely, but ventured that prices in April would be flat to 1¢/lb lower. He said production was up 12% in March, while domestic demand dropped 2% month-over-month. At the same time, export prices fell again, as did ethylene monomer prices for the fourth consecutive month. “Nothing in this picture supports a 2¢/lb increase that has been sought by suppliers for the last couple of months,” Kallman stated. He noted that domestic demand in construction, which got a late start this year, was starting to improve in May. He added that if prices went down in May by 1¢/lb or so, June and July might see some upward movement based on improving domestic demand, so prices would inch up by the third quarter, though low ethylene prices are likely to continue.

PCW’s Todd reported that ethylene contract prices dropped by 7¢/lb from last October through March. Moreover, industry statistics show that domestic PVC sales in March dropped by 14.2% year-over-year, while export sales were up by 15.8%. Todd said market watchers were expecting to see similar if not worse figures for the month of April.

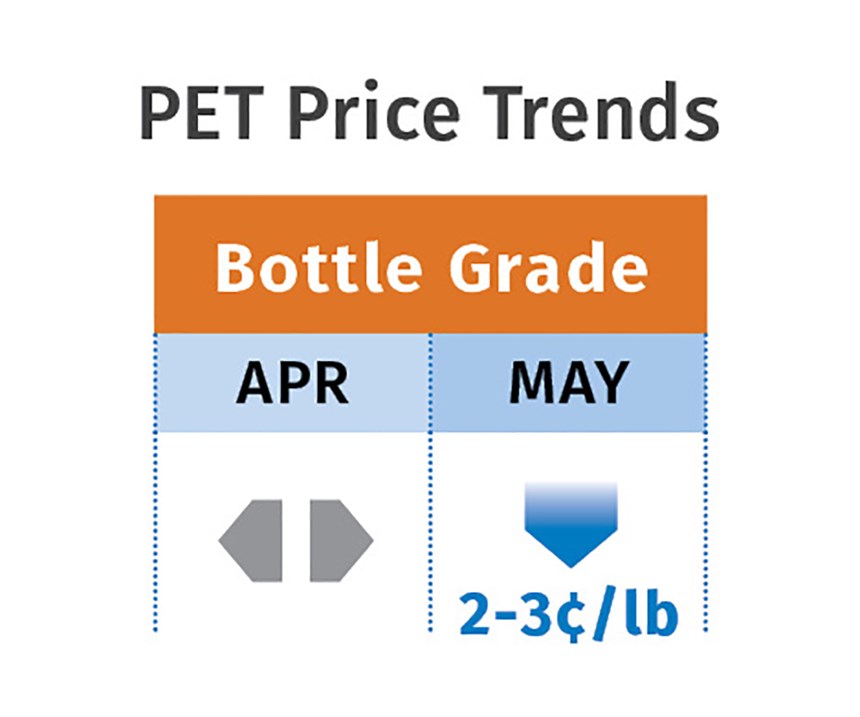

PET PRICES DOWN

Prices for domestic bottle-grade PET ended April unchanged from late March at about 60¢/lb railcar delivered Midwest. The price rose 3-4¢/lb during the month on normal seasonal demand, according to PCW senior editor Xavier Cronin. Prices for May are expected to drop 2-3¢/lb, driven by oversupply of domestic and imported PET.

Cronin cited one factor: “This is mainly driven by lower paraxylene prices caused by huge capacity coming on in Asia.” Other reasons include rising PET imports from 14 countries, including Vietnam, South Korea and South Africa; and increased use of recycled PET in food-grade bottles, containers and packaging. Cronin ventured that PET prices for June are likely to remain flat or fall slightly as oversupply keeps this as a buyers’ market, despite the arrival of the warm-weather heavy consumption period for beverages in PET bottles.

.

Related Content

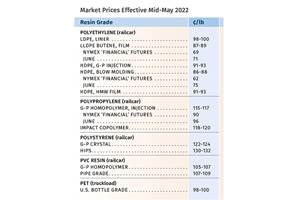

Mixed Pricing Outlook for Commodity Resins for Spring 2022

Prices of PE, PS may have peaked; they were slightly down for PP and PET, up for PVC.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MorePrices of the Five Commodity Resins Largely Flat

While price initiatives for PE and PVC were underway, resin prices had rollover potential for first two months of 2024, perhaps with the exception of PET.

Read MoreVolume Resin Prices Move in Different Directions

PE, PP, PVC, and ABS prices slump, while PS, PET, PC, and nylons 6 and 66 prices rise.

Read MoreRead Next

Why (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read More

.png;maxWidth=300;quality=90)