Total Mold Business Index for May 2005: 50.4

Activity levels for North American mold makers were mostly better in recent weeks, but supply-related issues (materials prices and supplier delivery times) were also more pronounced.

Activity levels for North American mold makers were mostly better in recent weeks, but supply-related issues (materials prices and supplier delivery times) were also more pronounced. Based on the latest survey for our Mold Business Index (MBI), the MBI value for May is 50.4. This represents a modest 0.8 percentage point decrease from the April value of 51.2. The New Orders, Production, and Employment sub-indices all advanced in the latest month. On the negative side, there was another strong rise in Materials Prices, and Supplier Delivery Times were longer. The Future Expectations sub-index escalated to a value of 72.4.

The Mold Business Index is based on a monthly survey of North American mold makers. Mountaintop Economics & Research, Inc. conducts the survey, and then calculates a diffusion index based on 50.0. A value above 50.0 for the MBI indicates that business activity expanded in the previous month, while a value below 50.0 means that business levels declined.

The latest sub-index value for New Orders of molds is 56.6, which means that the number of new orders was higher when compared with the previous month. The predominant trend in new orders recent months has been a gradual rise, and continued improvement in this component is necessary to generate consistent gains in the other components. Production activity in May also increased, as the latest Production sub-index is 57.9.

The Employment component for May is 53.9, which indicates that the total number of workers in the industry increased again during the past month. The industry's total backlog was steady-to-down, as the May Backlog sub-index is 48.7. The number of offshore orders for new molds was also steady-to-down last month. The Export Orders sub-index is 48.7.

The Mold Prices sub-index for May is 53.9. This means that prices for new molds were up a bit when compared with the previous month. But at the same time, the prices paid for materials also continue to rise, as the latest sub-index for Materials Prices came in at 75.0. Supplier Delivery Times were longer, with this sub-index posting a value of 36.8 in the latest month.

The Future Expectations sub-index for May indicates that mold makers are more optimistic than they were the month before. The latest value is 72.4. The rising optimism was matched by a small, but noticeable increase in the reported aggregate capital investment plans for the future.

The most-cited problem confronting North American mold makers at the present time is short lead times. It should be noted that for the first time in many months, foreign competition was not the most-cited problem. Other problems receiving multiple mentions were: offshore competition; the soaring costs of materials, healthcare, and energy; less favorable payment terms; and ill-conceived U.S. trade policies.

Our forecast calls for gradually rising activity in the plastics manufacturing and tooling industries throughout the remainder of 2005. This will result in a continuation of the overall trend in the MBI data, which has registered a gradual but steady gain. Plastics processors are still in a cyclical upturn in spending on new capital equipment. This combined with the continued rise in overall spending on industrial equipment in the U.S. indicates that the demand for new molds will remain in a gradual uptrend for the foreseeable future. Most of the major economic indicators suggest that plastics manufacturing levels in the U.S. increased modestly in recent weeks, and the U.S. economy's crucial leading indicators are still in a sustainable growth phase.

This means that our Injection Molding Business Index should continue to expand during the next few quarters. Following a gain of 3% in 2004, this Index is forecast to increase 5% in 2005. Consistent gains in the Mold Business Index depend on sustained growth of 4% to 5% in the output of injection molded products. The trend in the mold making industry also lags the trend in the processing sector by about six months. So as demand for molded products expands in the coming months, orders for new molds will continue to rise.

| Mold Business Index May 2005 | |||||

New Orders Production Employment Backlog Export Orders Supplier Deliveries Materials Prices Mold Prices Future Expectations | % Positive 40 37 24 29 0 0 50 24 55 | % Equal 34 42 60 39 97 74 50 60 34 | % Negative 26 21 16 32 3 26 0 16 11 | Net % Difference 14 16 8 -3 -3 -26 50 8 44 | Sub Index 56.6 57.9 53.9 48.7 48.7 36.8 75.0 53.9 72.4 |

| The total Mold Business Index is a weighted average of the Sub-Indices for new orders, production, employees, backlog, exports, and supplier deliveries. | |||||

Read Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

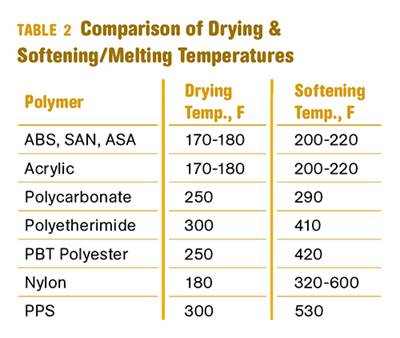

Read MoreWhy (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More