Your Business Outlook - September 2002

Dry-Food Film Wraps Are Recession-Proof

The state of the economy has little effect on the market for dry-food packaging.

The state of the economy has little effect on the market for dry-food packaging. It’s basically recession-proof. A slow economy can even be helpful to packaging makers, as people eat out less and stay closer to home.

Mastio & Company forecasts a 4% average annual growth rate for polyethylene films used in dry-food packaging through 2006. PE resin consumption in that market will reach 1 billion lb, up from 830 million lb in 2001. PE films for dry-food packaging represent 27% of the total consumer packaging market. Four end-use markets make up the dry-food category: candy, snack foods, baked goods, and carton liners and slug wrap. Baked goods are the largest segment, representing approximately 50% of the total. Next largest is carton liners and slug wrap at 25%, followed by snack foods and candy.

Though it’s the smallest segment, candy wrap has the fastest growth potential—about 7% a year through 2006. Carton liners and slug wrap are estimated to grow at an average annual rate of 5%, while snack-food gains of 4%/yr are expected. Baked-goods packaging, though the largest segment, will have the slowest annual growth—around 3% through 2006.

Society in the fast lane

The upsurge of single-parent and dual-income families results in less time for food preparation. Today’s hectic lifestyles and demand for convenient, ready-to-eat foods are positive factors for dry-food PE film packaging. More consumers are looking for prepackaged foods that require no preparation, such as individually wrapped cereal bars, donuts, chips, and breakfast pastries.

| Top Five Producers of PE Film for Dry-Food Packaging | ||

| 1998 Printpack, Inc. Huntsman Packaging Corp. Bemis Co., Inc. American National Can Co. Polystar Packaging, Inc. | Rank 1 2 3 4 5 | 2001 |

Growing popularity of resealable, easy-open, stand-up pouches has given a boost to this market. Pouches with zippers and sliders are now common for baked goods and snack foods such as nuts, cookies, and crackers. Candy, pet treats, and tuna are also popular foods taking advantage of the craze for reclosable stand-up pouches. Barrier films are important to the baked-good segment, as they maintain product freshness longer.

A negative factor for PE films is growth of thermoformed rigid trays for dry-food items such as Frito-Lay’s snack kits, which include Ruffles potato chips with French onion dip in a heat-sealed tray.

LDPE dominates

Although many dry-food packages require several layers of different resins and materials to guarantee freshness and quality, LDPE is the most-utilized PE resin in this market. LDPE film accounts for a little over 50% of total PE resin in this sector because it provides strength, gloss, flexibility, and the highest clarity. LDPE resins usually have higher clarity than LLDPE, though some LLDPE is often blended with LDPE to improve strength and allow for downgauging.

Though HDPE resins have a cloudy appearance, they are occasionally utilized for baked goods and candy wrap due to their strength and barrier properties. Furthermore, HDPE is the most commonly used resin for carton liner and slug-wrap film because of its excellent seal strength and barrier properties.

Mastio & Company, based in St. Joseph, Mo., is a well-known consulting firm specializing in industrial-consumer opinion research and market trends in the plastics industry. For more information, call (816) 364-6200 or visit www.mastio.com/pt/outlook.html.

Related Content

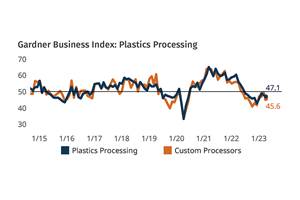

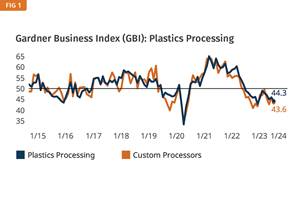

Plastics Processing Continued Contraction in April

Despite some index components accelerating and others leveling off, April spelled contraction for overall plastics processing activity.

Read MorePlastics Processing Continues to Contract

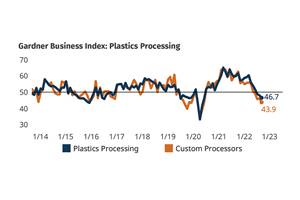

The September Index signaled a second month of declining activity for plastics processors overall, while custom processors fared even worse.

Read MorePlastics Processing Contracts Again

October’s reading marks four straight months of contraction.

Read MorePlastics Processing Business Index Contracts Further

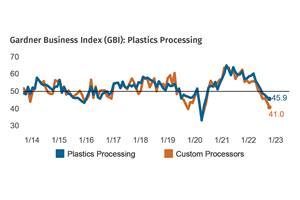

All components dip as index hits low point of 2023.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE 2024.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More