Wood On Plastics: Packaging: Growth Leader in 2011

Each quarter, the SPI’s Committee on Equipment Statistics and Processors’ Council survey their respective members and ask them to forecast future growth for the major end-markets for plastics.

Each quarter, the SPI’s Committee on Equipment Statistics and Processors’ Council survey their respective members and ask them to forecast future growth for the major end-markets for plastics. The detailed results from these surveys are usually available only to the groups’ member companies, but I can report that the end-market that has consistently ranked at the top of the list (usually by a wide margin) in recent quarters is packaging.

This will come as no surprise to readers of this magazine, or really to anybody who is involved in the plastics industry. Stories about the positive developments in plastics packaging are being reported at a furious and accelerating frequency. Of course, so are the negative stories about problems involving bans on products such as plastic bags, BPA, and PVC.

For most consumers, packaging represents their closest and most frequent interaction with the plastics industry. Durable goods such as automobiles, electronics, and appliances may be the sexiest markets and grab the biggest headlines, but it is non-durable goods—food, beverages, shampoos, soaps, detergents, and medications—that most affect our daily lives. Even in uncertain economic times like these, the packaging industry is widely considered the sector that will enjoy the strongest growth in coming months.

Economic data corroborate this forecast. Because plastics packaging is such a large and diverse sector, it is necessary to analyze more than one data series in order to get a sense of the trend in overall market demand. A couple of readily available data series have historically demonstrated a close correlation with packaging demand.

One of these is the growth in total U.S. retail sales, minus autos. So far in 2010, the gain in total retail sales has been about 6%. Receipts for food, beverage, and health and beauty products have grown at a solid pace, but one of the fastest growing segments this year has been electronic shopping and mail-order houses. So for a growing number of retail products, packaging needs are increasingly driven by shipping issues such as weight and protection from damage during handling, and are less focused on “shelf appeal.”

Another data series that demonstrates the direction of the tide in consumer demand for packaged products is the quarterly series that measures total profits in the food and kindred products industries. Total real consumer spending on food and beverage products is not very volatile, and it has expanded an average rate of 1% to 2% annually over the past 10 years. But since the middle of the last decade, the rate of growth in profits for this industry has been better than 6% a year on average.

It is particularly impressive how quickly profit levels in the food industry have recovered after the recent recession and despite rising energy costs. One of the primary reasons for this robust profit growth has been advances in food packaging technology during this time. Profit levels ultimately drive research, innovation, marketing, and investment in products, and plastics packaging products have been an important part of some of the biggest developments in the food industry in recent years. Business owners and managers are taught to follow the money, and there should be little wonder why recent survey respondents have been optimistic about the future of market demand for plastics packaging.

WHAT IT MEANS TO YOU

- Sustainability and being “green” are still driving concepts in the marketing and packaging strategies for most consumer non-durable products.

- Rising prices of feedstocks and finished materials have made the idea of recycling economical once again. Plastics packaging products are on the front line of the burgeoning recycling debate.

- Be assured that the time is rapidly approaching when it will no longer be economically viable to use petrochemical feedstocks for packaging applications.

About the Author

Bill Wood, an economist specializing in the plastics industry, heads up Mountaintop Economics & Research, Inc. in Greenfield, Mass. Contact BillWood@PlasticsEconomics.com.

Related Content

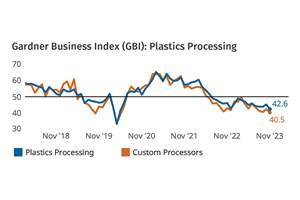

Plastics Processing Activity Drops in November

The drop in plastics activity appears to be driven by a return to accelerated contraction for three closely connected components — new orders, production and backlog.

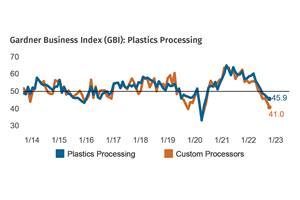

Read MorePlastics Processing Contracts Again

October’s reading marks four straight months of contraction.

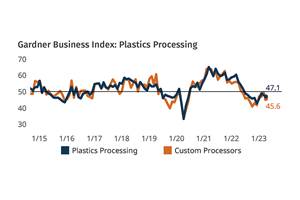

Read MorePlastics Processing Continued Contraction in April

Despite some index components accelerating and others leveling off, April spelled contraction for overall plastics processing activity.

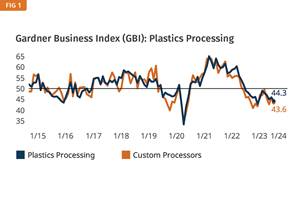

Read MorePlastics Processing Business Index Contracts Further

All components dip as index hits low point of 2023.

Read MoreRead Next

Advanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More