Wood on Plastics: Short-Term Gain But Long-Term Pain in Medical?

Though alive and kicking, the future of the medical market is fraught with uncertainty.

For a few years now, I have waxed enthusiastically about the rapidly growing need for medical equipment and supplies, and all the opportunities this market held for processors. My previous predictions about the future of this market were based on the hypothesis that people tend to consume more medical products as they get older, and that the largest age group in the U.S. and Europe—the Baby Boomers—was steadily advancing towards its Golden Years. This fact, combined with the notion that President Obama’s new healthcare program would soon add another 40 million previously uninsured Americans as “customers,” all but convinced me that this would be a growth industry for years to come.

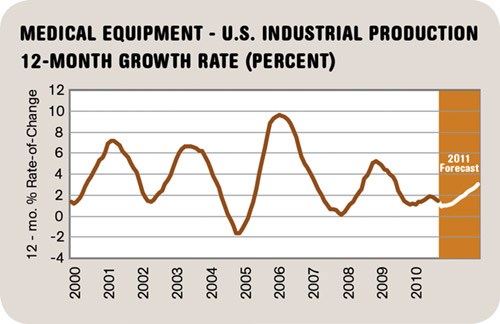

So far the data support this theory. The growth rate in U.S. production of medical equipment and supplies in recent years has been consistently positive. The average annual growth rate over the past decade has been a healthy 3%. Except for a brief dip in 2004, the industry has grown every year. In 2010, the rate of expansion slowed to 1%, but our forecast calls for a gradual acceleration in output, returning growth to the 3% range this year.

Nonetheless, the long-term outlook for the U.S. medical industry is fraught with uncertainty. There will be plenty of customers to be sure, but unless some drastic changes are made soon, there won’t be any money to pay for medical products. That is because Medicare in its current form is unsustainable.

A quick look at the facts is sobering. The U.S. federal government currently runs an annual budget deficit of well over $1 trillion. To make up for this shortfall, the government borrows money by selling Treasury notes. The biggest budget items for the federal government (far bigger than the military, earmarks, and bureaucrats’ salaries) are Social Security and Medicare. So the government is already running a huge and unsustainable deficit, and as the Baby Boomers retire, this deficit will only get larger.

Medicare and Social Security are not paid out of a savings account that each of us pays into while working. Every penny of what we workers currently pay into the system, and then some more that is borrowed, is already being spent on the current group of beneficiaries. Medicare currently covers 46 million seniors and disabled people. For every one person receiving benefits, there are 3.5 workers paying into the system. Consider that a couple with a combined yearly income of $89,000 who retire in 2011 will have paid $114,000 in Medicare taxes during their lifetimes, but will expect to receive $355,000 worth of Medicare benefits, on average, before they die.

What makes this an even bigger problem is that by the time the Baby Boomers have all retired, there will be 80 million people expecting benefits, and the number of workers paying into the system will shrink to 2.3 per beneficiary ... a recipe for disaster.

But regardless of how we respond to this problem, one thing seems certain: We will have less money to spend on medical products in the future than we are currently spending, regardless of the number of “customers” who want or need these products.

WHAT THIS MEANS TO YOU

•Whether you are already manufacturing medical products or plan to, make sure you understand who your real customer is and the risks to its revenue stream. (Who ultimately pays for your product?).

•Diversify your product line to mitigate future risk. Set aside some of your profits for the long-term, and do not become over-leveraged trying to chase the “hot” market. (This is sound advice no matter what industry you are supplying.)

Related Content

As Currier Grows in Medical Consumables, Blow Molding Is Its ‘Foot in the Door’

Currier Plastics has added substantial capacity recently in both injection and blow molding for medical/pharmaceutical products, including several machines to occupy a new, large clean room.

Read MoreUse Cavity Pressure Measurement to Simplify GMP-Compliant Medical Molding

Cavity-pressure monitoring describes precisely what’s taking place inside the mold, providing a transparent view of the conditions under which a part is created and ensuring conformance with GMP and ISO 13485 in medical injection molding.

Read MoreCatheter Specialist Finds Sweet Spot Serving Small, Medium-Sized Concerns

Medical-component specialist LightningCath has carved a niche meeting the needs of small to medium-sized entrepreneurs with complex catheter designs … quickly.

Read MorePlastic Compounding Market to Outpace Metal & Alloy Market Growth

Study shows the plastic compounding process is being used to boost electrical properties and UV resistance while custom compounding is increasingly being used to achieve high-performance in plastic-based goods.

Read MoreRead Next

How Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read More