Full Supply-Chain Involvement Needed to Drive Recycling Growth

China, new global regulations, and consumer brands’ demand … the U.S. recycling industry is very much in a period of transition. But the potential is massive.

Recycling isn’t just a feel-good endeavor, it’s a real business. And everyone in the value chain has a role to play to improve recycling. Kim Holmes, V.P. of sustainability for Plastics Industry Association (PLASTICS) in Washington, D.C., believes that the recycling industry in the U.S. is in a period of transition, and China is just one contributing factor. “It’s a large one, but the industry was already responding to effects of sustained low prime-resin pricing due to increased prime production and low-cost chemical building blocks,” she says. “This had affected overall demand for recycled content, but we are seeing new commitments to using recycled content, which is reversing that demand trend.”

The potential to use recycled plastics in manufacturing is massive. After all, the U.S. plastics industry produces nearly $400 billion in products. Using recycled plastics presents a big opportunity across the supply chain.

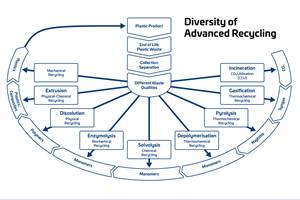

“I believe brand owners and others in the industry are realizing that the traditional mechanical recycling model has limitations,” she says. “In order to meaningfully drive use of recycled content forward, we need new technologies and methods in our toolbox.”

Technology Advances

Brand owners and retailers play a huge role, but so can the other players in the supply chain. “Material suppliers are exploring offering grades of recycled-content resins for their customers,” Holmes says. “That could absorb a huge volume of recycled materials if they are successful with this.” She says that large converters like Berry Global are looking to use recycled content to help their customers (brand owners) meet their PCR and sustainability goals.

There are also some chemical recycling systems nearing commercialization, like one developed by Agilyx. The energy company, known for converting plastics into valuable commodities, recently expanded to include a process that uses recycled polystyrene to produce high-quality styrene monomer and other petrochemical products.

And don’t forget, we’re going to start recycling in space—NASA is launching a machine that 3D prints plastic parts and recycles them back into reusable raw materials to make more parts—so we can clearly recycle more on planet earth.

Retailers Pushing Change

If you go to a recycling conference or trade show, there’s at least one common dominator: consumer-goods companies in attendance. And for good reason—there’s global pressure on these companies to reduce the amount of waste. For instance, in 2017, The Ellen MacArthur Foundation and World Economic Forum released The New Plastics Economy: Catalyzing Action, which aims to address global plastics issues through innovation in packaging design, recycling, and delivery models. The report looks to present a path to increase global recycling rates for plastics packaging from just 14 percent today to 70 percent or more.

Six participants in the Ellen MacArthur Foundation’s New Plastics Economy initiative—candy maker Mars Inc., retailer M&S (Marks & Spencer), PepsiCo, The Coca-Cola Co., consumer-goods company Unilever, and home-care products supplier Werner & Mertz—are making or reiterating commitments to use 100 percent reusable, recyclable, or compostable packaging by 2025 at the latest.

P&G has made advances in use of post-consumer plastics (PCR) by producing packaging made partly with “ocean plastic” (marine waste). The company also partnered with PureCycle Technologies to open a plant that will restore used polypropylene plastic to “virgin-like” quality with a recycling method that the consumer-goods giant calls “one of a kind.” The patented technology was created in P&G labs and then licensed to PureCycle.

“I think you are seeing durable-goods manufacturers beginning to get creative with compounding, exploring additives that can enhance properties of recycled materials,” Holmes says. “And brand owners like Unilever and P&G have invested in solvent-extraction technologies that eliminate colorants and other additives, and can separate resins used in products like multilayer structures.”

More brand owners are embracing a circular economy mindset—a plan of action that covers the entire lifecycle, from production to consumption to waste management and the market for post-consumer plastics. Research from McKinsey and Co., a global consulting firm, suggests that the global savings in materials alone could exceed $1 trillion a year by 2025, and that, under the right conditions, a circular economy could become a driver of global industrial innovation, job creation, and growth for the 21st century.

“It’s an exciting time in innovation and it’s being directly driven by brand-owner demand to use more recycled content in a wider variety of applications,” Holmes says.

Demonstration Projects

To bolster demand, efforts are being made to identify new end markets for recycled plastics. PLASTICS has developed an innovative supply chain approach to evaluating emerging plastics streams and proving out end market applications. One such project is focused on the recovery of plastics from end-of-life vehicles (ELV), specifically bumpers. The goal of this effort is to demonstrate the viability of collection and recycling of auto plastics from ELVs and build a basic recovery model, beginning with Thermoplastic Polyolefin (TPO) bumpers. Initial evaluation of ELV bumpers suggests high material performance, which could lend to strong demand for the recycled TPO, if the right end markets are identified.

A report detailing the learnings of phase I of research, which focused on collection, processing and property testing will be released this spring. The ELV Phase I Technology Package will offer insights on the economics of recovery, recycle process and new opportunities for this significant stream of material, all of which could not have been evaluated without participation from all parts of the supply chain in this research effort.

Focus on Sustainability at NPE

This year, the Re|focus Sustainability & Recycling Summit is co-located with NPE2018. The educational program will focus on the environmental challenges companies face in their supply chains and product design processes. Featured discussion topics include the use of recycled content, design for recycling, the pursuit of zero waste in manufacturing, and cutting-edge technologies that are allowing broader recovery of plastic products. The keynote speaker will be Oliver Campbell, director of procurement & packaging at Dell Technologies.

There is also a designated Re|focus Zone on the show floor that will offer a concentration of sustainability solution providers. In addition, PLASTICS President and CEO Bill Carteaux announced a 100 percent diversion of all plastics produced on the NPE2018 show floor.

“I think the attendees will see recycling and sustainability has a presence throughout the show floor, at individual exhibit spaces and in many of the zones, like the Bottle Zone,” Holmes says. “Seeing the prominence of sustainability solutions continue to grow at NPE has been a very exciting and encouraging evolution to watch.”

Related Content

‘Monomaterial’ Trend in Packaging and Beyond Will Only Thrive

In terms of sustainability measures, monomaterial structures are already making good headway and will evolve even further.

Read MoreRecycled Material Prices Show Stability Heading into 2023

After summer's steep drop, most prices leveled off in the second half.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MoreAvoid Four Common Traps In Granulation

Today, more than ever, granulation is an important step in the total production process. Our expert explains a few of the many common traps to avoid when thinking about granulators

Read MoreRead Next

Why (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More