Manufacturing Will Pick Up in the Second Half

With a few exceptions, activity levels for most U.S. manufacturing sectors hit a "soft patch" in the first half of this year.

With a few exceptions, activity levels for most U.S. manufacturing sectors hit a "soft patch" in the first half of this year. This was particularly true for the plastics industry. According to data released by the Federal Reserve Board, the year-to-date average for the monthly industrial production index for plastics product is 107.0 (1997=100). This average is virtually unchanged from the same period of a year earlier.

Much of this softness in the manufacturing sector data was due to a correction in auto production following an unwanted accumulation of inventories earlier this year. The auto sector is second only to computers in terms of its size in the durable goods manufacturing data, and since autos account for almost 10% of total manufacturing in the U.S., the slowdown in auto production had a far-reaching effect on many other industries, including plastics. Recent incentive programs have succeeded in reducing inventory levels in the auto sector, and most of the other major manufacturing segments have also pared their inventories. The result is that there is currently a very low cumulative inventory-to-sales ratio for total manufactured goods.

But one dark cloud in the inventory data at the present time is that inventory-to-sales ratio for the plastics sector, which tends to follow the trend in the auto sector, is still higher than the historical average. As the chart indicates, processor inventories began to build substantially in the second half of 2004, and they hit a peak in the first quarter of this year. However, just as in the auto industry, the trend in this plastics industry indicator over the past two months has been downward.

Some of this inventory accumulation by processors is due to the rapid rise in resins prices last year. When resins prices are in a sharp up trend, some processors will choose to build inventories rather than purchase more expensive resins in the future. Processors are currently starting to pare these inventories, and this has curtailed demand for resins so far in 2005. So despite the steady level of output of plastics products this year when compared with last, total year-to-date demand for resins is actually down 2%-3% when compared with the same period in 2004.

But recent indicators provide evidence that this trend is turning, and demand for all types of manufactured goods will improve later this year. Historical analysis demonstrates that the trend in the manufacturing sector’s inventory-to-sales (I/S) ratio tends to move in the opposite direction as the trend in the ISM index (formerly known as the Purchasing Managers’ Index) for manufacturing. This is because a rising I/S ratio indicates that inventories are rising faster than sales, and once it reaches a certain point, manufacturers will scale back on production.

The ISM index for manufacturing hit its most recent cyclical peak of 63.6 in the early part of 2004 and then trended down to the low fifties. At the same time that the ISM index was peaking in 2004, the I/S ratio for manufacturing hit its cyclical low-point and has since been in a gradual uptrend.

Further analysis of the inventory data shows that this recent increase in the I/S ratio for manufactured goods shows that the excess stockpiles accumulated only in the durable goods sector. In fact, the I/S ratio for nondurable goods has continued to trend downward and is currently well below its historical average. The fact that only durable goods inventories increased is one of the main reasons why the recent cyclical slowdown in the manufacturing sector was much milder than the one in 2000 when the I/S ratios for both durable and nondurable goods sectors were quite high.

And the good news is that the ISM index for June rebounded off of its most recent low- point quite nicely and is poised to go even higher in the second half of this year. This rebound combined with the fact that vehicle sales posted a stellar 20% annualized gain in the second quarter and that the unemployment rate fell to 5.0% indicates that the rate of economic growth posted in the first half of the year will accelerate during the second half. And since personal consumption expenditures for manufactured goods have continued to expand at a solid rate, the combination of lean inventories and steadily increasing demand will result in increased manufacturing output in the second half of the year.

Read Next

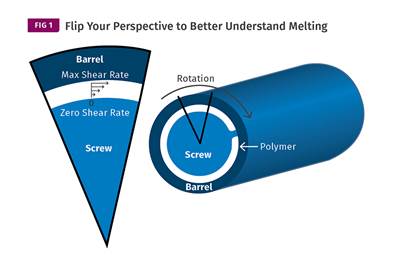

Understanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreAdvanced Recycling: Beyond Pyrolysis

Consumer-product brand owners increasingly see advanced chemical recycling as a necessary complement to mechanical recycling if they are to meet ambitious goals for a circular economy in the next decade. Dozens of technology providers are developing new technologies to overcome the limitations of existing pyrolysis methods and to commercialize various alternative approaches to chemical recycling of plastics.

Read More