Top Shops Benchmarking Report: Molding at the Margin

In a world of rising costs and uncertain market conditions, the ability to wring maximum profits from existing business was truly the mark of a Top Shop in 2022.

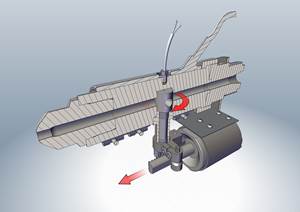

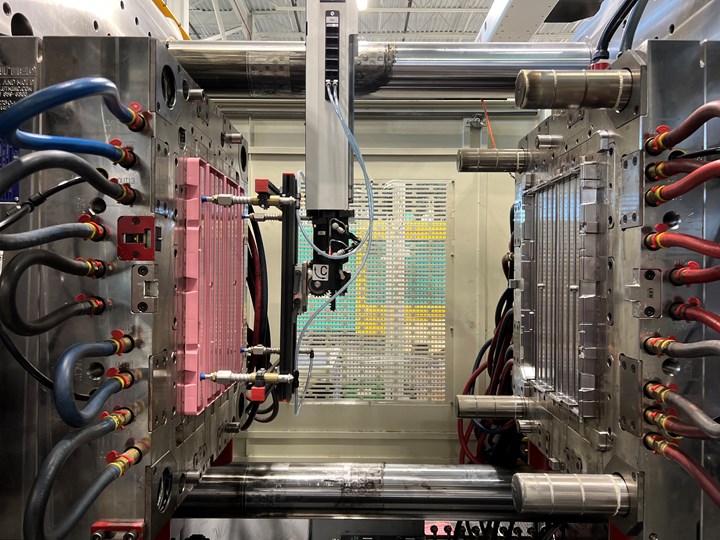

Core Technology Molding quotes at least 75% of incoming jobs with advanced automation.

Photo Credit: Core Technology Molding

While the leaders of Plastics Technology’s annual benchmarking survey generated 69% more total revenue, 87% greater gross sales per machine and 59% higher gross sales per employee than the rest of the study’s participants, it was the yawning gap in profit margin between the two groups of molders — 16% vs. 1% — that delineated the best from the rest in 2022.

“Margins are key for any business,” explains Pete Aretz, owner of Top Shops honoree Pioneer Plastics Inc., Marinette, Wisconsin. “As a job shop, we focus on reducing waste, cycle time and labor where we can.” This effort includes a tactic as simple, but effective, as scheduling out runs of the same material to decrease purging and downtime between jobs.

Noting that profits are only trumped by people and safety in terms of prioritization at Core Technology Molding Corp., Greensboro, North Carolina, Brandon Frederick says maintaining margins is fundamental for the newly named Top Shop. “Our strategy to protect margins starts with clearly identifying the cost of goods sold (CoGS),” Frederick says. “Negotiating with suppliers to find out how we both can win, continuously training our staff and maximizing the use of our ERP system are keys.”

For Plastikos and Plastikos Medical (both Erie, Pennsylvania), healthy profit margins are “vital” to success, explains Philip Katen, president and general manager. “Our profitability serves as the lifeblood to support our internal purchases and investments, including investments in our team, our equipment, our facilities, our technology and numerous continuous improvement projects that are in the works at any given time,” Katen says.

Alex Aretz (right) and Ben Aretz inspect a mold at Pioneer Plastics. Family-run businesses were prevalent throughout 2023 Top Shops. Photo Credit: Pioneer Plastics

Survey Snapshot

Now in its seventh year, the annual, free and anonymous Top Shops benchmarking survey of injection molders gathers up and analyzes demographic data, performance indicators, and business and process strategies. The Intelligence unit of Plastics Technology’s publisher, Gardner Business Media, scores a selection of performance metrics from the questionnaire, and the highest scoring companies were named Top Shops for 2023 based on their 2022 operations.

“As a job shop, we focus on reducing waste, cycle time and labor where we can.”

In total, 17 companies were honored as Top Shops for 2023, hailing from 11 states, five countries and three continents, with winners’ locations ranging from Australia to Canada, Europe to the U.S. and down into Mexico.

Fully 94% of Top Shops, including PlastiCert pictured here, have an in-house toolroom with 94% of those used for mold repair. Photo Credit: PlastiCert

Top Shops, on average, molded more parts (82 million vs. 36 million) from more active tools (248 vs. 197), but did so with a similar number of machines (26 at Top Shops, 32 for the rest), which averaged roughly the same age — 10 years for honorees versus 12 for the rest. Where the groups diverged with regard to their presses was in machine size and utilization of hybrid units, with top shops deploying combination electric/hydraulic machines at a rate almost double that of other facilities.

An average of 76% of Top Shops reported running machines up to 100 tons in clamp force compared to just 56% for others. Although roughly three quarters of all survey participants utilized machines from 101-500 tons, only 6% of Top Shops have machines in the 501-1,000 ton range in their facilities, compared to 43% for others, and just 12% of Top Shops run anything above 1,000 tons, compared to 26% of other facilities.

In terms of materials processed, Top Shops used more polyolefins, PVC, engineering resins and bioplastics than the full slate of survey takers, but both groups reported utilizing recycled resin: 59% for honorees and 58% for others. Top Shops processed a lower mass of material — 4.2 million lb compared to 5.8 million lb — but from a greater variety of materials with an average of 35 different resins processed compared to 23.

Looking at value-added services, Top Shops were more likely to provide additive manufacturing, contract manufacturing and inventory stocking/logistics, but less likely to offer customers product design, product testing and shipping/packaging/labeling than the other survey takers.

Plastikos operates whiteroom molding floors as a key differentiator for its business. Photo credit: Plastikos

While few Top Shops served the aerospace/commercial (23%) and aerospace/general aviation (29%) markets, this participation greatly outstripped the participation of the rest of the survey in those sectors, with just 8% winning business in each among the rest of the survey takers. Elsewhere, both saw pluralities in medical (53% for Top Shops and 54% for others), while fewer honorees worked in automotive (41% to 50%).

All the Top Shops were custom molders, while 8% of the rest of the survey takers represented a captive operation. Both groups came with an average of more than three decades in business (31 years for Top Shops and 33 for the rest), with Top Shops occupying slightly less space on average (62,000 ft2 vs. 79,000 ft2).

Wrangling Resin Prices

Maintaining margins directly relates to managing costs, and the biggest cost for nearly all molders is resin. While 65% of Top Shops reported that average resin prices increased in 2022, with a combined 35% saying costs decreased or stayed the same, fully 85% of other survey participants said resin prices increased with just 15% noting that they decreased or stayed the same.

At PlastiCert, Lewiston, Minnesota, Owner and President Craig Porter says the custom molder uses a combination of supplier and customer collaboration to achieve the best resin pricing possible. “Through use of our ERP system, our suppliers know that our order and forecast numbers are reliable, inspiring somewhat flexible terms and conditions,” Porter says. “Our customers work with us to provide blanket orders and reliable forecasts, allowing us to make firmer resin commitments.”

In 2022, Core started Molding Kids for Success, focused on providing STEM education opportunities for underserved youth, aged 10-14. Photo Credit: Core Technology Molding

Communications with suppliers and customers can enable bulk buys. “Utilizing bulk purchase orders with release dates helps both Pioneer and our supplier know when and what materials we need,” Aretz says.

“We utilize larger order quantities/bulk buys, including collaborating and partnering with our OEM customers to leverage their buying power where possible,” Katen at Plastikos says. “They may have that power via a more holistic view of their larger supplier chain that includes multiple injection molding suppliers running the same grades of raw material for the OEM.”

“Our business model is centered around long-term contracts and protecting the customer at all costs,” Core’s Frederick says. “One of the risks is cost transparency and, more often than not, we have to revisit raw material costs, but the ability to accurately forecast and keeping the supplier informed has proved to be invaluable.”

Fully 88% of Top Shops access and use customer forecasts (with 81% of others also doing so), and 71% of 2023 honorees utilize customer surveys to guide their business compared to 39% of the remaining respondents.

“Our team is continually on the lookout for opportunities to identify alternative raw materials that may yield some savings.”

In addition to locking in resin pricing where possible, Top Shops also help their customers settle on a material, or switch to a new one, based on extensive consultation. “Our customers are looking for PlastiCert to be their material and molding expert,” Porter says, “and they recognize the added value of our expertise. With new customers, we work closely with them on mold design in conjunction with component design for molding, as well as resin selection and order-volume optimization.”

“Our team is continually on the lookout for opportunities to identify alternative raw materials that may yield some savings,” Plastikos’ Katen says. “Our engineering team will collaborate with our strategic customers to sample and qualify those alternative raw materials via a formal, engineering continuous-improvement project.” One such project recently netted one of Plastikos’ global medical device customers $1 million in annual savings per production line, of which the company has five, resulting in $5 million in total savings per year.

PlastiCert’s business model is focused on low-to-medium volume jobs for complex components that utilize engineering resins. Photo Credit: PlastiCert

Picky in Plastics

Such close customer collaboration dictates that Tops Shops are selective in the companies they seek to work with and the jobs they take on. When it comes to active customers (41 vs. 200), monthly quotes (11 vs. 45), and customer-retention rate (99% vs. 87%), Top Shops overall sought less business from fewer clients but with better outcomes and greater loyalty.

At Pioneer Plastics, the goal of “focused growth” is achieved through the Entrepreneurial Operating System (EOS). “This system has guided us to be focused on our niche and not chase rainbows,” Aretz says.

“At Core Technology we view our supplier customer relationship as a long-term strategic partnership,” Frederick says. “Not everybody gets it right on the first try, but with sustainability and continual improvement, we are able to find and keep our long-term partnerships.”

“Plastikos is very targeted and strategic in our custom selection to identify and work with those customers that strategically fit with our unique company culture, business vision, internal operation and related processes,” Katen says. In addition to how it seeks new customers, the same strategic thinking applies to winnowing out customers, jobs and molds that are no longer a fit, a process Katen calls “pruning.”

The Generational View

The survey found that 88% of Top Shops are family owned, compared to 75% of the rest of the respondents, a fact that some of the honorees view as a contributing factor to their high performance.

“Pioneer Plastics is a family business,” Aretz says, “and one of our core values is to be dependable to all by treating everyone as your customer. If we want our employees to treat everyone like a customer, we had better treat our customer with the highest respect.”

Core Technology, which is owned by Geoff and Tonya Foster, credits is family-like culture with keeping turnover at less than 2% during a “war for technical talent,” Frederick says. In addition to increased medical benefits, the company has taken its employees on all-expense-paid trips, visiting Cabo San Lucas this year, with trips to the Dominican Republic, Jamaica and Orlando in past years.

“Plastikos and Plastikos Medical are a private, closely-held family business,” Katen says, “and that business structure affords us with the ability to take a very long-term approach and view to our businesses … As a multigenerational family business, the leadership team evaluates key strategic decisions from a perspective spanning generations rather than through the much shorter time frame lens that a publicly-traded, private equity or outside investor lead company would employ.”

Workers at Plastikos Medical position one of its latest molding machines on its new cleanroom floor. Photo Credit: Plastikos Medical

Related Content

Know Your Options in Injection Machine Nozzles

Improvements in nozzle design in recent years overcome some of the limitations of previous filter, mixing, and shut-off nozzles.

Read MoreUnderstanding the ‘Science’ of Color

And as with all sciences, there are fundamentals that must be considered to do color right. Here’s a helpful start.

Read MoreWhat to Do About Weak Weld Lines

Weld or knit lines are perhaps the most common and difficult injection molding defect to eliminate.

Read MoreHow to Mount an Injection Mold

Five industry pros with more than 200 years of combined molding experience provide step-by-step best practices on mounting a mold in a horizontal injection molding machine.

Read MoreRead Next

Top Shops 2020: Molding More from Less

Plastics Technology’s 2020 Top Shops benchmarking survey reveals that the most effective molders are, not surprisingly, the most efficient, accomplishing more than their peers from a smaller manufacturing footprint.

Read More2022 Top Shops Benchmarking Survey: Cost Conquerors

Higher costs for materials, wages, utilities and more, coupled with delivery difficulties for both incoming supplies and outgoing production, posed unique challenges to 2022’s class of Top Shops.

Read MoreTop Shops Adapt, Evolve and Overcome

Like a stress test on steroids, the pandemic took full measure of Plastics Technology’s Top Shops as it exacerbated or revealed preexisting conditions around labor, the supply chain and more.

Read More