Your Business Pricing Update - April 2007

Prices Creep Up Slowly

Polyolefins, PET, and PVC were on the way up last month, as resin suppliers sought to recover margins shrunken by lackluster demand and higher feedstock costs.

Polyolefins, PET, and PVC were on the way up last month, as resin suppliers sought to recover margins shrunken by lackluster demand and higher feedstock costs. A strong export market over the last few months and expectation of a lift from second-quarter seasonal demand has lifted resin plant operating rates after a slump in the fourth quarter.

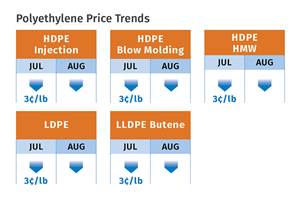

PE prices up a little

Polyethylene moved up 3¢/lb in February, implementing half of the price hike originally slated for Jan. 1. By mid-March, it did not appear that the second half of the increase (for LL/LDPE only) was taking hold. A second increase of 7¢, announced for mid-January, was pushed back to Apr. 1. The London Metal Exchange (LME) short-term futures contract for April in g-p butene LLDPE for blown film sold at 52.2¢/lb, up from March’s 51¢.

Contributing factors: With two price initiatives pending, resin suppliers hope to recover at least part of the fourth quarter’s 17¢ erosion in profit margins. Suppliers’ inventories are low due to reduced operating rates in the fourth quarter and strong exports, offsetting slow domestic demand from November through February.

Ethylene monomer contract prices for February and March did not go up as expected. In fact, February contracts settled down 1¢ to 38.9¢/lb, and March contracts held even.

PP inches up, too

Polypropylene prices moved up in January and February a total of 5¢/lb. Suppliers posted a 4¢ increase for March 1, but industry sources indicated that no more than 2¢ of that is likely to be implemented. LME’s April short-term futures contract for g-p injection-grade homopolymer sold at 52.2¢/lb, the same as in March.

Contributing factors: So far this year, PP prices have closely tracked monomer prices. Propylene contract prices for February rose 2¢/lb, followed by settlement of March contracts at the February level. However, some industry sources project that monomer prices will start rising, owing to some planned cracker turnarounds, good exports, and the start of the driving season.

In the short term, PP resin prices are expected to be mostly flat. Scott Newell, managing partner at purchasing consultant Resin Technology, Inc. (RTI), Fort Worth, Texas, says resin makers lack pricing power to improve their margins because domestic demand has been weak. “While I would not say you can expect prices to go down, they are also not likely to go up for now,” Newell concludes. PP producers say inventories are low across the supply chain and the usual seasonal uptick in demand could change the picture.

PET prices moving up

PET prices were slated to rise 5¢/lb last month, and suppliers tacked on another 4¢/lb increase for Apr. 1.

Contributing factors: PET producers are aiming for margin recovery, having lost most of their 12¢ to 15¢ gains of the last half of 2006. They also expect price pressure from feedstocks, especially paraxylene, as the approaching driving season boosts demand for gasoline at refineries.

The supply/demand balance is said to be on the tight side, with demand up about 6% and operating rates in the low 90s. But the situation is expected to reverse by the end of the second quarter as major new resin capacity comes on stream after start-up delays at the new PET plants.

PVC announces second hike

In mid-March, PVC producers were trying hard to get 2¢ of a 3¢/lb increase announced for March 1. They also all announced another 3¢ increase for Apr. 1. Three-cent hikes are highly unusual for PVC, which typically goes up or down in 2¢ increments. This is considered an attempt to stem the slide that began in the very weak fourth quarter and continued in January and February, when prices slipped 3¢.

Contributing factors: Resin producers’ operating rates in February were 86%, up a little from January but generally not considered enough to support a price increase. In-ground pipe demand is strong, but other sectors like siding, windows, and electrical conduit are still very weak.

PS is quiet, ABS up

Resin producers say they encountered no resistance to the 4¢ hike in March, which was prompted by higher benzene prices. There were no further pricing moves as of mid-March.

On the other hand, Dow raised prices by 10¢/lb on Apr. 1 for two styrene copolymers—ABS and SAN.

Epoxy & isocyanates rise

Dow Epoxy added 6¢ to 10¢/lb to prices of epoxies and curing agents on Apr. 1.

Also on that date, Dow Polyurethanes lifted tabs on TDI by 10¢ and MDI by 5¢/lb.

| Market Prices Effective Mid-March A |

|

|

KEY: Colored areas indicate pricing activity. An arrow () indicates direction of price change. aTruckload, unless otherwise specified. bUnfilled, natural color, unless otherwise specified. cBased on typical or average density. dNot applicable. eNovolac and anhydride grades for coils, bushings, transformers. fNovolac and anhydride grades for resisitors, capacitors, diodes. gIn quantities of 20,000 lb. h19,800-lb load. jLME 30-day futures contract for lots of 54,564 lb.. |

Related Content

Prices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MorePrices of All Five Commodity Resins Drop

Factors include slowed demand, more than ample supplier inventories, and lower feedstock costs.

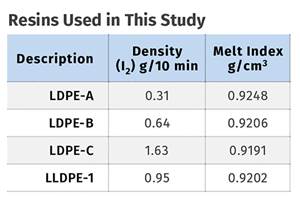

Read MoreFormulating LLDPE/LDPE Blends For Abuse–Resistant Blown Film

A new study shows how the type and amount of LDPE in blends with LLDPE affect the processing and strength/toughness properties of blown film. Data are shown for both LDPE-rich and LLDPE-rich blends.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MoreRead Next

How Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

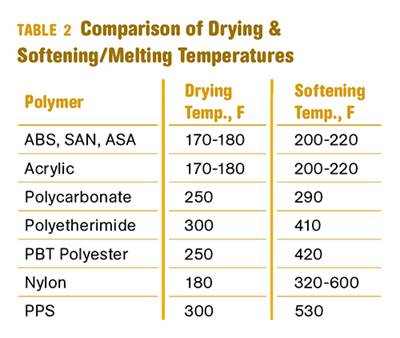

Read MoreWhy (and What) You Need to Dry

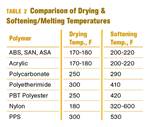

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read More

(2).jpg;maxWidth=300;quality=90)