Report Forecasts Continued Expansion in Global Biobased Polymer Production

Nova Institute forecasts 17% growth 2023-2028, driven by Asian and American demand.

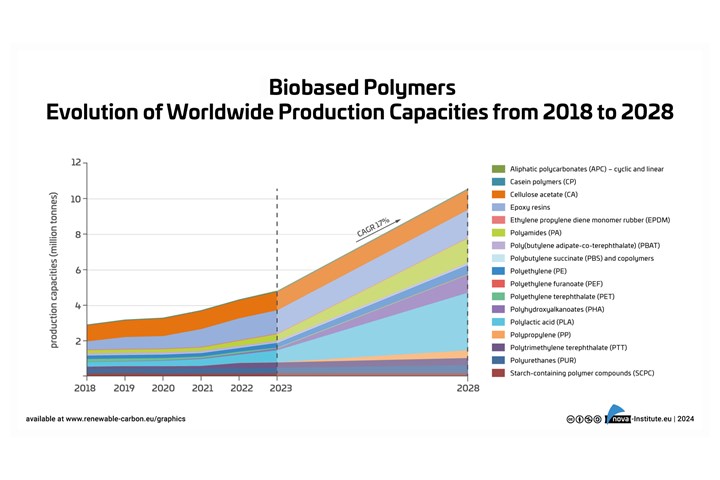

Nova Institute, a private research institute located in Germany, has released a report projecting continued increases in biobased polymer production capacity, forecasting 17% growth over the next five years. According to the institute, demand in Asia and the U.S. is driving growth, while European demand is lagging.

Biopolymer production capacity is expected to increase globally thanks to new capacity, especially in polylactic acid and polyamides. Source: Nova Institute

During 2023, capacity for producing PLA, polyamide and epoxy resins have all increased, as well as biobased PE and PP. Biobased PET production fell by 50%. Total production volume of biobased polymers was 4.4 million tonnes, which is 1% of the total production volume of fossil‑based polymers. The forecasted CAGR, 17%, of biobased polymers is significantly higher than the overall growth of the polymer market (2–3 %) — which is expected to continue until 2028.

The new market trend report “Biobased Building Blocks and Polymers — Global Capacities, Production and Trends 2023–2028,” written by the international biopolymer expert group of the Nova Institute, shows capacities and contains production data for 17 commercially available, biobased polymers in the year 2023 and a forecast for 2028.

Of the total 4.4 million metric tonnes of biobased polymers produced in 2023, cellulose acetate (CA) with a biobased content of 50% and epoxy resins with a biobased content of 45% made up 24% and 30%, respectively. Biobased polylactic acid (PLA) made up 11 %, polyamides (PA) (60% biobased content) made up 8% and 30% biobased polyurethanes (PUR) made up 7%. Polyethylene (PE) (available with 100 and 30% biobased content) and polytrimethylene terephthalate (PTT) (31% biobased content) had a share of 6 and 5%, respectively. The share of polybutylene adipate-co-terephthalate) (PBAT), polyethylene terephthalate (PET), polyhydroxyalkanoates (PHA) and starch-containing polymer compounds (SCPC) were below 5%.

Several global brands are already expanding their feedstock portfolio to include sources of renewable carbon, CO2, recycling and, in particular, biomass in addition to fossil-based sources, thereby increasing the demand for biobased and biodegradable polymers.

Related Content

-

Why Are They Blending Biopolymers?

A sit-down with bioplastic producer Danimer Scientific showed me there are more possible answers to that question than I had previously thought.

-

How to Optimize Injection Molding of PHA and PHA/PLA Blends

Here are processing guidelines aimed at both getting the PHA resin into the process without degrading it, and reducing residence time at melt temperatures.

-

How to Optimize Your Molds and Hot Runners for Processing Bioresins

Demand for bioresins is growing in molded goods, particularly as a sustainability play to replace fossil-fuel based materials, but these materials are not a drop-in replacement for traditional materials. Molds and hot runners need to be optimized for these materials.