Experts Advise on How to Get Smart About Resin Purchasing

Close Up: Resin Buying

Resin markets are not fair!

Resin markets are not fair! Different customers pay different amounts for the same product, and that’s not based only on how much they buy—it’s at least as important how much they know. The resin seller’s greatest weapon is the buyer’s lack of information, so better information is the customer’s only defense. That was the message of the annual Executive Forum for Processors held this spring in Fort Worth, Tex., by Resin Technology Inc. (RTi), a firm dedicated to helping processors become smarter resin buyers. It was the second year that RTi invited members of the press to attend, so we can convey some key points of advice from RTi, along with pointed comments from processors in the audience.

RTi in Fort Worth (resinpros.com) was founded in 1998 by Garland Strong, president, who had headed an injection molding company; and by Bill Bowie, COO, who had run a large compounding firm. “We saw that eight in 10 resin purchasing people in our industry had no idea how to do it right,” said Strong. They put together a team (now numbering almost 20) of similarly experienced industry veterans to advise plastics processors on how to approach their suppliers on a more equal footing. Their motto is, “Get ResinSmart!”

Explains Gus Garrett, director of education, who has 27 years’ experience selling polyethylene for Dow—and, by his own admission, knows every trick in the book, “We have either sold you resin or walked in your shoes. With the right approach, you can know more than a typical resin salesperson. It might not stop, but it could mitigate, a price increase.

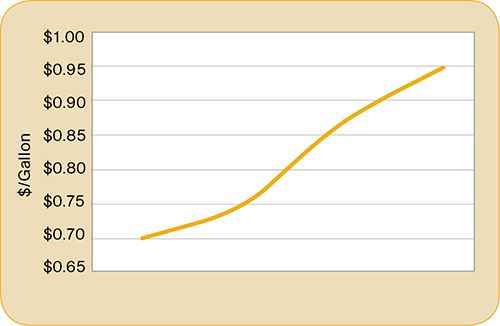

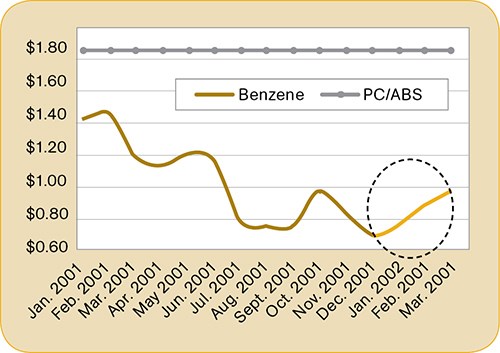

”Why does it pay to know more than your resin salesman? Take this anecdote from Scott Newell, director of client services for PP. When he worked for a molding company, his supplier of PC/ABS asked for a price increase because the cost of benzene—a key ingredient in both ABS and PC—was rising. The salesman bolstered his point with the first graph on this page. Newell did some research and came up with the second graph, which shows that although benzene’s price had been rising in the short term, its price over the longer term had declined significantly. “He was asking for a price increase, but I got a decrease!” Newell reports. “I figured out that I needed to understand my supplier’s business.

”RTi claims that its approach to smart buying saves its customers an average of 2-4¢/lb. RTi benefits through a “gain sharing” approach: “If we can’t save you money on resin, you don’t owe us a thing.”

BUYER BEWARE

“You have a sales plan. You have a preventive maintenance plan. You should have a resin purchasing plan,” advises Sam Beasley, director of business development. With resin accounting for an average of 65% of your cost of doing business—anywhere from 50% for typical injection molding to 85-90% for film extrusion, “Resin purchasing should be a full-time job,” says Beasley. Real-time market information is more valuable than ever, and there’s more you need to know than ever:

•There are fewer and fewer suppliers to choose from, which strengthens their bargaining position. What are the suppliers you don’t deal with doing in terms of pricing? You need to know the full slate of suppliers and decide which of them are best for your business.

•Supplier-customer relationships are “out the window,” says Kevin Roberson, director of core client services. “They want your business, but they won’t do anything special if it costs them money.”

•Price volatility in resins and their underlying feedstocks is greater than ever and not likely to go away. “Volatility is the new normal,” says Newell. Prices of PP resin have swung wildly, by as much as 15-17¢/lb from month to month lately. And over the last 28 months, there have been 28 changes in PS pricing—14 increases and six decreases.

•A global view of resin and feedstock trends is essential: “Global events increasingly drive North American pricing,” notes Craig Farrell, vp of international.

•Hurricanes Katrina and Rita in 2005 changed the industry forever, according to Roberson. Suppliers learned they could shove through large increases in a single month. And they learned to live on lower inventories. Since the recent Great Recession, resin producers have moved from a make-to-inventory model to make-to-order. One PS supplier reported told customers that its manufacturing plan for the month of May was, “If you don’t order it by May 12, we won’t produce it.”

What you need to know, above all, is how does your price compare with what your competitors are paying. Some processors pay a posted increase on the announced effective date, others start paying it a month later, or split the increase over two months. And the size of price hikes isn’t the same for everyone. As one savvy processor noted at the RTi forum, “I never pay an increase until the end of the month. I wait to see whether the price hike sticks, or how much of it sticks, and then I negotiate the best deal I can.”

Which leads Mike Burns, vp of polyethylene, to comment, “That’s how it is in this industry: You manufacture something today, but you don’t know your material price until next month. The average business person would think you’re crazy!”

WHAT DRIVES PRICES?

In the view of Mark Kallman, director of client services for engineering resins, three factors drive prices:

•Real-time raw-material cost (resins and feedstocks);

•Supply (of resins and feedstocks);

•Demand (domestic and international, real and artificial).

To properly understand these three factors, you must grasp the nine “Real-Time Market Drivers” that make up RTi’s ResinSmart philosophy:

•Pricing benchmarks: This means knowing in real time what are the actual selling prices for your resins globally. Also, what are the recent trends in resin prices—up, down, or flat? What “non-market” moves have been taking place behind the scenes? These are the unannounced price changes for suppliers’ best customers.

•Demand: Is it real demand or false demand—pre-buying ahead of an expected increase, or delayed buying ahead of an expected decrease? According to Roberson, this is what makes year-to-year demand comparisons misleading, because any month’s sales data can be distorted by pricing moves.

•Secondary markets: This means anything other than your normal channel for buying prime resin. Secondary markets are often the first to indicate market changes, the first to move up or down.

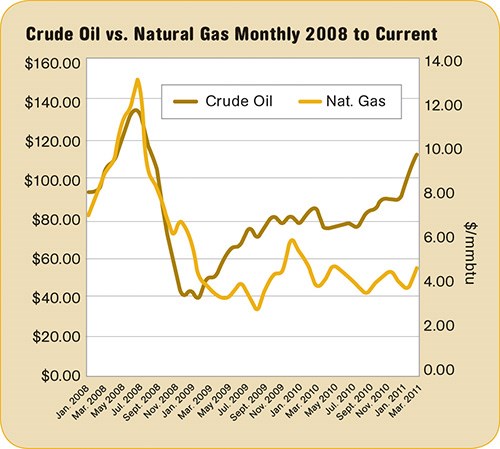

•Natural gas/crude oil: It’s no secret that almost all plastics are derived wholly or in part from these two sources. What’s less widely recognized is that the U.S. olefins industry (which makes feedstocks for polyolefins, styrenics, and PVC, among others) is much more reliant on natural gas than oil, unlike its counterparts in Europe or Asia. Oil price volatility is probably here to stay, but natural gas supply is disconnected from oil and its price is much less volatile—in fact, it has barely budged at all in the past year. On an energy basis, natural gas prices are roughly equivalent to oil at around $30 a barrel. RTi believes natural gas will remain plentiful and cheaper than oil for the foreseeable future. So don’t be bamboozled the next time a resin salesman tells you the price of a barrel of oil has gone up.

•Feedstocks: Get to know the real direct feedstocks for your resins, and know their price and supply moves, advises Greg Smith, vp of engineering resins, PVC, and PS. Burns notes that suppliers will often try to justify a PE price increase by pointing out that spot ethylene monomer prices are up—but they’re not buying spot ethylene. Same goes for contract ethylene monomer—almost no one buys ethylene because almost all PE producers are back-integrated to monomer. Burns also notes that U.S. producers’ reliance on natural gas instead of oil means that “we have the lowest cost to produce PE in the world, but we have the highest prices!” The difference is the profit that goes into your suppliers’ pockets. Burns says to multiply the price of ethane (natural gas) by 0.43 to determine the cash cost of making ethylene. Then add 15¢ to derive the cash cost to make a pound of PE. In May, that was a little over 53¢/lb. How does that compare with what you were actually paying?

(Incidentally, that reliance on natural gas instead of oil is also the root of why the U.S. has the highest PP prices. Natural gas provides relatively little propylene monomer as compared with oil.)

•International markets: Like it or not, we live in a globally interconnected economy, so you need to track market activity in other regions that can impact your resin price and supply, Kallman advises. Supply problems, demand changes, and currency-rate shifts on any continent channel import/export flows of resins and feedstocks to wherever suppliers can get the best price. For example, suppliers benefit from strong export demand ahead of the Chinese New Year in late January/early February. Nylon 6 prices are up in part due to heavy exports of caprolactam feedstock to China for making textile fibers. Knowing that global cotton prices have gone “through the roof” helps understand the demand for nylon fibers. Heavy phenol demand for plywood to rebuild Japan after the earthquake and tsunami could put price pressure on phenol-based polycarbonate. There were problems shipping chemicals on the Rhine last year because low water levels obstructed barge traffic—and then a barge of sulfuric acid capsized, further halting traffic. In February of this year, suppliers reportedly used fear that spreading Mideast crises could disrupt oil shipments to raise resin prices. All this explains the recent formation of RTi Europe GmbH and the firm’s alliance with Kunststoff Information (aka Plastics Information Europe), which provides daily and weekly pricing coverage in print and online.

•Producer operating rates/inventories: “Inventory is going to be one of the biggest drivers in PE,” notes Burns. But be careful how you interpret supplier signals. Cautions Garrett, “If a couple of suppliers offer you an extra railcar you didn’t ask for, you think it’s a glut. If a couple of suppliers deny you an extra railcar when you ask for it, then you think it’s a shortage.” Data, not emotion, is the solution.

•Supplier actions: Understanding your vendor’s business plays a key role here. As Roberson points out, “There are a lot of reasons for announcing a price increase—even sometimes just to keep prices from falling, especially when feedstock prices are dropping.” Or, as Beasley puts it, “Resin Price Increase 101: You must follow one increase with another, just to prove you’re serious.”

•Sourcing benchmarks: This means knowing the full slate of suppliers that produce your resin, including those you don’t currently deal with.

Burns has developed a Market Indicator Value Work Sheet based on these nine market factors. To simplify analysis, he offers three possibilities for any one factor, and assigns numerical values to each possibility. The average of those values provides a rating of Strong Buy, Buy As Needed, or Reduce Inventory. The worksheet is still experimental, but its results have been pretty much on target so far, Burns says.

Related Content

Fundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreMelt Flow Rate Testing–Part 1

Though often criticized, MFR is a very good gauge of the relative average molecular weight of the polymer. Since molecular weight (MW) is the driving force behind performance in polymers, it turns out to be a very useful number.

Read MoreDensity & Molecular Weight in Polyethylene

This so-called 'commodity' material is actually quite complex, making selecting the right type a challenge.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MoreRead Next

Troubleshooting Screw and Barrel Wear in Extrusion

Extruder screws and barrels will wear over time. If you are seeing a reduction in specific rate and higher discharge temperatures, wear is the likely culprit.

Read MoreWhy (and What) You Need to Dry

Other than polyolefins, almost every other polymer exhibits some level of polarity and therefore can absorb a certain amount of moisture from the atmosphere. Here’s a look at some of these materials, and what needs to be done to dry them.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More