Molder Builds a Business From Next to Nothing

Under new ownership, Cumberland Plastics Solutions’ decision to invest when times were tough has paid big dividends.

It started out in 2008 about as inauspicious as it gets: “Two machines and one customer” in a 20,000 ft² plant with about 10 employees. Then the economy blew up and one customer became no customer. John Chuplis, the newly minted owner and president of Cumberland Plastics Solutions in Auburn, Ala., had a choice to make: Fish or cut bait. He cast another line and hasn’t looked back since.

At the time, Chuplis had four decades in plastics under his belt, but had never been involved before in injection molding. With a background in resin sales, he joined Entec Polymers in Orlando, Fla., as a partner five years after it started in the 1980s as a global trading business. Buoyed by two acquisitions, Entec grew to a $950 million compounder, distributor, and recycler before Chuplis and his partner sold it to Ravago of Belgium, in 2007. Shortly thereafter, Chuplis ran into one of the former owners of Cumberland—who also happened to be a customer of his at Entec—who was looking for some fresh capital for his startup molding company

So Chuplis, not ready to retire, bought in. “In less than two years my wife and I owned the whole thing. And the timing was poor, because in 2008-2009 the recession hit and we had a choice: Pull the plug or put more money in and hang on for the ride. Walking away was not an option.”

“Hanging on” turned out to be the right decision. Chuplis and his son-in-law hit the road and made sales calls at major OEMs in lawn and garden equipment and at automotive Tier 1 suppliers. “I read that as a result of the economic crisis, North America lost 40% of its injection molding capacity. During the recession, the only way to get business was if another molder went out of business. So we were one of the 60% still standing. Things started to build, and we were getting small pieces of business here and there.”

Chuplis invested all during this period. The two presses he started out with turned into 17 hydraulic, electric, and hybrid machines ranging from 120 to 1000 tons from Nissei; and four presses from Ube Machinery of 950 to 1500 tons, all but one 1000-tonner being all-electric. Says Chuplis. “Unless you have 20 machines it’s tough to make money. We’re on our way.”

The molder is also on its way to a second plant in Opelika, Ala., about 14 miles from Auburn. At 150,000 ft², the new plant will house its two biggest Ube presses, and the 500 and 700-ton Nissei machines. All machines are automated, mostly with 5-axis robots from Wittmann Battenfeld. The 1500-ton Ube is equipped with a 6-axis robot from Fanuc America. Cumberland also installed a central material handling and drying system from Novatec Inc. A business that started out with fewer than a dozen people has grown into a full-service molder with a staff of 220, and Chuplis is hoping to add 50 more over the next few months.

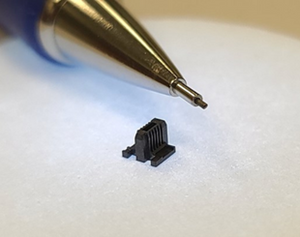

Since Chuplis took over, Cumberland has focused primarily on automotive, making interior trim and a wide range of other components for Mercedes-Benz, BMW, Volkswagen, GM, Nissan, Freightliner, and others. “About 80% of our business is automotive now,” says Chuplis, who’s extremely bullish on the future of car-making in the U.S. “The automotive business can be difficult because there is simply no room for defects and no excuses for late deliveries. If the part we’re delivering is not perfect, the ramifications can be significant. But doing business for automotive has made us a better supplier.” Cumberland, in fact, has earned ISO/TS 16949 certification for its automotive quality-management program.

Cumberland’s business has grown 40% since 2013, and Chuplis projects a 20-25% bump in 2015-16. “You can’t be stagnant if you want to grow, and you have to spend money to make money. And you need the right people. Over the years, we have added a lot of young, talented engineers, as well as people in other key positions, and it’s paid off for us.”

Related Content

US Merchants Makes its Mark in Injection Molding

In less than a decade in injection molding, US Merchants has acquired hundreds of machines spread across facilities in California, Texas, Virginia and Arizona, with even more growth coming.

Read MoreEvolving Opportunities for Ambitious Plastics Recycler

St. Joseph Plastics grew from a simple grinding operation and now pursues growing markets in recycled PP, food-grade recycled materials, and customized post-industrial and post-consumer compounds.

Read MoreInside the Florida Recycler Gearing Up to Take on Scrap at NPE2024

Hundreds of tons of demonstration products will be created at NPE2024 next spring. Commercial Plastics Recycling strives to recycle all of it.

Read MoreMatrix Tool: Welcome to the Family

In its 50th year, Matrix Tool applies moldmaking and injection molding expertise, plus a long family heritage, to high-precision jobs that many would deem impossible.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More