Price Hikes Could Moderate in 2Q

Except for polyolefins, a prices of volume resins could hit a breather in the second quarter.

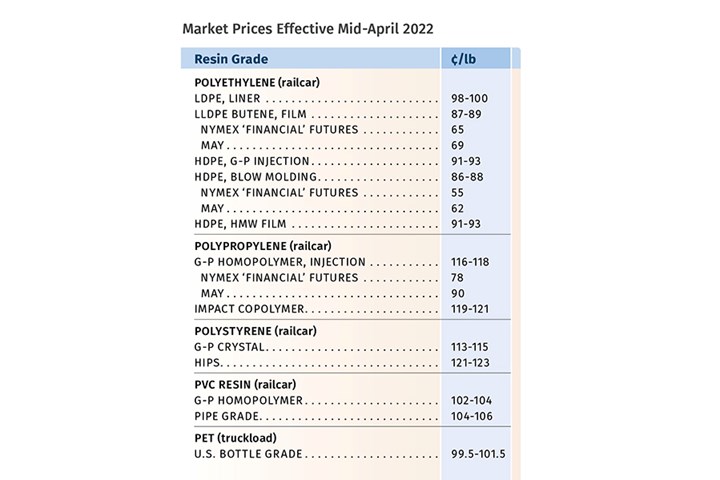

March marked an upward trajectory for the five major-volume commodity resins, which appeared to continue through April. Playing a role were such factors as higher feedstock and energy costs, planned and unplanned production shutdowns, and continued logistical issues plaguing the industry—all exacerbated to some degree by the war in Ukraine. Other issues included higher costs and continued supply constraints for key additives. But prices of each of these resins could bottom out this month, based largely on feedstock costs and/or supplier inventory corrections.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior editors from Houston-based PetroChem Wire (PCW), CEO Michael Greenberg of The Plastics Exchange, and Scott Newell, executive v.p. polyolefins at Spartan Polymers.

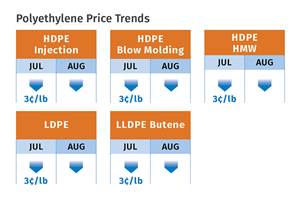

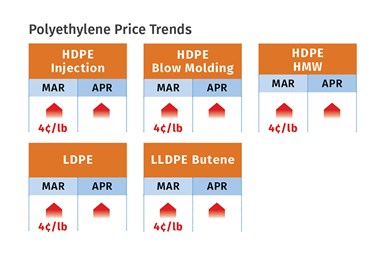

PE Demand High, Supplies Tight

Polyethylene prices in March moved up 4¢/lb and suppliers issued increases of 6¢/lb for April. Further price hikes were possible, according to Greenberg and PCW senior editor David Barry. Burns predicted that if demand flagged, suppliers would likely aim to support prices by throttling back production.

Concurring that price decreases are not in the cards during the second quarter, Barry reported that spot PE prices were unchanged as buyers hunkered down for pending increases. “HDPE and LDPE film-resin supply was adequate while LLDPE film-resin spot availability remained tight. This is despite a new source of this resin in the recent startup of the ExxonMobil/SABIC LLDPE plant near Corpus Christi, Texas. At the same time, resin-plant turnarounds and scattered shortages of certain additives and comonomers were contributing to tight supply,” he reported. Greenberg agreed that sustained strong spot-market demand kept pricing for all commodity grades at the highest levels of the year, while supply remained very constrained.

These sources also commented on the continued logistical issues, ranging from port congestion and delayed container bookings to truck shortages. Noted one long-time market observer, “The absence of quick railcar export turnaround and limited silo and railcar storage at the supplier level (the export backup is hindering available resin storage) has created an unprecedented situation. The inability to repeatedly load and ship resin, is expected to lead to production cuts.”

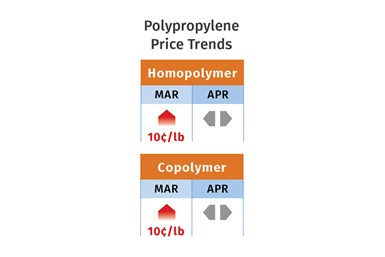

PP Prices Rising

Polypropylene prices spiked 10¢/lb higher in March, in step with propylene monomer following the February 6¢/lb hike, and April-May pricing was difficult to gauge, according to Greenberg, Barry and Scott Newell of Spartan Polymers. One supplier announced a non-monomer-based increase of 4¢/lb, which initially looked like a long shot, but two force majeure declarations in late March were expected to pressure April prices higher, as reported by PCW’s Barry: “Demand for PP from end users remained strong, as it was through March. Demand for PP products like medicine vials, tool boxes, yogurt cups, caps, pipe and flower pots is expected to remain strong throughout the second quarter.”

Newell noted that we are in a tight propylene monomer situation and that resin demand will be the key driver. “If PP demand goes up, monomer prices will move up. There is a lot of uncertainty in the marketplace and conflicting issues. While PP demand appears to have improved, it is unclear whether that was due to prebuying in anticipation of monomer increases, while prime material inventories appear to be tighter.”

Greenberg reported that strong demand for most PP grades kept spot prices elevated at this year’s highs. “With PP inventories balanced to tight and lack of a safety valve in timely imports to supplement the market, prices will continue to fluctuate with energy and feedstock prices, and likely see even more sensitivity if those markets move to the upside,” he reported.

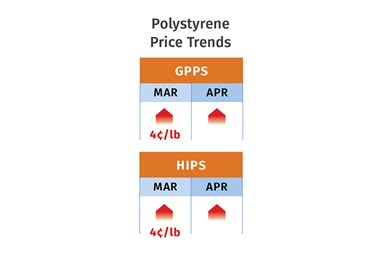

PS Price Hikes Could Pause

Polystyrene prices moved up generally by 4¢/lb in March, after the February 5¢/lb increase, according to Barry and Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets. Chesshier noted that higher crude oil prices pushed up prices of key feedstock benzene and thus also styrene monomer. She ventured that rising prices would continue through April.

Meanwhile, Barry reported that two PS suppliers had issued price increases of 9¢/lb for April, attributed to planned turnarounds for styrene monomer. Spot styrene prices moved up 10¢/lb from February to the end of March. But Barry ventured, “A PS price hike for April could be the last increase unless crude oil prices jump up to $140/barrel—expect prices to bottom out in May.” He noted that significant capacity in styrene monomer, of which the U.S. is a net exporter, is coming on stream in China.

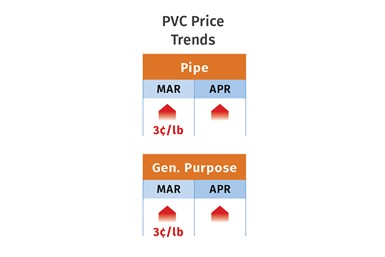

PVC Prices Flattening

PVC prices in March were moving up by 2¢ to 3¢/lb as suppliers aimed to implement their 3¢ hike for that month. Meanwhile, three major suppliers came out with a 4¢/lb hike for April, and the fourth 5¢/lb, according to Mark Kallman, RTi’s v.p. of PVC and engineering resins, and PCW senior editor Donna Todd.

Kallman noted that the April increase was partly to bolster implementation of the March increase and risk mitigation due to global uncertainties and the impact of inflation on the domestic construction market. While PVC export prices were significantly higher—which typically signals that domestic prices will be raised, domestic suppliers have benefited from lower production costs due to dropping ethylene prices. Moreover, supplier inventories were higher (about 18 days vs. a typical 10 days), and production rates were higher as suppliers saw significant opportunities for exports, though bottlenecked ports continued to be an issue. Said Kallmann, “Under normal market conditions, prices should be flat-to-down in the April/May timeframe.”

While domestic PVC suppliers have a significant feedstock cost advantage as ethylene produced here comes from natural gas liquids, Todd reported, “However, the logistical logjam at U.S. ports has slowed exports of all resins. Packaging warehouses are saturated with product due to the shortages of outbound trucking and vessel space, and they are being very restrictive in the number of railcars they will take. Neither PVC producers nor traders know when the situation will begin to improve.” She noted that most market watchers are expecting a quiet summer with flat pricing, barring any hurricanes landing on the Texas or Louisiana Gulf Coast.

Flatter PET Tabs Ahead?

PET prices in March were on the way up by about 7¢/lb, after rising 4¢/lb in February. The key driver was higher cost of paraxylene/PTA, which follows crude oil prices; whereas prices of the MEG feedstock component were flat, thanks to lower ethylene prices, according to RTi’s Kallman. PET imports continued to be priced above domestic PET contract prices. Kallman ventured that PET prices in April and May could be flat or possibly a bit lower, barring a runup of crude oil prices over $100/barrel.

Related Content

Fundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MorePrices of All Five Commodity Resins Drop

Factors include slowed demand, more than ample supplier inventories, and lower feedstock costs.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MoreThe Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More

(2).jpg;maxWidth=300;quality=90)