Prices Bottom Out for Volume Resins?

Flat-to-down trajectory underway for fourth quarter for commodity resins.

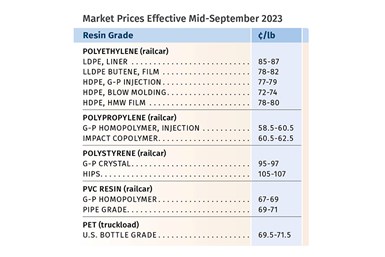

Prices of volume resins going into 2023’s fourth quarter were a mixed bag, though a “bottoming out” somewhat characterized the overall market. Partially, that is due to price decreases across the board for most of the year until contract settlements in August, which saw prices move up for PE, PS, PVC and PET, and just a fractional decrease for PP, with more price hikes being attempted for September.

While prices of volume engineering resins continued to drop in the same time period — and some were expected to drop further — a lesser decline was expected. The temporary upward trajectory was primarily driven by higher prices of some feedstocks, such as benzene and ethylene, due to unplanned and planned production shutdowns.

As such, barring production disruptions during the hurricane season or other major event, the pricing trajectory for all volume resins appear to be somewhat flat-to-down. Slowed domestic and global demand, the lowering of plant operating rates, cost-cutting measures across the supply chain and, in some cases, more new capacity, lower feedstock costs and competition from lower-cost imports are all contributing factors.

These are the views of purchasing consultants from Resin Technology Inc. (RTi), senior analysts from Houston-based PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, and Scott Newell, executive v.p. polyolefins at distributor/compounder Spartan Polymers.

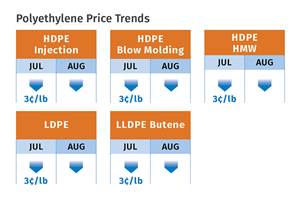

PE Prices Firm Up

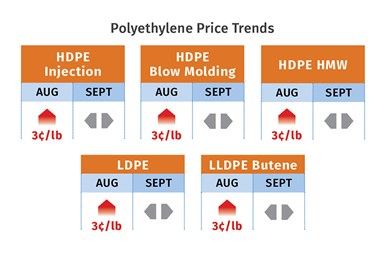

Polyethylene prices moved up 3¢/lb in August while suppliers were seeking another 5¢/lb for September, and appeared to be firming up heading into this month, according to David Barry, PCW’s associate director for PE, PP and PS, Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets, and The Plastic Exchange’s CEO Michael Greenberg. PCW’s Barry notes that while demand is showing a moderate improvement, it remains well below 2022 levels. “The exports market has been holding things up, but there were concerns about whether that trend would persist into fourth quarter,” he says.

Suppliers appear to have created a sense of tightness, according to RTi’s Chesshier, who notes that domestic demand is still not good, new capacity is still being brought on stream in fourth quarter by Shell, Nova and Baystar, along with concerns that this summer’s record level exports will not continue. Reports The Plastic Exchange’s Greenberg, “Producers (suppliers) continued to hold back material in favor of incremental export shipments at prices that rival some domestic sales.”

Referring to supplier’s concerted effort to ramp up PE exports, the key reason much of the new capacity was built, Greenberg ventures the possibility that before year’s end, more polyethylene will actually be exported than sold into the domestic market in a given month. Overall, these sources see PE contract and spot prices staying firm going into fourth quarter.

PP Prices Down

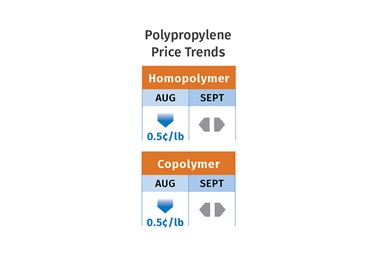

Polypropylene prices dropped 0.5¢/lb in August in step with propylene monomer contracts for a decline of 19.5¢/lb since March, and are generally expected to be bottoming out, according to PCW’s Barry, Spartan Polymers’ Newell and The Plastic Exchange’s Greenberg. PCW’s Barry reports that some market participants project a 5¢/lb increase for September propylene monomer contracts and PP. Meanwhile, PP suppliers are out with non-monomer price hikes of 3¢/lb (though one called for 2¢/lb for homopolymer and 4¢/lb for PP copolymer).

These sources characterized the market as somewhat more stable. Says Spartan Polymers’ Newell, “The broader market sector’s sentiment is still bearish. Suppliers appear to have a better handle on a better supply/demand balance, even though plant operating rates are only in the low-to-mid-70s percentile. Most everyone appears to have given up on seeing a significant rebound in 2023 and are looking to cut costs.” Going into August, PP domestic demand was down 6%, year-to-date, according to Barry, who did not see much chance for suppliers to implement non-monomer increases this year.

The Plastic Exchange’s Greenberg is more bullish about the PP spot market, noting that spot market prices have firmed up as resin availability was becoming a bit strained. Still, he thinks most processors are comfortable with their inventories as they have built supply buffers during hurricane season. Newell estimates that spot prices were up by as much as 10¢/lb, though they had been heavily discounted earlier in the year.

PS Prices Up

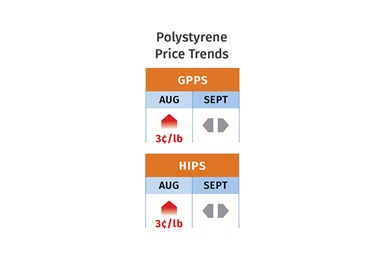

Polystyrene prices rose by 3¢/lb in August and suppliers were out with another 3¢/lb increase for September, according to PCW’s Barry and RTi’s Chesshier. This is after dropping a total of 9¢/lb the two previous months. Both sources venture there was some potential for implementation for the second increase solely due to anticipation that September benzene contract prices would also move up. Barry reported that the implied styrene cost, based on a 30% ethylene/70% benzene spot formula rose to 40.3¢/lb in early September, up 4.4¢/lb from early August.

Still, Chesshier sees potential for a reversal of this upward trajectory as early as this month, citing continued lackluster demand domestically and plant operating rates that are still below 60%. “Lots of competition from both low-cost PS imports and domestic supplies,” is how Barry characterizes the PS generic prime spot market going into this month.

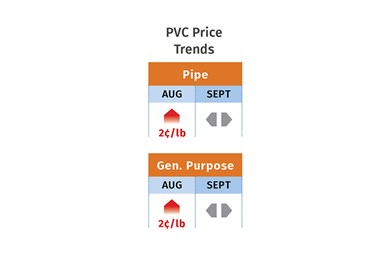

PVC Prices Up

PVC prices increased by 2¢/lb in August as suppliers implemented that month’s increase and were aiming from another 4¢/lb price hike for September, according to Paul Pavlov, RTi’s v.p. of PP and PVC and PCW’s senior editor Donna Todd. This is after dropping 2¢/lb in June and rolling over in July. Pavlov ventures that September, and possibly this month, would be a rollover owing to continued weak demand, ample supplies and raw materials cost stability. Todd initially ventured that suppliers would likely get 1¢/lb of the nominated September price hike. A continuation of higher PVC exports has led some industry sources to believe that all that matters anymore in determining domestic PVC prices is the export market, according to Todd.

However, one unplanned and two planned ethylene cracker shutdowns going through September and into this month, prompted an increase in ethylene prices, giving some support to PVC suppliers’ price moves. Yet another is concern of a hurricane making a landfall in an area with ethylene or PVC plants, as indicated by one PVC supplier who justified the Sept. 4¢/lb increase as a “weather hedge.”

PET Prices Up, Then Down

PET prices moved up 3¢/lb to 4¢/lb in August, based on raw material formulation contracts, particularly higher prices of paraxylene driven by higher crude oil octane values during the summer months, according to Mark Kallman RTi’s v.p. of PVC, PET and engineering resins. Still, he saw the potential of a 2¢/lb to 3¢/lb reduction within the Sept.-Oct. time frame, as octane values ease up along with continued ample domestic PET resin inventories and lower cost PET imports.

ABS Prices Drop, Then Flat

ABS prices dropped by 5¢/lb to 9¢/lb between June and August’s end, following decreases totaling 10¢ to 18¢/lb in the first two quarters of 2023, according to RTi’s Kallman. As benzene prices were moving upward, Kallman ventures ABS prices would stabilize for the Sept.-Oct. time frame. He characterizes the domestic market as amply supplied with a continued influx of well-priced Asian ABS imports.

PC Prices Lower

Polycarbonate prices fell from June to August by as much as another 5¢/lb to 7¢/lb in more competitive situations, after dropping 5¢/lb to 10¢/lb in January, according to RTi’s Kallman. He ventures prices for Sept.-Oct. would be largely flat to slightly down, noting that domestic supplier inventories were pretty high. He notes that well-priced PC imports had slowed a bit, but there was concern of a potential automotive industry strike, the PC market sector that was showing a rebound.

Prices of Nylon 6, 66 Drop

Nylon 6 prices dropped further in the July-Aug. time frame by 5¢/lb to 10¢/lb, after dropping a total of 15¢/lb to 30¢/lb in first and second quarters, according to RTi’s Chesshier. She saw potential for further price erosion, but at a lesser level in the Sept.-Oct. time frame due to the very amply supplied domestic market, with lower-priced PC imports really driving the market and the downward trajectory. Chesshier notes that depending on the supplier and grade, nylon 6 prices dropped in the range of 45¢/lb to 80¢/lb, depending on the supplier and grade since August 2022.

Nylon 66 prices also continued to fall between June and August by 10¢/lb or more, depending on the compound, after falling 10¢/lb in April, according to RTi’s Kallman. He saw a pricing rollover in for September and the potential for a 3¢/lb to 4¢/lb decrease in October. “Even with the improvements in the automotive sector, the market has continued to be soft as demand from the construction and appliances sectors is not enough,” Kallman notes.

Related Content

Prices of All Five Commodity Resins Drop

Factors include slowed demand, more than ample supplier inventories, and lower feedstock costs.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreFormulating LLDPE/LDPE Blends For Abuse–Resistant Blown Film

A new study shows how the type and amount of LDPE in blends with LLDPE affect the processing and strength/toughness properties of blown film. Data are shown for both LDPE-rich and LLDPE-rich blends.

Read MoreThe Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MoreRead Next

How Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MoreProcessor Turns to AI to Help Keep Machines Humming

At captive processor McConkey, a new generation of artificial intelligence models, highlighted by ChatGPT, is helping it wade through the shortage of skilled labor and keep its production lines churning out good parts.

Read MoreUnderstanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read More