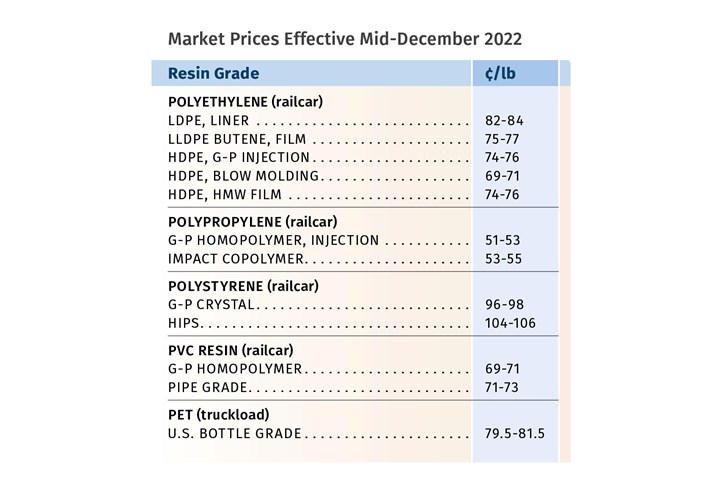

Prices of Volume Resins Drop--Except for PE

The downward trajectory appears to be continuing into the first quarter for most resin prices, though PE and possibly PP may remain somewhat stable.

Heading into January, prices of all the major volume resins continued to slump, with the exception of PE, which appeared to have stabilized in the late fourth quarter, owing largely to a significant reduction in plant operating rates. Factors contributing to the downward trajectory for most of these resins include diminished demand, higher inventories across the supply chain, and lower feedstock costs. Also supporting this trend is significant new capacity brought on stream in PE and PP, and competition from lower-priced imports of PS, PET, ABS, PC, and nylon 6.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior analysts from PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, and Scott Newell, executive v.p. polyolefins at distributor/compounder Spartan Polymers.

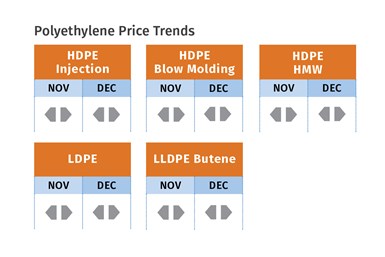

PE Prices Flat

Polyethylene prices in November appeared to remain unchanged, and suppliers pushed back their announced price hikes of 5¢ to 7¢/lb, so the pricing outlook for December-January was likely to continue relatively flat, according to David Barry, PCW’s associate director for PE, PP, and PS; Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets; and The Plastic Exchange’s CEO Michael Greenberg.

Barry noted that demand was quite diminished, with one industry player citing October sales as the lowest in two years. “There is also lots of inventory still waiting to set out for exports due to both some continued shipping logistics issues and not much global demand.” He expected suppliers would continue to run plants at rates in the low 70% range, and they would need to lower export prices further to get material moving. Chesshier noted that due to large inventories of both resin and finished goods, many processors were planning for extended shutdowns. She did not see demand making much of a comeback in the first quarter.

Going into December, The Plastic Exchange’s Greenberg noted that spot PE market demand was relatively healthy, with HDPE blow molding and LLDPE film and injection grades in the lead and LDPE activity more limited. “More balanced supply/demand factored into the rollover for October contracts and we expect the same for November, even as new capacity is still hitting the market,” he reported. All three sources noted that significant new capacity from Shell and Baystar (the new 50/50 joint venture between Borealis and Total Energies), which represents a 10% domestic capacity increase, was another factor for projections of relatively flat pricing.

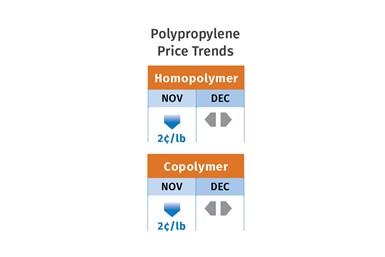

PP Prices Staying Low?

Polypropylene prices in November were expected to drop by 2¢/lb, as propylene monomer contracts were settling 1¢/lb higher, but another 2¢/lb slice of supplier margin was coming off, according to Barry, Greenberg and Spartan Polymers’ Newell. The November decrease followed a 15¢/lb drop in October. In December-January, these sources generally saw prices as likely to stay put.

Barry ventured that suppliers were unlikely to give back any more margin but also did not expect prices of propylene to go any lower. Domestic PP is now the lowest priced globally, according to Newell. Barry noted that buying patterns in first quarter had some potential of returning to more normal levels. He noted that some processors were building up inventory at year’s end due to attractive pricing.

Newell noted that domestic demand has been very weak and cited a 10.3% drop within a 12-month period, along with resin and finished-goods inventory accumulation. Supplier inventory days were at 43.5 versus the usual 32 to 34 days, despite suppliers having dropped their operating rates to around 72%. Newell did not expect to see demand return to any where near normal levels within the first quarter. All three sources noted that the significant new capacity brought on stream by Heartland Polymers and ExxonMobil will also impact the market.

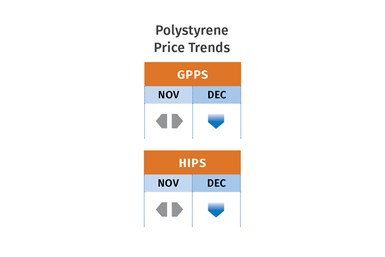

PS Prices Down

Polystyrene prices in November had a chance of holding even, despite some suppliers’ announced hikes of 3¢ to 4¢/lb based on an uptick in benzene price, because market fundamentals did not support any upward movement, according to both PCW’s Barry and RTi’s Chesshier. Meanwhile, spot PS prices for November were down 2¢/lb and GPPS and HIPS tabs sunk 3¢/lb lower.

Barry saw PS prices for December-January as likely to drop, as benzene prices were collapsing. Benzene contracts for November rose to $3.26/gal but spot benzene was trading at $2.52 for December. “December benzene contracts could drop by 50¢gal to 60¢/gal, which would translate to a 5¢/lb to 6¢/lb decrease in PS prices,” Barry noted. The implied styrene cost based on a 30% ethylene/70% benzene formula was down nearly 4¢/lb by the last week of November to 39.7¢/lb.

Chesshier said there was potential for a 6¢ to 7¢/lb drop in December and projected that further decreases would come this month, barring some major global production interruption. Demand has been very soft both domestically and globally; PS suppliers have run plants at historically low rates in the 60-65% range; and high volumes of attractively priced PS imports are coming into the U.S. market.

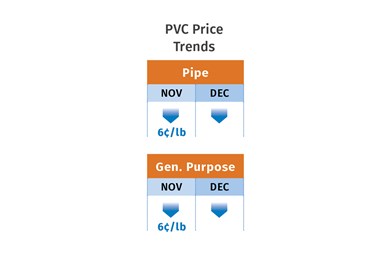

PVC Tabs Tumble

PVC prices for November and December were expected to drop in the double-digit range, following the 5¢/lb October dip, according to Mark Kallman, RTi’s v.p. of PVC and engineering resins, and PCW senior editor Donna Todd. She reported that industry pundits were indicating prices would drop by 6¢/lb in November and again in December. Similarly, Kallman saw potential for a total drop of 10¢ to 14¢lb by year’s end.

These sources anticipated further price decreases through the first quarter. Todd expected a decline of 3¢/lb for this month and 2¢/lb each in February and March. “The continued price erosion is predicated on high producer inventories, weak demand and falling export prices,” she explained. Kallman emphasized the significant drop in export prices, which ultimately affect domestic prices, noting that the gap was at 30¢/lb or more.

PET Prices Slipping

PET prices dropped by 1¢ to 1.5¢/lb in November and were poised to drop by another 1.5¢ to 2¢/lb in December, based on feedstock costs. Characterizing domestic supply as ample, RTI’s Kallman foresaw a similar drop in prices this month based on lower seasonal demand along with competition from lower-priced imports.

ABS Dives Even Lower

ABS prices dropped in the vicinity of 20¢ to 30¢/lb in the third quarter and continued to drop on the order of 10¢ to 15¢/lb in the fourth quarter, according to Kallman. He characterized the market as very well supplied, with slower demand in both automotive and electronics, along with lower feedstock costs and continued competition from lower-priced imports. He ventured that first-quarter ABS prices could be flat to lower by 5¢ to 10¢/lb.

PC Tabs Continue Downward

Polycarbonate prices dropped on the order of 5¢ to 10¢/lb in the third quarter and appeared to be sinking 10¢/lb lower by the end of the fourth quarter, according to RTi’s Kallman. He expected first-quarter PC pricing would be flat to lower, owing to a well-supplied market despite indications of lowered production rates. Softer demand in automotive and construction, lower feedstock costs, and inexpensive imports were other driving factors.

Prices of Nylon 6, 66 Plunge

Nylon 6 prices dropped 5¢ to 10¢/lb in October-November after falling 20¢ to 22¢/lb in August. Another substantial price drop in December-January was very likely, according according to RTi’s Chesshier. Factors driving the action are slowed demand and lower feedstock costs. But the biggest factor is arrival of imports from Asia priced at 20 to 30% lower than domestic resin. This was of great concern to suppliers, who needed to drop prices further before year’s end in fear of losing more business, according to Chesshier.

Nylon 66 prices fell in the third quarter for both resins and compounds on the order of 8¢ to 15¢lb, with compounds on the lower end, and it appeared that another drop of the same proportions was underway in the fourth quarter, according to RTi’s Kallman. He characterized the market as well supplied with slowed demand in automotive and construction, along with lower feedstock costs. He ventured nylon 66 prices in first quarter would be flat to a bit lower.

Related Content

Recycled Material Prices Show Stability Heading into 2023

After summer's steep drop, most prices leveled off in the second half.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MoreThe Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MoreFundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreRead Next

Understanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so that the barrel appears to be turning clockwise around a stationary screw.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreHow Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read More